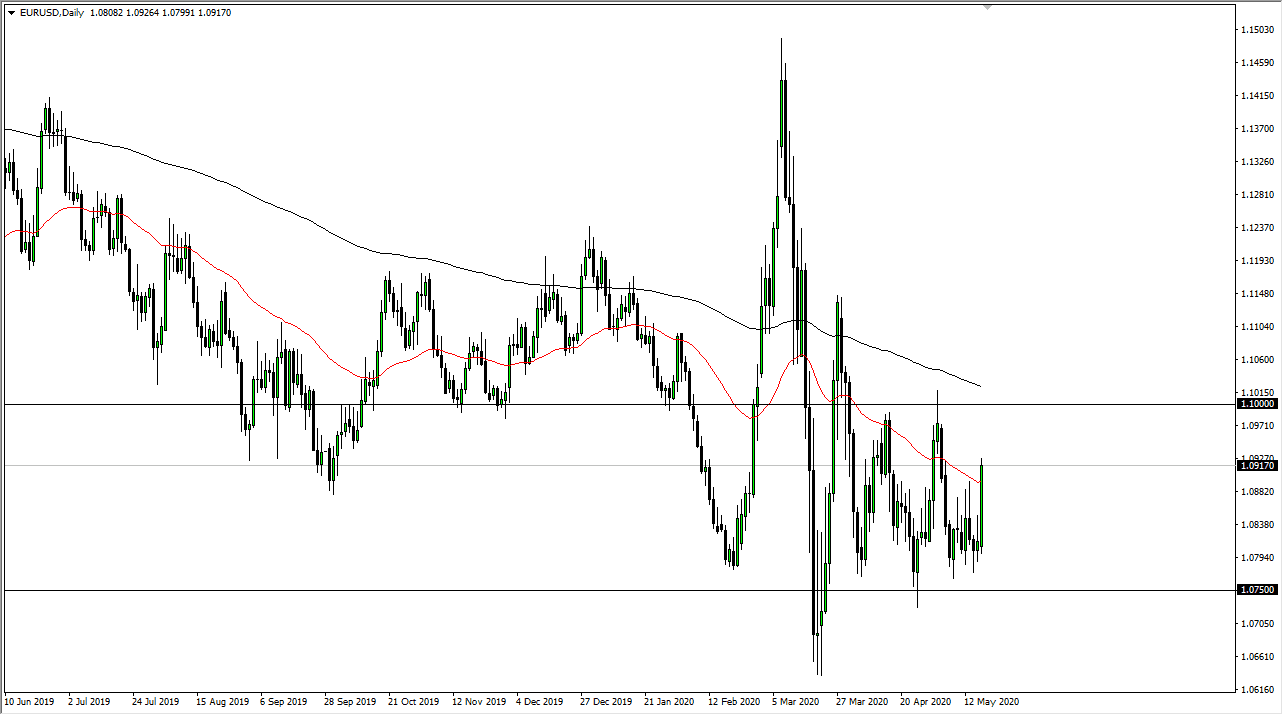

The Euro has rallied quite significantly during the trading session on Monday to break through the 50 day EMA, showing signs of strength again. However, this is a market that continues to be very choppy and at this point I believe it is still very much range bound. If that is going to be the case, then I believe the best way to trade this market is to simply look for signs of exhaustion, especially near the 1.0950 level. That is the beginning of pretty significant resistance that extends to the 1.10 level, so at this juncture I like the idea of fading the area just above where we currently said. I think this is going to remain very sideways and has nowhere to be anytime soon. Both of these central banks are looking to kill their own currencies and doing a damn fine job of it.

That being said, the US dollar will continue to be favored longer-term due to the fact that the European Union cannot find itself positive longer-term due to the fact that the ECB is buying everything that has not nailed to the floor. The Federal Reserve is shortly behind that, but the Federal Reserve has the benefit of having the world’s reserve currency, and in times of concern it makes sense that the US dollar will probably continue to see a lot of inflows. With that being the case, I believe this is a market that will head back towards the 1.08 level given enough time, but it is going to take a certain amount of noisy trading to get down there. I think that the Euro is essentially stuck in this area while the world tries to figure out what to do next.

The European Union has horrific industrial numbers, as well as growth. This was before the pandemic and has only gotten worse. Furthermore, the Germans in the ECB are fighting tooth and nail about some of the decisions that the central bank is made, and then of course there is that whole “Brexit thing” that still needs to be worked out. At this point, longer-term traders certainly should be favoring the US dollar as a much more of a safety currency in general, and of course the fact that the treasury markets still are attracting quite a bit of inflow, and that of course favors the greenback strengthening overall.