Japan’s Prime Minister Abe decided to lift the state of emergency for Tokyo, while the government is considering a second stimulus worth ¥100 trillion. It follows the initial one worth over ¥117 trillion and essentially places the world’s third-largest economy under government support. Japan announced the most consequential fiscal response to the global Covid-19 pandemic, exceeding 40% of GDP. The Bank of Japan already owns over 80% of the domestic equity market, which negates a free-market policy. Economic data out of Japan suggests more hardship ahead, likely to be mirrored by other economies. Despite bearish pressures, the Japanese Yen is expected to maintain its safe-haven status, positioning the CAD/JPY for a profit-taking sell-off.

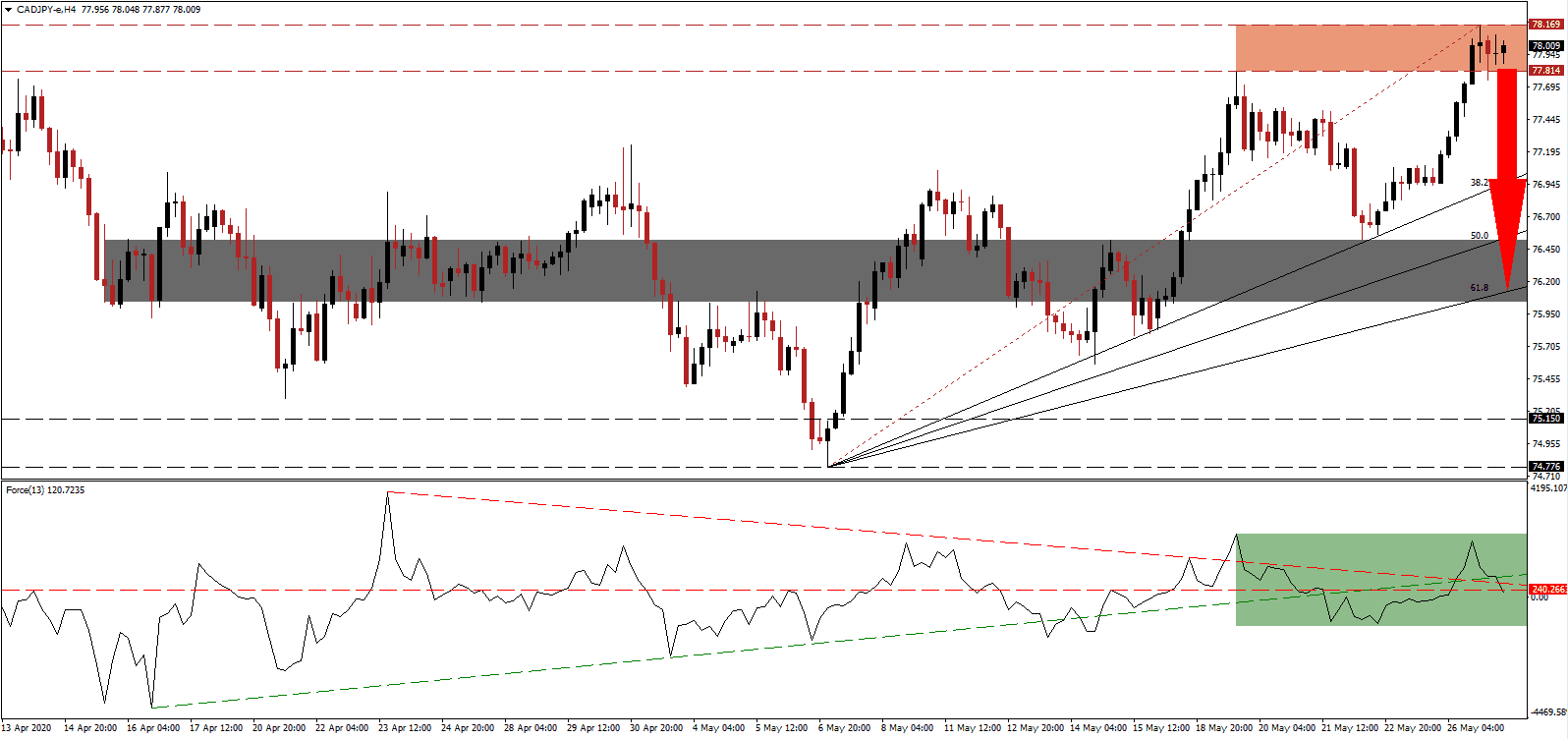

The Force Index, a next-generation technical indicator, recorded a marginally lower high and a negative divergence materialized, an initial warning that a trend reversal is pending. It resulted in the collapse below its ascending support level. The Force Index extended its breakdown below its descending resistance level, as marked by the green rectangle, before converting its horizontal support level into resistance. This technical indicator is poised to correct into negative territory, granting bears control of the CAD/JPY.

While Japan was unable to enforce a nationwide lockdown, due to its constitution, the highly disciplined society adhered to government recommendations, and the business community complied with requests to shut down during the pandemic. It resulted in considerably fewer infections and death than compared with the rest of the developed world. With a global economic recovery remains distant, Japan will face challenges due to its reliance on exports. The Japanese Yen is favored to attract safe-haven inflows with global data well-below expectations, nurturing breakdown pressures in the CAD/JPY inside its resistance zone located between 77.814 and 78.169, as marked by the red rectangle.

Canadian sentiment in the housing sector remains depressed, while the Bank of Canada displays a lack of urgency. Hopes that the provided stimulus and disregard for fiscal responsibility sufficed to bridge the period from the Covid-19 induced recession to recovery could lead to more monetary policy mistakes. The Canadian Dollar is also under pressure from weak commodity markets, adding to the likelihood of a correction in the CAD/JPY into its short-term support zone located between 76.041 and 76.520, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is currently passing through this zone, providing a potential end to the pending sell-off.

CAD/JPY Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 78.000

Take Profit @ 76.200

Stop Loss @ 78.600

Downside Potential: 180 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.00

Should the Force Index accelerate above its ascending support level, serving as resistance, the CAD/JPY may attempt to push higher. Forex traders are advised to take advantage of any breakout attempt with new net short positions. The threat of a new infection wave over the summer, as governments lift lockdowns, remains dominant and favors a strengthening in Japanese Yen. The next resistance zone awaits price action between 79.406 and 79.845.

CAD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 79.000

Take Profit @ 79.800

Stop Loss @ 78.600

Upside Potential: 80 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 2.00