Canada is faced with a more significant mortgage default crisis than after the 2008 global financial crisis, which originated in the US housing sector. The oil price recovery over the past few weeks has eased another substantial area of concern. It may be temporary as the global economy could remain in a recession for longer than presently priced. The Bank of Canada warned of the mortgage default rate increasing to 0.8%. Without its unprecedented market manipulation, it was forecast to rise to 2.1%. Adding to concerns is the lack of capital in home-owning households, making any post-Covid-19 recovery challenging. The CAD/CHF was able to push higher, as safe-haven demand for the Swiss Franc eased, but is positioned to retrace the breakout above its short-term support zone.

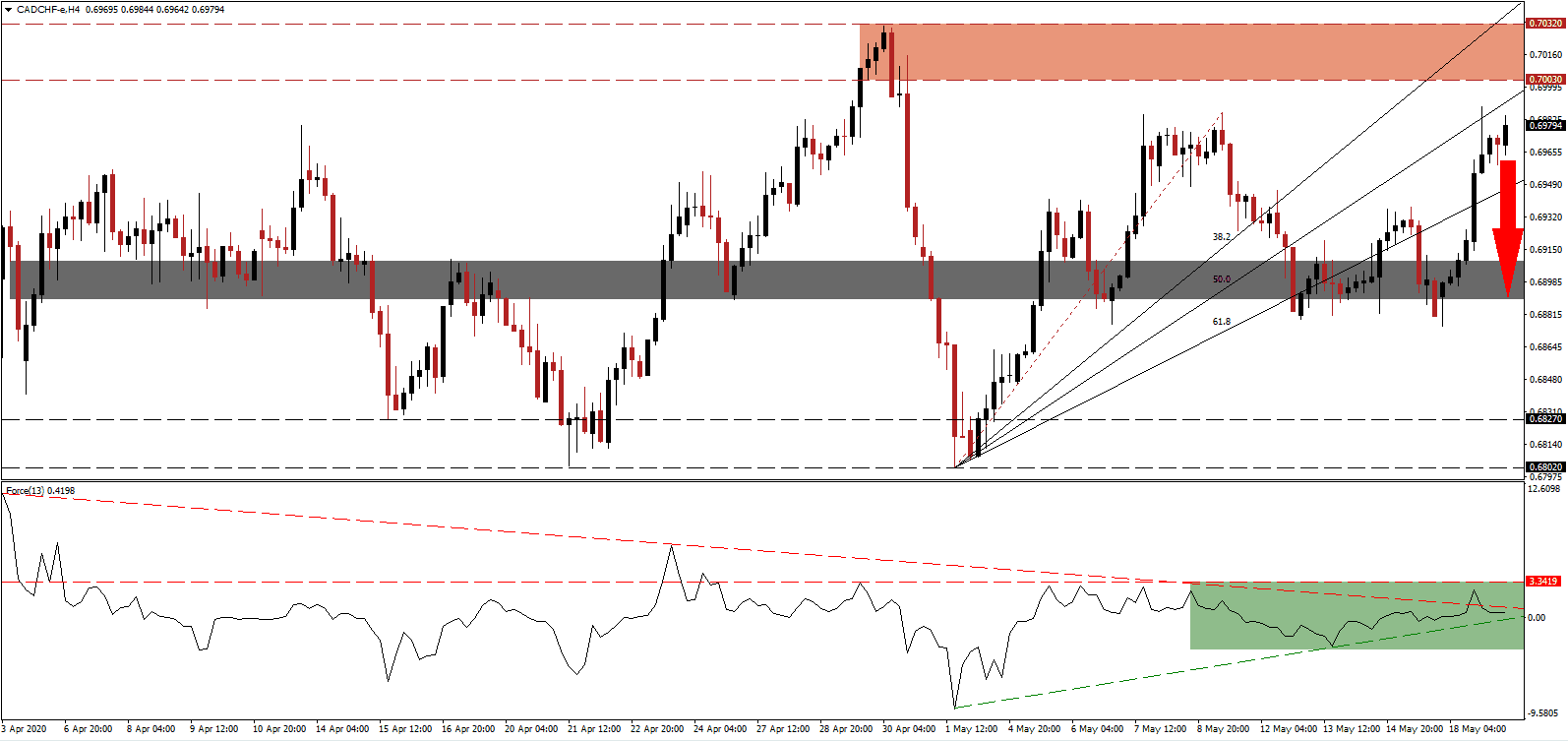

The Force Index, a next-generation technical indicator, drifted higher after bouncing off of its ascending support level but remains below its horizontal resistance level. A brief push above its descending resistance level was swiftly reversed, as marked by the green rectangle, confirming deteriorating bullish momentum. This technical indicator is on the verge of crossing below the 0 center-line, granting bears control of the CAD/CHF. You can learn more about the Force Index here.

While Canada has an opportunity to recalibrate its economy, a false sense of security may derail necessary adjustments. The six biggest Canadian banks passed a recent stress test, but remain under pressure by monetary policy, which is eliminating profitability and a willingness to make loans. Rising debt levels remain a long-term problem mostly ignored by market participants, adding a distinct bearish fundamental catalyst to price action in the CAD/CHF. A breakdown into its short-term support zone located between 0.6889 and 0.6909, as identified by the grey rectangle, is anticipated to unfold.

A more realistic approach by the Swiss National Bank, ruling out a V-shaped economic recovery, will allow for a more efficient decision-making process geared towards long-term sustainability. While a weaker Swiss Franc is beneficial for the country’s export sector, Forex traders are expected to keep demand for the Swiss Franc elevated, especially once a favorable economic outlook becomes dominant. The CAD/CHF is presently trapped inside a channel created by its ascending 61.8 Fibonacci Retracement Fan Support Level and its 50.0 Fibonacci Retracement Fan Resistance Level. Price action may spike into its resistance zone located between 0.7003 and 0.7032, as marked by the red rectangle, but breakdown pressures for a more massive reversal are on the rise.

CAD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.6980

Take Profit @ 0.6890

Stop Loss @ 0.7010

Downside Potential: 90 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.00

Should the Force Index recover with the assistance of its ascending support level, the CAD/CHF is likely to be pressured into a breakout attempt. Due to lingering global economic risks, the upside is limited to the next resistance zone located between 0.7112 and 0.7146. The outlook and recovery potential for Switzerland exceed those of Canada, and Forex traders are advised to take advantage of any breakout with new net short positions.

CAD/CHF Technical Trading Set-Up - Confined Breakout Scenario

Long Entry @ 0.7060

Take Profit @ 0.7120

Stop Loss @ 0.7030

Upside Potential: 60 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.00