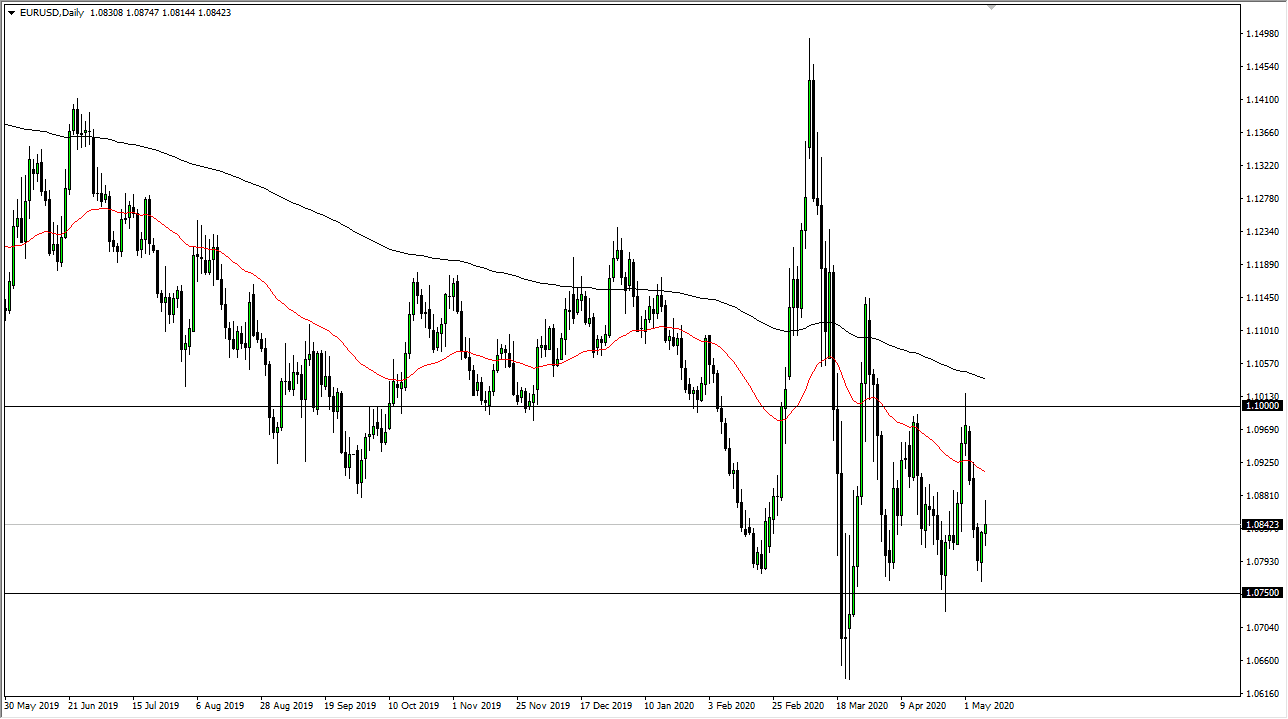

The Euro rallied a bit during the trading session on Friday but gave back quite a bit of the gains in order to form a bit of a shooting star. The shooting star of course is a negative candlestick, but I think we probably rally a bit from here as the longer-term chart suggests that we are in the midst of a bigger consolidation region. The 1.0750 level should be supportive, with the 1.10 level above being resistive. Ultimately, it is going to take a significant amount of momentum to finally break out of this range, and it is more likely that we break down than up, especially as the US dollar is favored over so many other currencies around the world.

The 50 day EMA above is near the 1.09 level and sloping lower. That is an area that should cause some issues as well, so I am simply looking to fade the Euro as it rallies. The European Union continues to struggle overall, as the coronavirus has truly slammed an already soft economy. Furthermore, there is a huge and insatiable demand for US dollars out there to pay off debts, so this will continue to be a major problem for anything that is not the greenback.

Having said that, this pair does tend to be very choppy, so it makes sense that we continue to do more of the same. It is likely that we will see the market stay within this range for the time being. Just below, the 1.0750 level offers significant support, but a break down below their opens up another 100 pips to the downside, and then eventually the 1.05 level after that. If we were to break down below there it would signify the trapdoor opening up and the Euro will fall quite drastically. We need to clear the 200 day EMA above to start thinking about buying, but it seems to be very unlikely to happen. Rallies at this point will continue to be sold into, especially as we continue to see significant concerns around the world. This will continue to be one of the main drivers for greenback strength, and of course as yields continue to drop in the United States, it shows a flow into the greenback as well. When things around the world are a complete mess, it is almost always the US dollar that gains.