Australia attempts to utilize the Covid-19 pandemic as a catalyst to achieve economic sovereignty. While countries are anticipated to introduce permanent changes to supply chains, Australia has been dependent on China for most of its growth over the past thirty years. It allowed it to avoid a recession for three decades but is now headed for profound economic disruption. Amid the coronavirus crisis, Australia opted to start a diplomatic spat with its primary trading partner, which has led to a trade dispute. Negative progress in the AUD/USD has been presently avoided, as the US is rushing to deteriorate a challenging relationship with China. It positions price action for a new breakout sequence, with upside pressures on the rise below its resistance zone.

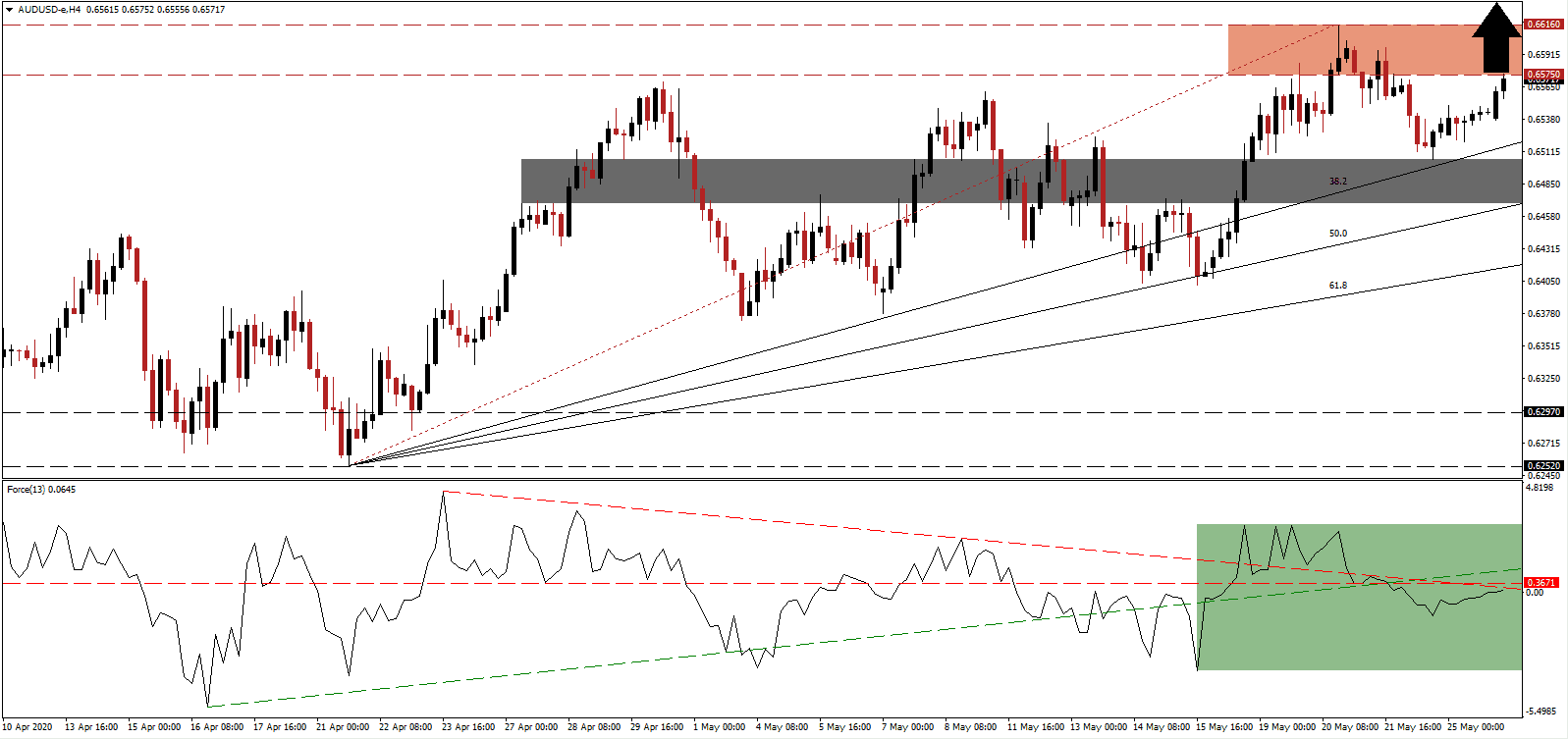

The Force Index, a next-generation technical indicator, recovered from its most recent low after collapsing below its horizontal support level, converting it into resistance. It is now challenging its descending resistance level, as marked by the green rectangle. Bulls started to regain control of price action after this technical indicator crossed above the 0 center-line. A spike above its ascending support level, serving as resistance, is favored to pressure the AUD/USD farther to the upside.

Manufacturing has been singled out as an essential sector for a new economic model moving forward in Australia. The country is rich in natural resources and has a stable food supply, but took advantage of cheap labor in developing countries. Aspirations to repatriate well-paid jobs will ensure long-term stability, but the medium-term outlook remains challenging. This currency pair was able to use its short-term support zone located between 0.6469 and 0.6505, as marked by the grey rectangle, to reverse its previous rejection, and the AUD/USD is now challenging its resistance zone.

With the US rumored to apply sanctions on China, which will likely ruin the phase on trade truce, price action is expected to initiate a new breakout sequence. The ascending Fibonacci Retracement Fan sequence is applying breakout pressures in the AUD/USD, poised for a move above its resistance zone located between 0.6575 and 0.6616, as identified by the red rectangle. The toxic combination of US monetary and foreign policy, with a preference for debt, can spike this currency pair into its next resistance zone located between 0.6749 and 0.6774, supported by the formation of a distinct bullish chart pattern.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.6560

Take Profit @ 0.6775

Stop Loss @ 0.6500

Upside Potential: 215 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 3.58

In the event the descending resistance level rejects the Force Index, leading to a build-up in bearish momentum, the AUD/USD is likely to be pressured to the downside. Given bearish US progress, economically, fiscally, and internationally, the downside potential is limited to its 61.8 Fibonacci Retracement Fan Support Level. Forex traders are recommended to consider this an excellent buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Reversal Scenario

Short Entry @ 0.6475

Take Profit @ 0.6420

Stop Loss @ 0.6500

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20