A global race to built a TTI infrastructure, referring to test, trace, and isolate, has emerged. With pressure on governments to reopen economies growing, one fatal error in this push is evident. Most consumers will voluntarily remain in lockdown until the virus is under control, and new infections confirm a slowing trend. TTI holds the key, as evident in South Korea, where a functioning infrastructure for its exits. Other countries should exercise patience, to ensure a sustained recovery is possible. The UK has been patient, allowing more time to implement proper steps. Short-term criticism has increased, granting the EUR/GBP a catalyst to accelerate into its resistance zone, from where a new breakdown sequence is pending.

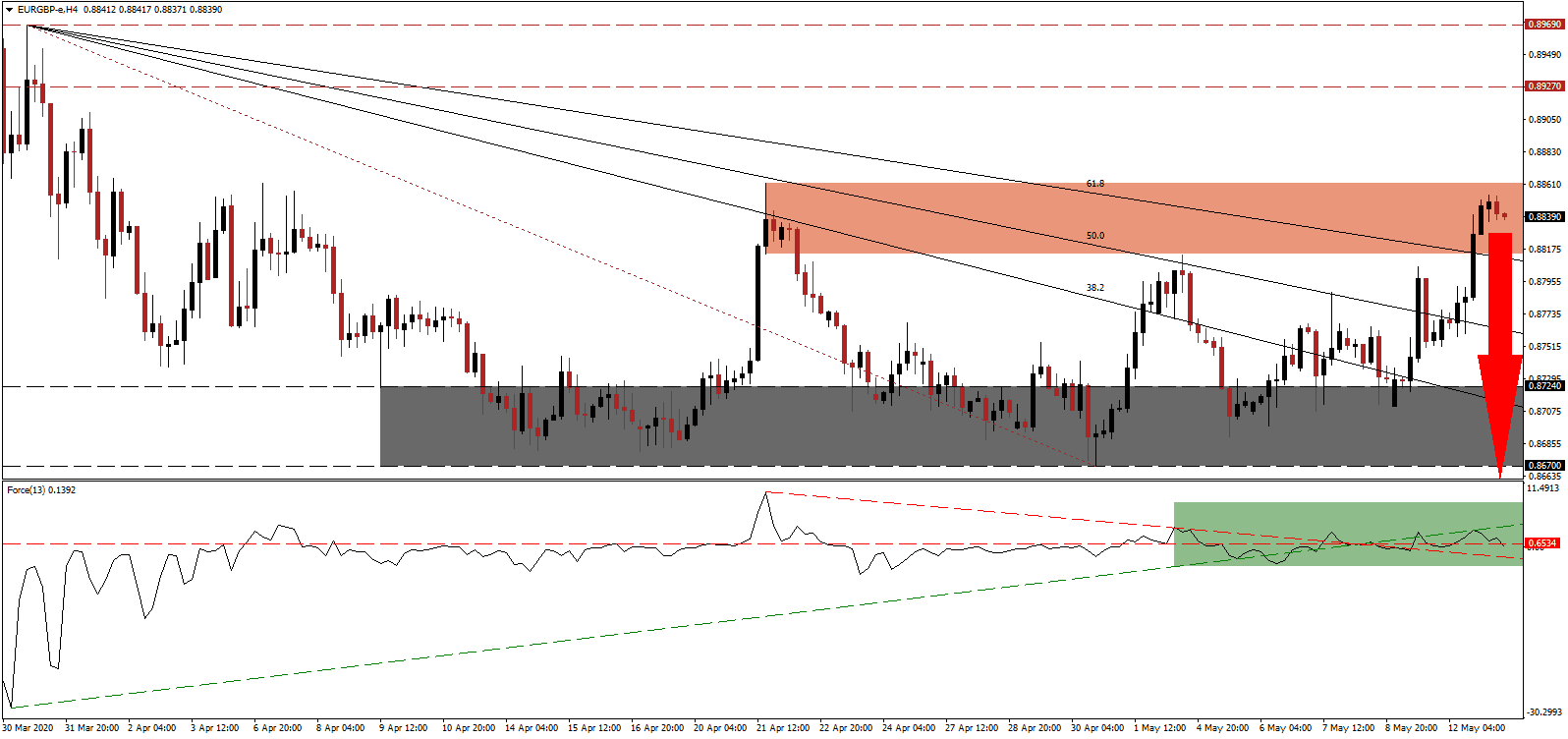

The Force Index, a next-generation technical indicator, was rejected by its ascending support level, leading to a conversion of its horizontal support level into resistance, as marked by the green rectangle. Bearish momentum is building up, and the Force Index is positioned to extend its reversal below its descending resistance level. Bears wait for a collapse into negative territory by this technical indicator, ceding control of the EUR/GBP to them.

Adding to bearish developments in this currency pair is the lack of unity across the Eurozone. Germany’s ruling against the ECB and its monetary policy, while necessary and welcome, highlighted the deep divide across the bloc. It questions the viability of the Euro past the Covid-19 pandemic with individual member countries charting their course. Italy has been at the forefront of speculation to take costly measures to abandon it. After the EUR/GBP advanced into its short-term resistance zone located between 0.8814 and 0.8862, as marked by the red rectangle, bullish momentum faded, and a profit-taking sell-off is developing.

Forex traders are advised to monitor the EUR/GBP for a breakdown below its descending 61.8 Fibonacci Retracement Fan Support Level, which is expected to initiate the net series of net short positions. It will stimulate the pending corrective phase until this currency pair can challenge its support zone located between 0.8670 and 0.8724, as identified by the grey rectangle. A breakdown extension is probable, on the back of increasing bearish progress and deterioration of unity in the Eurozone. The next support zone is located between 0.8487 and 0.8537.

EUR/GBP Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 0.8840

- Take Profit @ 0.8490

- Stop Loss @ 0.8940

- Downside Potential: 350 pips

- Upside Risk: 100 pips

- Risk/Reward Ratio: 3.50

Should the Force Index reclaim its ascending support level, currently serving as resistance, the EUR/GBP could push farther to the upside. Any breakout from current levels will offer Forex traders an excellent long-term selling opportunity. Short-term volatility is anticipated to increase, but the outlook continues to accumulate significant bearish fundamental catalysts. The next resistance zone awaits price action between 0.9149 and 0.9223.

EUR/GBP Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 0.9025

- Take Profit @ 0.9150

- Stop Loss @ 0.8970

- Upside Potential: 125 pips

- Downside Risk: 55 pips

- Risk/Reward Ratio: 2.27