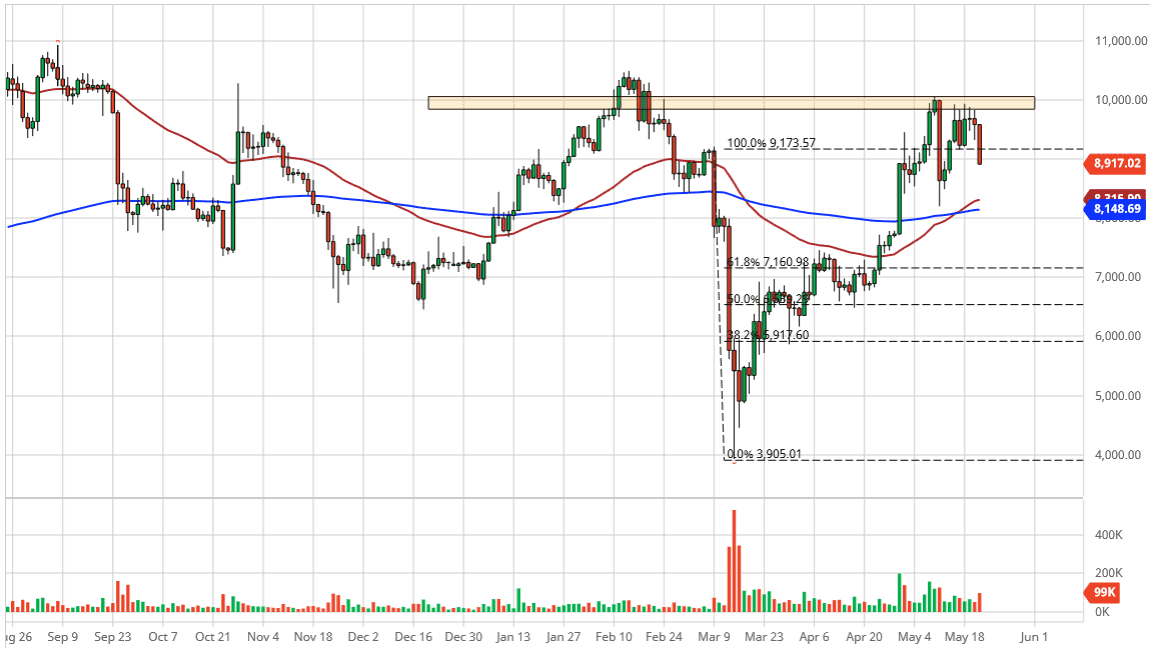

Bitcoin markets broke down significantly during the trading session on Thursday as we had seen a move into the US dollar overall. In fact, the Bitcoin market is closing at the bottom of the range, which is almost always a very bearish sign. Quite often, that means that we will see some type of continuation. This does not necessarily mean that Bitcoin has to fall apart, just that we are likely to see lower pricing.

The size of the candlestick is something to pay attention to as well because we slice through several candles in movie lower to form this candlestick. Because of this, we are now below the $9000 level, which of course suggests that there is a certain amount of psychological destruction as well. Looking at the chart underneath, it looks as if the market is trying to reach towards the 50 day EMA underneath, as I had anticipated a couple of days ago. This makes sense, because the $10,000 level will of course attract a lot of attention anyway so pulling back from there is not a huge surprise. The ferocity of the candlestick for the trading session does suggest more negativity, especially considering that the volume has picked up a bit as well.

We had recently seen the so-called “golden cross”, which is when the 50 day EMA rises above the 200 day EMA. This typically brings and a lot of longer-term traders, who of course like the idea of holding long-term moves. That being said, the fact that we pull back from the $10,000 level and perhaps go looking towards these moving averages would not be a huge surprise. I believe that the $8000 level is significant support, and quite frankly if we are to break out to the upside, we need to build up the necessary momentum. Expect a lot of choppiness and volatility, but that is going to be true with all assets, not just Bitcoin. In fact, in that sense it is highly likely that the Bitcoin market is starting to mature in the sense that it is starting to act like a lot of other ones. Unfortunately, it is a different type of volatility than most Bitcoin traders are used to, as the volatility goes back and forth as opposed to in one direction suddenly. Ultimately, I do think that we get an opportunity to buy at lower levels, but you may have to wait a day or two.