Optimism over the proposed Franc-German one-off €500 billion fund, to assist economic recovery across the European Union in the aftermath of the Covid-19 pandemic, is fading. While the two biggest EU economies suggest no conditions should apply for countries receiving capital, which does not require payback as other EU funds, it requires consensus from all 27 members. The Netherlands and Austria are generally opposed and may seek to adjust terms and conditions. Italy and Spain would be the biggest beneficiaries, but opposition remains. After the Euro initially spiked, selling pressure returned, forcing a breakdown in the EUR/CHF below its resistance zone, partially aided by the safe-haven appeal of the Swiss Franc.

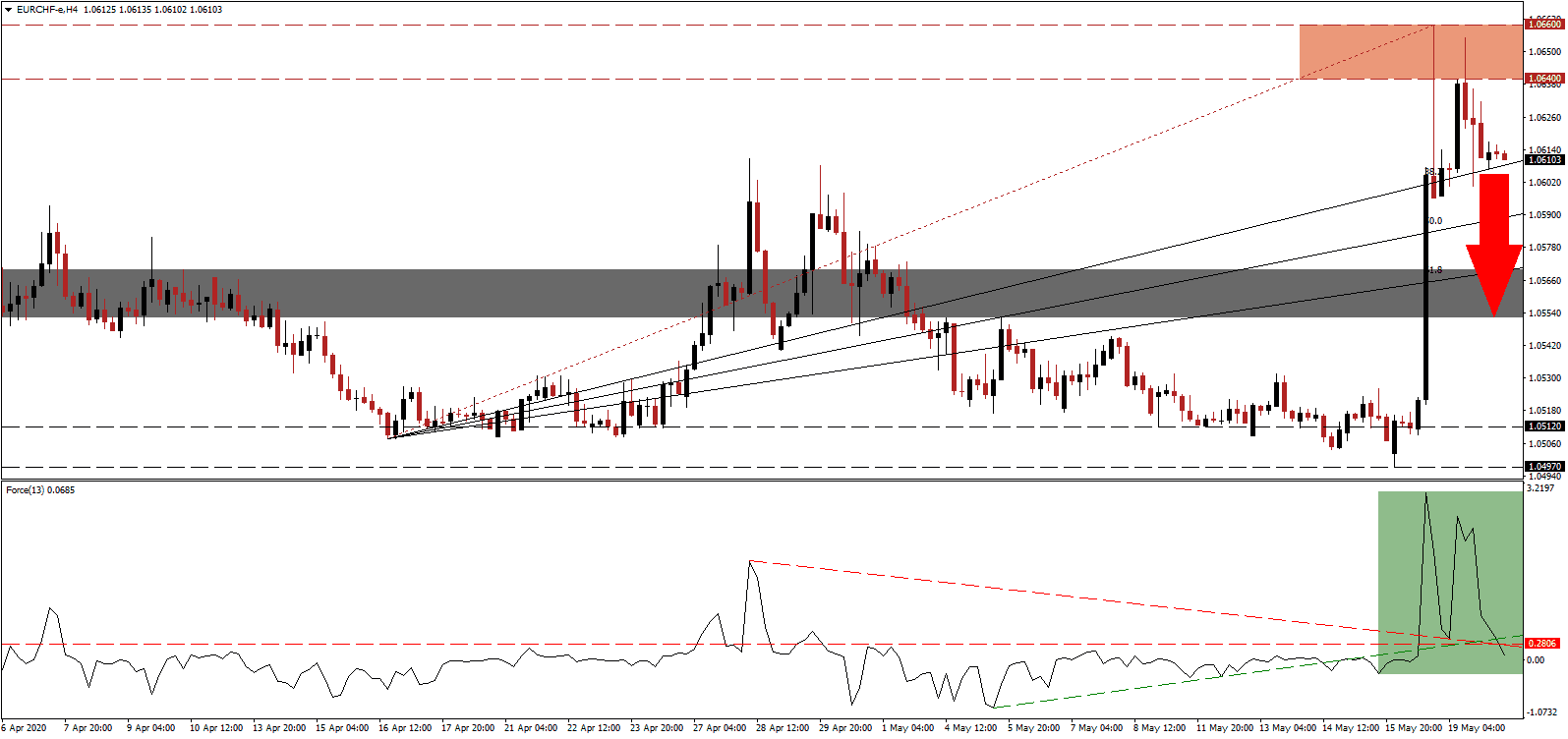

The Force Index, a next-generation technical indicator, confirmed the price spike in this currency pair before collapsing. After correcting below its ascending support level, as marked by the green rectangle, it converted its horizontal support level into resistance. Adding to bearish developments was the breakdown in the Force Index below its descending resistance level, clearing the path for more downside. This technical indicator is on track to move into negative territory, ceding control of the EUR/CHF to bears.

Bearish developments increased after Philip Lane, Chief Economist at the European Central Bank, stated an economic recovery to pre-virus levels before 2021 at the earliest is unlikely. Misconceptions of a V-shaped recovery are fading quickly, with more countries accepting the reality of a prolonged recession, high unemployment, and a need to recalibrate supply chains, which will lead to a change in consumer behavior. The EUR/CHF paused at its ascending 38.2 Fibonacci Retracement Fan Support Level, following the drop below its resistance zone located between 1.0640 and 1.0660, as marked by the red rectangle. The breakdown sequence is well-positioned to accelerate due to negative fundamental progress.

Forex traders are advised to monitor the EUR/CHF for a collapse below its 38.2 Fibonacci Retracement Fan Support Level, converting it into resistance. It is expected to generate the required volume to pressure this currency pair into its short-term support zone located between 1.0552 and 1.0570, as identified by the grey rectangle. Switzerland is in a superior position, economically and fiscally, to recover into a more robust economy, adding to breakdown momentum in price action. Market manipulation by the Swiss National Bank to weaken its currency and assist the essential export sector cannot be ignored.

EUR/CHF Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.0610

Take Profit @ 1.0550

Stop Loss @ 1.0630

Downside Potential: 60 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.00

Should the Force Index reclaim its ascending support level, serving as current resistance, the EUR/CHF could reverse higher. Due to an increasingly bearish outlook for the Eurozone economy, any advance will offer Forex traders a superior short-selling entry-opportunity to consider. The upside potential remains limited to the top range of its long-term resistance zone unless a new catalyst emerges.

EUR/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.0640

Take Profit @ 1.0660

Stop Loss @ 1.0630

Upside Potential: 20 pips

Downside Risk: 10 pips

Risk/Reward Ratio: 2.00