Australia moved the timetable to ease the nationwide lockdown forward by several months, despite elevated risks for a potential second wave of Covid-19 infections. China, South Korea, and Germany reported a rise in new cases after allowing limited economic activity to resume. A rush to ease social distancing threatens a sustained recovery. Prime Minister Morrison warned against overconfidence, as complacency over the risk and long-term negative impact on the economy have become evident. The AUD/USD entered a minor correction after reaching its resistance zone, but this healthy pullback ensured the health and longevity of the dominant bullish chart pattern.

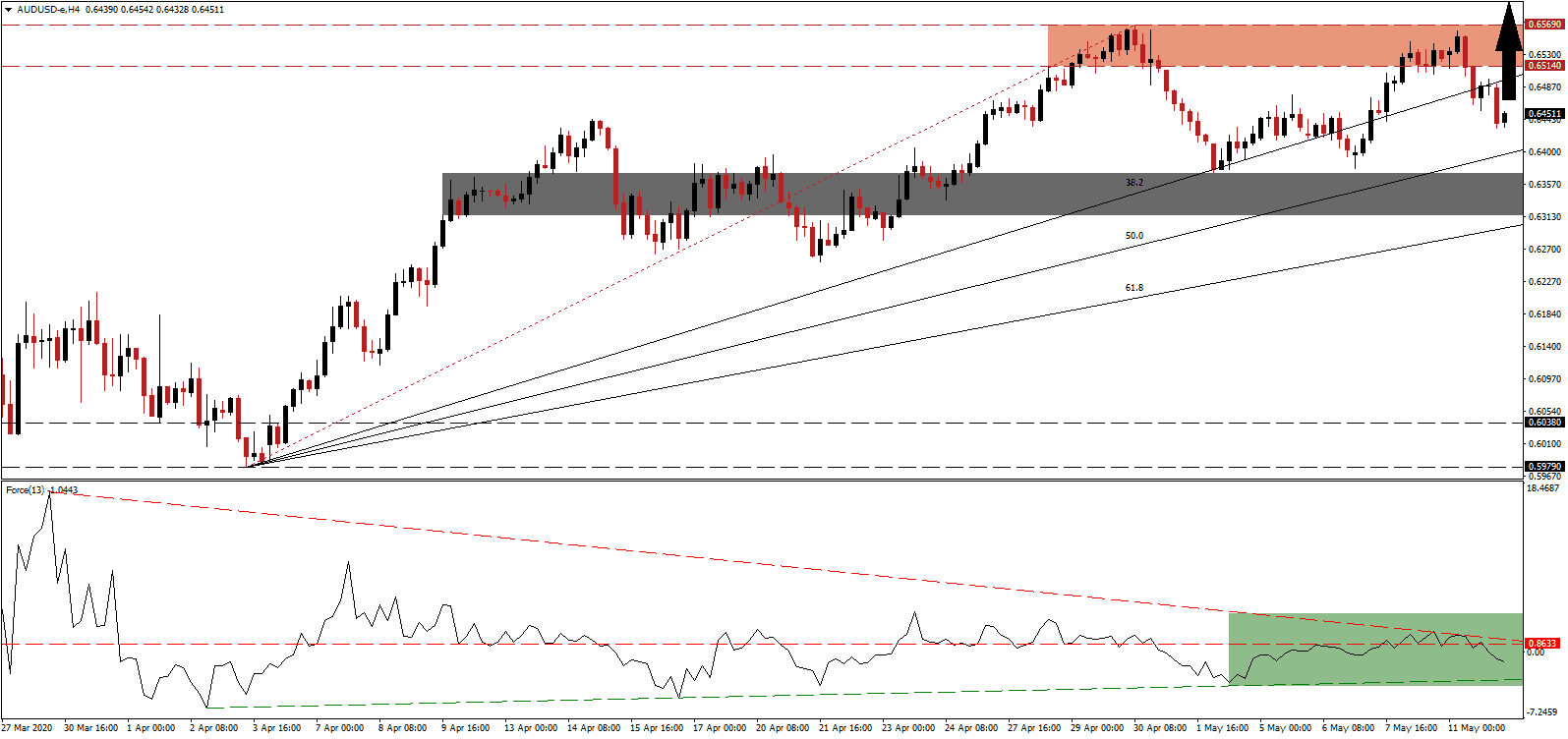

The Force Index, a next-generation technical indicator, was pressured below its horizontal support level, converting it into resistance, by its descending resistance. It additionally moved into negative territory, as marked by the green rectangle, while the ascending support level is expected to reverse the Force Index. After this technical indicator recovers above the 0 center-line, bulls will regain control of the AUD/USD and are favored to push for more upside in this currency pair.

China, Australia’s primary trading partner and source of economic strength suspended beef imports from four slaughterhouses, fueling concerns over the diplomatic row Australia initiated with China over independent testing of wet markets in Wuhan, where the Covid-19 virus was initially reported. The NAB Business Survey for April slipped deeper into negative territory, but confidence rebounded while remaining in depressed conditions. It sufficed to add to temporary selling pressure in the AUD/USD and the breakdown below its resistance zone located between 0.6514 and 0.6569, as marked by the red rectangle.

Despite the current issues in Australian-Chinese relations, it is anticipated both sides will reach an agreement and smooth over differences. Australia cannot afford to decouple from China, especially with economic challenges posed by the need to adjust to a post-virus economy. The ascending 50.0 Fibonacci Retracement Fan Support Level, which crossed above the short-term support zone located between 0.6315 and 0.6372, as identified by the grey rectangle, is likely to enforce the bullish chart pattern. A renewed advance can take the AUD/USD into its next resistance zone awaiting between 0.6736 and 0.6776.

AUD/USD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.6455

Take Profit @ 0.6775

Stop Loss @ 0.6375

Upside Potential: 320 pips

Downside Risk: 80 pips

Risk/Reward Ratio: 4.00

In the event the Force Index collapses below its ascending support level, the AUD/USD could extend its corrective phase. Due to a significantly weaker US economy, in conjunction with added debt-funded stimulus, the downside potential remains limited to its 61.8 Fibonacci Retracement Fan Support Level, position below its short-term support zone. Forex traders are recommended to view this as a second buying opportunity.

AUD/USD Technical Trading Set-Up - Limited Breakdown Extension Scenario

Short Entry @ 0.6355

Take Profit @ 0.6300

Stop Loss @ 0.6375

Downside Potential: 55 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.75