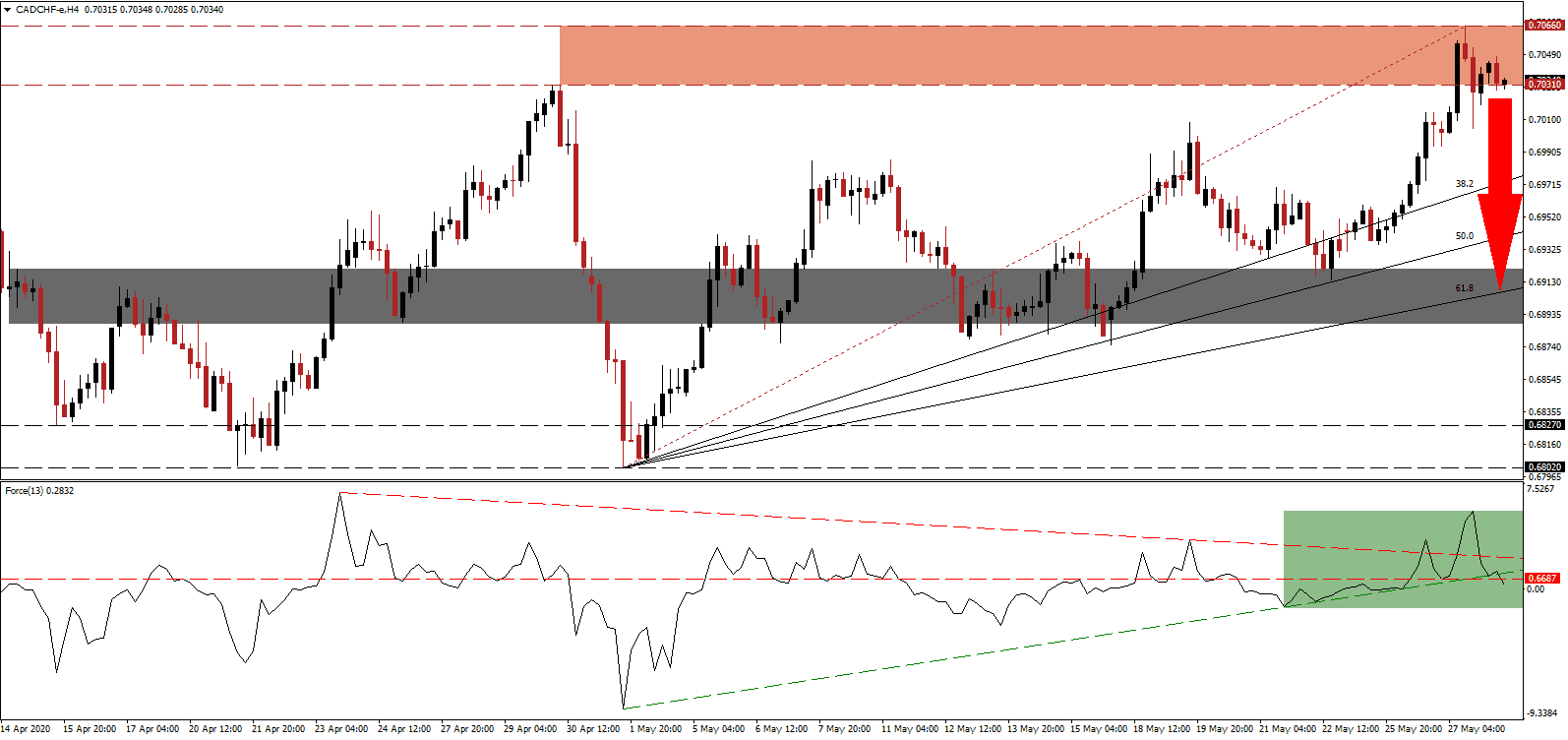

Canada’s economy struggled before the Covid-19 outbreak, issues were intensified after oil prices collapsed, and the problems persist today. While the economy is projected to contract 4.3% in 2020, per the Conference Board of Canada, it forecasts a 6.0% recovery in 2021. Complacency over supply-chain adjustments, and permanent changes in consumer behavior, position the CAD/CHF for disappointments moving forward. Bullish momentum is breaking down after this currency pair advanced into its resistance zone, with price action poised to follow.

The Force Index, a next-generation technical indicator, initially spiked to a multi-week high before swiftly correcting below its descending resistance level. It was followed by a breakdown below its ascending support level, as marked by the green rectangle, which led to a conversion of the horizontal support level into resistance. This technical indicator is on course to move into negative territory, ceding control of the CAD/CHF to bears.

After New Zealand announced it considers a four-day workweek as part of its economic recovery plan, Canada is opening up to the idea. It is primarily anticipated to benefit white-collar workers and the tourism industry. Researches caution flexibility remains paramount, and various sectors will require a different approach. Until Canada addresses fundamental challenges, the economy and its labor force will be under pressure. The CAD/CHF is positioned to enter a profit-taking sell-off once price action completes a breakdown below the resistance zone located between 0.7031 and 0.7066, as identified by the red rectangle.

Switzerland is home to one of the most active central banks in the global financial system. The Swiss National Bank (SNB) stressed the importance of its direct currency manipulation, and its foreign currency holdings now total more than CHF800 billion, more than the entire output of the Swiss economy. Safe-haven demand for the Swiss Franc and the SNB noted a desire to expand the balance sheet while placing further interest rate cuts on the table. It already has the lowest rates at -0.75%. Despite interventions, the CAD/CHF is anticipated to correct into its short-term support zone located between 0.6888 and 0.6921, as marked by the grey rectangle, and enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level. Safe-haven demand for the Swiss Franc outpaces the ability of the central bank to intervene, adding a bearish catalyst to this currency pair.

CAD/CHF Technical Trading Set-Up - Profit-Taking Scenario

- Short Entry @ 0.7035

- Take Profit @ 0.6915

- Stop Loss @ 0.7075

- Downside Potential: 120 pips

- Upside Risk: 40 pips

- Risk/Reward Ratio: 3.00

A breakout in the Force Index above its descending resistance level is expected to result in an attempt to extend the current advance in the CAD/CHF. Economic worries out of Canada exceed those in Switzerland, with reduced recovery potential. Therefore, Forex traders are recommended to view any breakout as a secondary short-selling opportunity. The next resistance zone is located between 0.7112 and 0.7146.

CAD/CHF Technical Trading Set-Up - Limited Breakout Scenario

- Long Entry @ 0.7095

- Take Profit @ 0.7140

- Stop Loss @ 0.7075

- Upside Potential: 45 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 2.25