Over the past 24 hours, new global Covid-19 infections recorded the highest single-day increase, per statistics presented by the World Health Organization. It serves as a reminder that the pandemic is far from under control. While four countries accounted for two-thirds of the infections, led by the US, supply chains around the globe are impacted. Japan reported an annualized collapse of 21.9% in April exports, nearly double the contraction printed in March. The threat of a secondary infection wave, anticipated to be more severe than the initial one, cannot be ignored, but warnings by health officials and lockdown fatigue are dominant. Upside exhaustion in the CHF/JPY set in with the breakdown in bullish momentum favored resulting in a price action reversal.

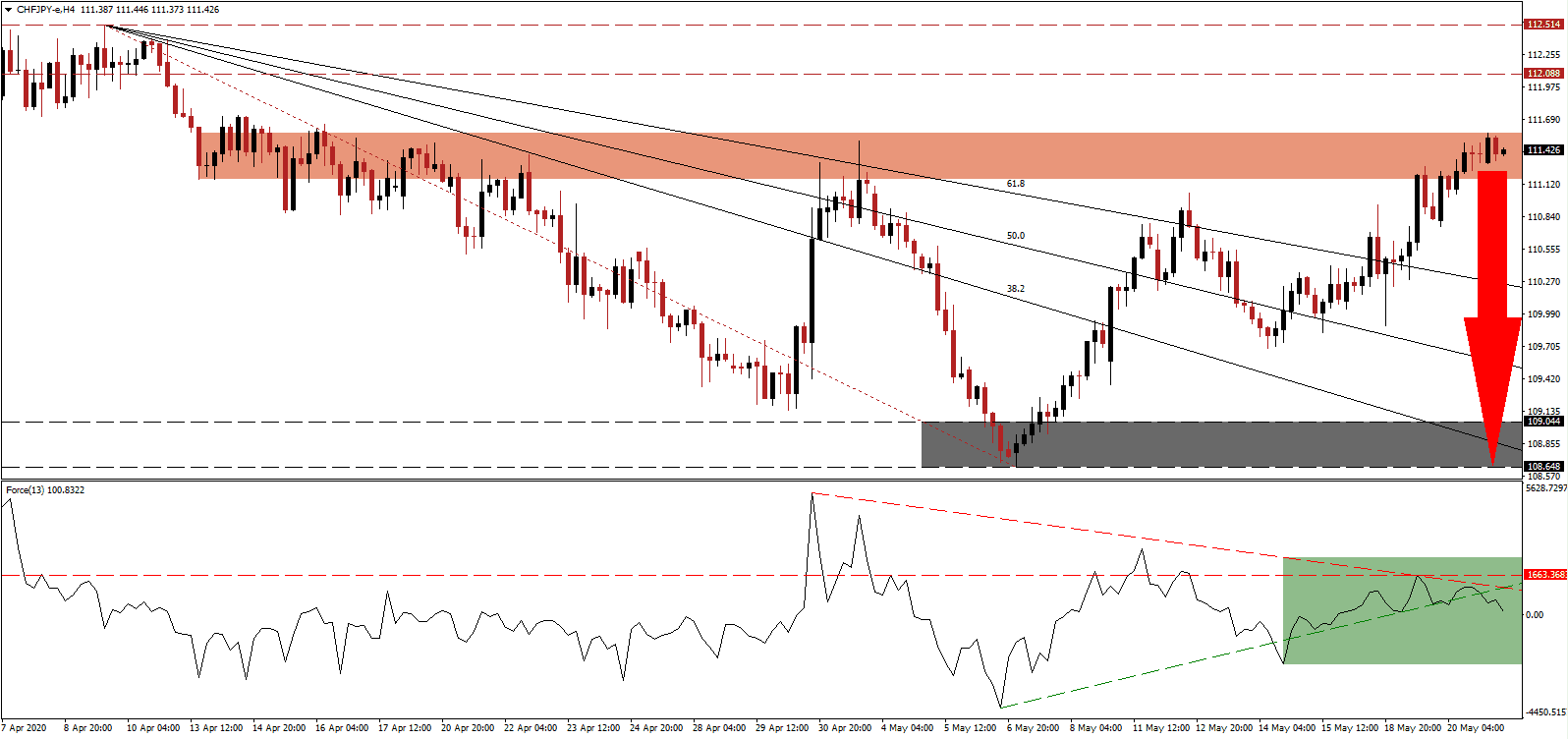

The Force Index, a next-generation technical indicator, was rejected by its horizontal resistance level, with the descending resistance level increasing downside pressure. Adding to bearish developments was the breakdown in the Force Index below its ascending support level, as marked by the green rectangle. This technical indicator is expected to cede control of the CHF/JPY to bears with a move below the 0 center-line.

Japan entered its first recession since 2015, but data suggests the economic condition may worsen significantly in the months ahead. Despite the pending weakness, the Japanese Yen remains the primary safe-haven currency, followed by the Swiss Franc. It creates a minor bearish bias, which is enhanced by the open market manipulation by the Swiss National Bank in an attempt to assist its dominant export industry. Japan is reliant on exports as well, but the Bank of Japan is less active with direct intervention. The CHF/JPY is, therefore, positioned fort a breakdown below its short-term resistance zone located between 111.170 and 111.569, as identified by the red rectangle.

A breakdown from current levels is likely to spark a profit-taking sell-off in this currency pair, and close the gap between the CHF/JPY and its descending 61.8 Fibonacci Retracement Fan Support Level. Forex traders are recommended to monitor price action for a collapse below it, which will create conditions for an extension of the correction into its next support zone. It is located between 108.648 and 109.044, as marked by the grey rectangle. Volatility may increase with fluctuating safe-haven demand in both currencies, as central banks in both economies understand a V-shaped recovery is not supported by fundamentals. You can learn more about a profit-taking sell-off here.

CHF/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 111.450

Take Profit @ 108.650

Stop Loss @ 112.200

Downside Potential: 280 pips

Upside Risk: 75 pips

Risk/Reward Ratio: 3.73

Should the Force Index accelerate above its ascending support level, serving as current resistance, the CHF/JPY may come under upside pressure. The next resistance zone awaits this currency pair between 113.765 and 114.269, which will create a secondary short-selling opportunity for Forex traders to consider. Threats of a prolonged global recession render a distinct bearish driver for price action, backed by more prominent demand with less interference in the Japanese Yen as compared to the Swiss Franc.

CHF/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 112.850

Take Profit @ 114.250

Stop Loss @ 112.200

Upside Potential: 140 pips

Downside Risk: 65 pips

Risk/Reward Ratio: 2.15