Oil prices rebounded significantly from record lows, adding a minor catalyst to the Canadian Dollar, which is dependent on the energy sector. The conditions leading to the price collapse remain place, threatening the recovery. Today’s April employment report is forecast to show the loss of four million jobs, adding to more than one million lost positions reported for March. A dangerous assumption of a V-shaped recovery could prevent taking necessary measures to adjust the composition of economic contributors. Following the breakout in the CAD/JPY above its support zone, a reversal after today’s data cannot be excluded.

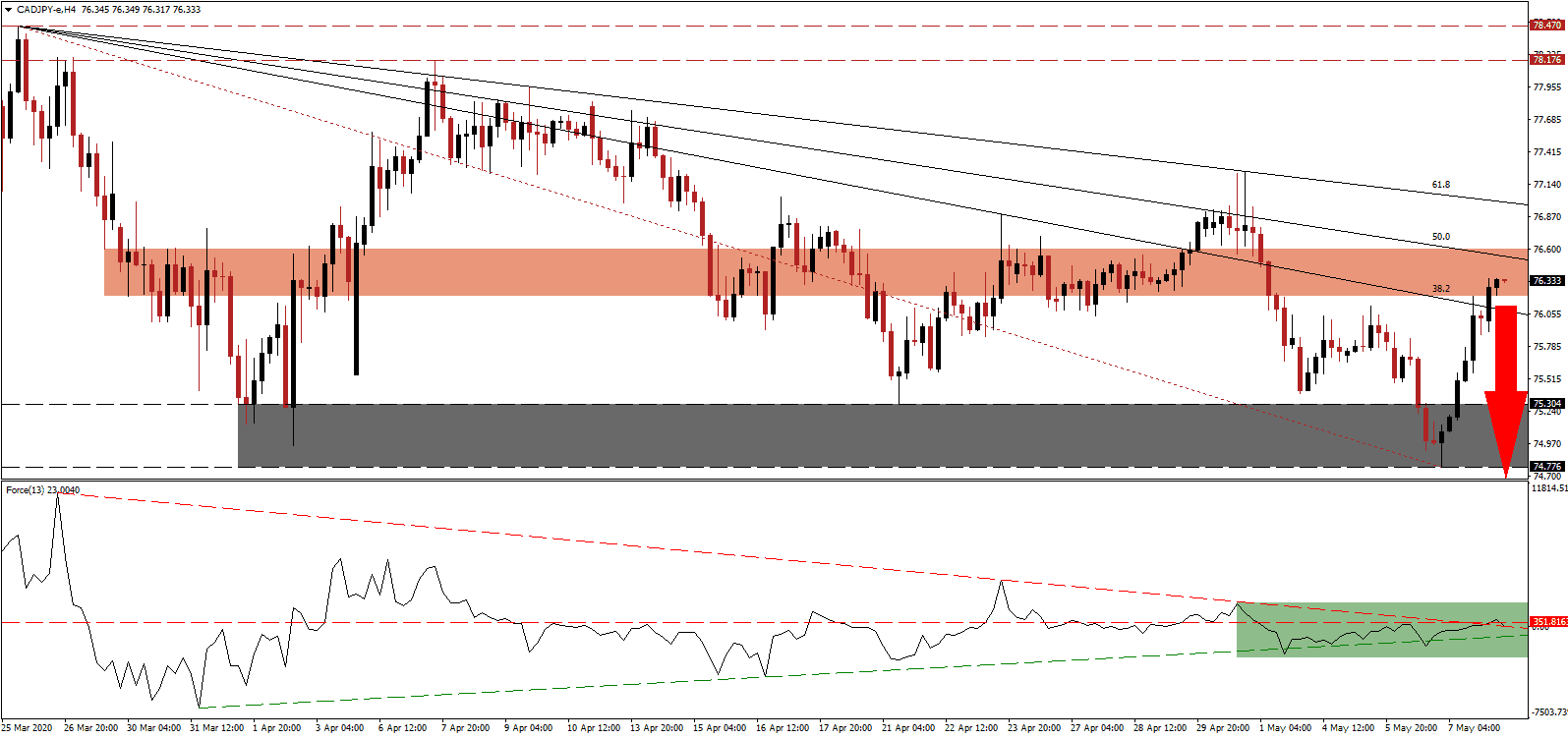

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level before retreating. It is now in the process of moving below its descending resistance level, a marked by the green rectangle, from where the Force Index is favored to accelerate into a breakdown below its ascending support level. Bears await a crossover in this technical indicator below the 0 center-line, granting them full control of the CAD/JPY. You can learn more about the Force Index here.

Japan reported an expected slump in household spending for March, assisting the temporary advance in price action. Risk-on sentiment driven by retail demand diminished the safe-haven appeal of the Japanese Yen in the short-term, with more dismal economic data anticipated to reverse the trend. The CAD/JPY is presently positioned between its descending 38.2 Fibonacci Retracement Fan Support Level and its 50.0 Fibonacci Retracement Fan Resistance Level, inside of its short-term resistance zone. This zone is located between 76.206 and 76.597, as marked by the red rectangle, where breakdown pressures are accumulating.

Forex traders are advised to monitor the intra-day low of 75.882, the base before the most recent push to the upside. A breakdown is likely to intensify the sell-off with new net short positions, adding volume for a more massive correction. The CAD/JPY is expected to retest its support zone located between 74.776 and 75.304, as identified by the grey rectangle from where a supplementary breakdown may commence a challenge of its 2020 intra-day low of 73.740. Caution ahead of the Canadian employment report is recommended.

CAD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 76.300

Take Profit @ 73.750

Stop Loss @ 77.000

Downside Potential: 255 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.64

Should the ascending support level inspire the Force Index to push higher, the CAD/JPY could attempt to extend its recovery. Without a bullish fundamental catalyst, any advance remains vulnerable to a violent reversal. Present conditions suggest more downside in this currency pair, and any breakout from current levels should be viewed by Forex traders as a selling opportunity. The next resistance zone is located between 78.176 and 78.470.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 77.600

Take Profit @ 78.300

Stop Loss @ 77.300

Upside Potential: 70 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.33