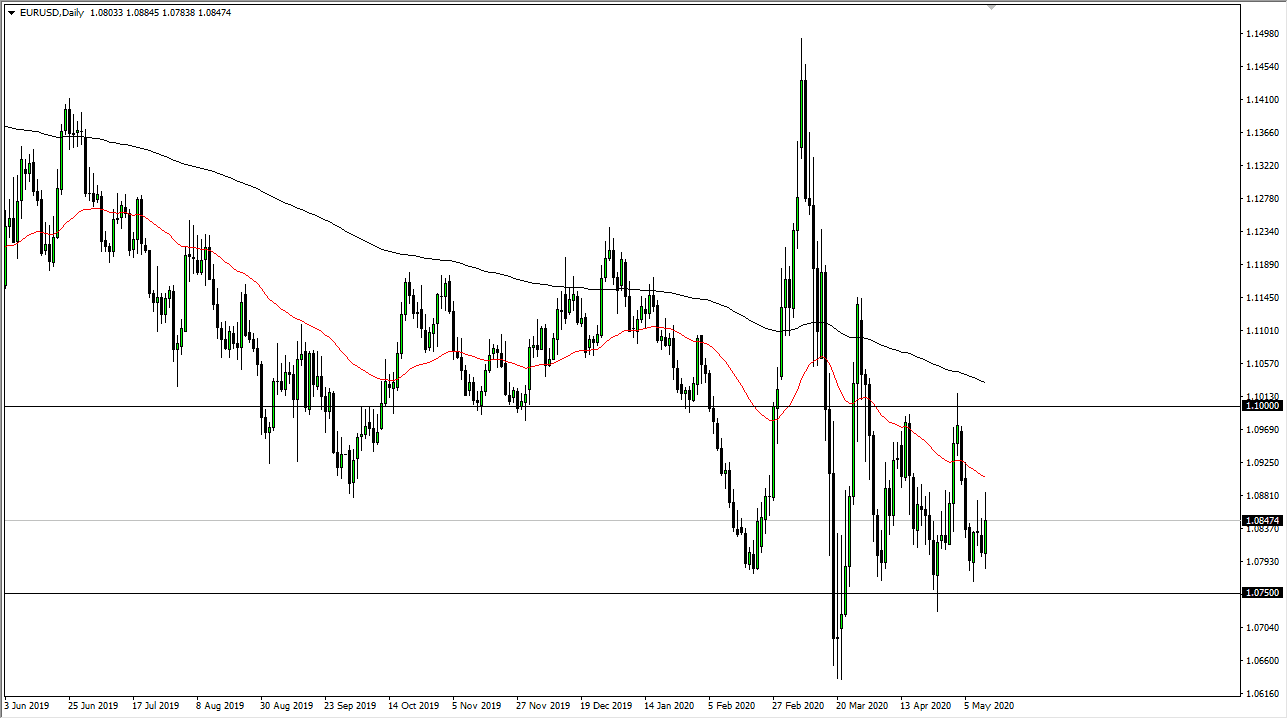

The Euro rallied significantly during the trading session on Tuesday but continues to fail near the 1.09 level and starting at the 1.0850 level. The Euro continues to be a major problem for the markets, as the Germans and the EU continue to quibble over the legality of the ECB buying corporate bonds. Furthermore though, there are a lot of concerns about growth in the European Union and of course there is a major shortage of US dollars longer term. Ultimately, market participants continue to favor the greenback overall Fort safety and of course we have the treasury markets out there continuing to show inflows, which of course will jack up the price of the US dollar in general.

To the downside I believe that the 1.0750 level should continue to offer support, and as long as we can stay above there then one would have to think that we are going to stay in the same consolidation area that we have been in for some time. However, if we were to break down below that level then it opens up the possibility of a move down to the 1.06 level, possibly even the 1.05 level after that. As things stand right now, I have no interest in buying the Euro because there are far too many things working against it, not the least of which will be an underlying uneasiness with traders around the world when it comes to risk appetite.

At this juncture, it is likely that we will continue to see a lot of back and forth, but I am much more interested in buying the US dollar longer-term, and therefore I do think that eventually we get the breakdown that the charts are suggesting. This is not to say that we cannot rally in the short term, but it is very unlikely to be anything that sticks. In fact, I see a significant amount of resistance near the 1.10 level that looks very unlikely to be broken. Look at rallies as an invitation to pick up US dollars “on the cheap.” As we have seen time and time again, the Euro continues to lose value. Overall, this is a market that I do believe continues to offer plenty of trading opportunities for those who are patient enough to take advantage of value. Until then, one must be overly cautious about overexposing themselves.