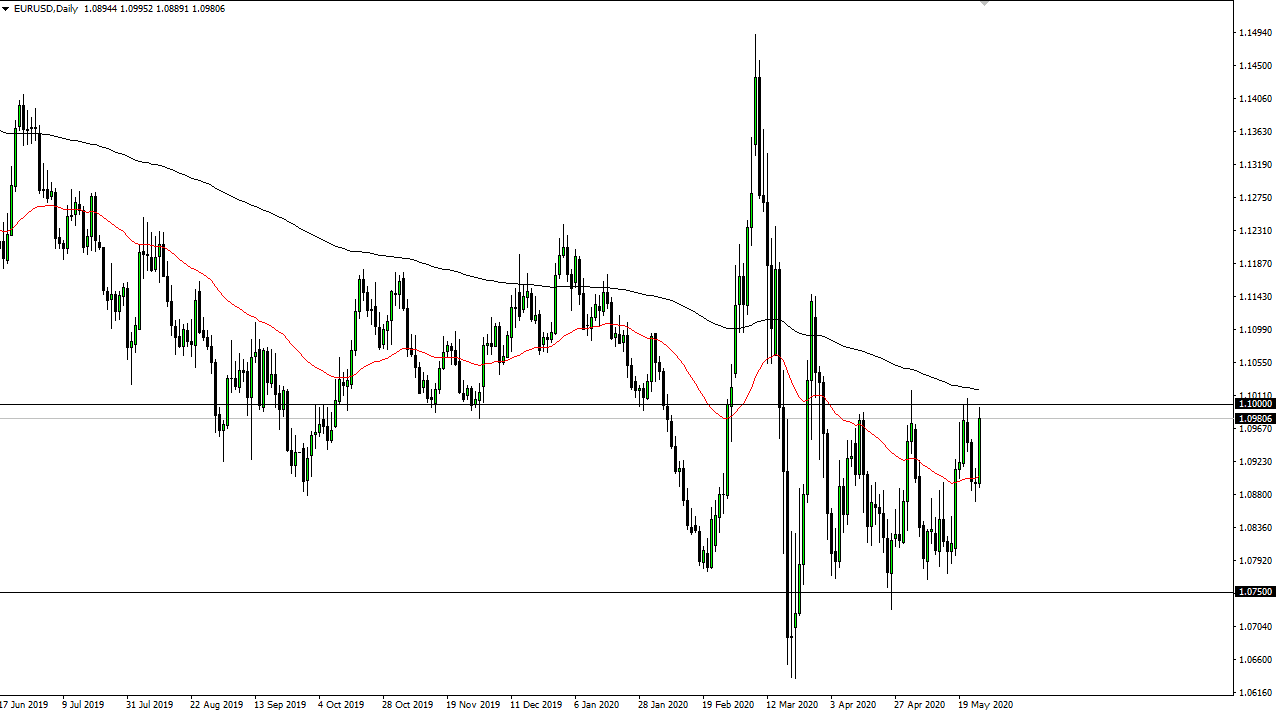

The Euro has rallied rather significantly during the trading session on Tuesday, reaching towards the 1.10 level. This is an area that has offered resistance previously, and as a result it should not be a huge surprise to consider that the market has pulled back from there. That being said, the most recent low, formed on Monday, should be noticed as being higher than the previous one. However, we also have to keep in mind that the Monday session with the holiday session, so there would have been a serious lack of volume.

The 50 day EMA looks to be offering short-term support, down at the Monday candlestick, just as the 200 day EMA looks to be significant resistance above, sitting just above the 1.10 level. It will be interesting to see how this plays out, because the European Central Bank continues to work against the value of the Euro, loosening monetary policy but at the same time the Federal Reserve is doing very much the same thing at this point. Because of this, this is a market that should continue to be choppy and noisy. That of course is the norm when it comes to this pair, as we continue to see high-frequency traders push this thing back and forth.

Looking at the size of the candlestick, it does suggest that there is some buying pressure underneath, but we will have to wait and see how the market deals with the large, round, significant figure of 1.10 above. If we can close above there and of course the 200 day EMA just above there, then it is a very bullish sign, perhaps opening up the door to the 1.1150 level. However, if we fail at this area that I believe that we will probably pull back to look towards the 50 day EMA which is closer to the 1.09 level. A breakdown below that level allows the market to continue the longer-term consolidation that we have seen for some time which extends all the way down to about the 1.08 level. Ultimately, this is a market that has some decisions to make, and we are most clearly in an area that it will have to make them mad. I do think that it is also worth mentioning that some of the monthly candlesticks are showing hammers, but we have not broken out yet. If we do, then it is likely that the market will try to continue higher.