Per Christine Lagarde, the President of the European Central Bank, the Eurozone economy is forecast to plunge 8% to 12% in 2020 due to the nationwide lockdowns implemented in response to the Covid-19 pandemic. She labeled the central bank’s mild scenario of a 5% contraction outdated, highlighting the actual disruption exceeded initial estimates. Therefore, any recovery will be longer than previously hoped. The announcement of a €750 billion stimulus to purchase government debt and private securities pushed the EUR/GBP into its resistance zone.

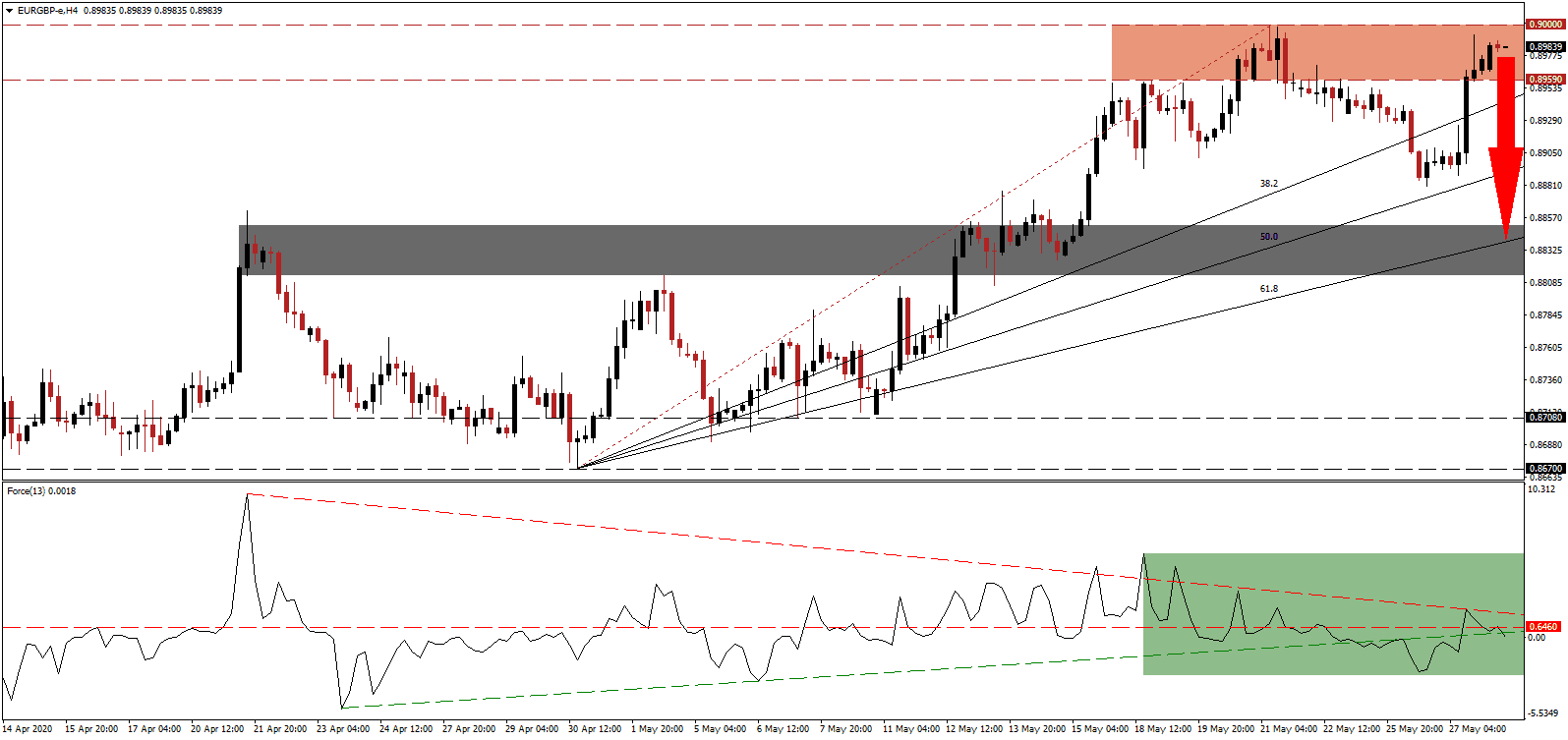

The Force Index, a next-generation technical indicator, suggests a trend reversal may be imminent. While this currency pair spiked higher, the Force Index recorded a lower high, resulting in the emergence of a negative divergence. After the descending resistance level rejected an advance, as marked by the green rectangle, a conversion of the horizontal support level into resistance followed. This technical indicator also corrected below its ascending support level and is now on track to cross below the 0 center-line, granting bears complete control over the EUR/GBP.

Many governments fail to acknowledge the prolonged time a recovery will require and that a swift reversal is impossible. While the level of maximum damage in terms of job losses and restrictions passed, data equally suggests that it will not be until 2021 at the earliest before significant progress is made. Complacent countries will lag the recovery process, but the UK has warned its business and private communities to prepare for gradual improvement. The collapse in bullish momentum inside of the resistance zone located between 0.8959 and 0.9000, as marked by the red rectangle, positions the EUR/GBP for a new breakdown.

Given the proximity of the ascending 38.2 Fibonacci Retracement Fan Support Level to the bottom range of the resistance zone, a double breakdown is anticipated. It is favored to initiate a profit-taking sell-off, supported by an expansion in volume, which will provide the required catalyst for an accelerated contraction. The EUR/GBP is poised to challenge its short-term support zone located between 0.8814 and 0.8851, as identified by the grey rectangle. It is enforced by the 61.8 Fibonacci Retracement Fan Support Level.

EUR/GBP Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 0.8980

- Take Profit @ 0.8840

- Stop Loss @ 0.9020

- Downside Potential: 140 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 3.50

Should the Force Index spike above its descending resistance level, the EUR/GBP could pressure higher. Forex traders are advised to take advantage of a breakout attempt with new short positions, as the outlook for this currency pair is increasingly bearish. The delayed Eurozone response with a lack of unity limits the options for proper economic assistance. Price action will face its next resistance zone between 0.9120 and 0.9163.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 0.9060

- Take Profit @ 0.9140

- Stop Loss @ 0.9020

- Upside Potential: 80 pips

- Downside Risk: 40 pips

- Risk/Reward Ratio: 2.00