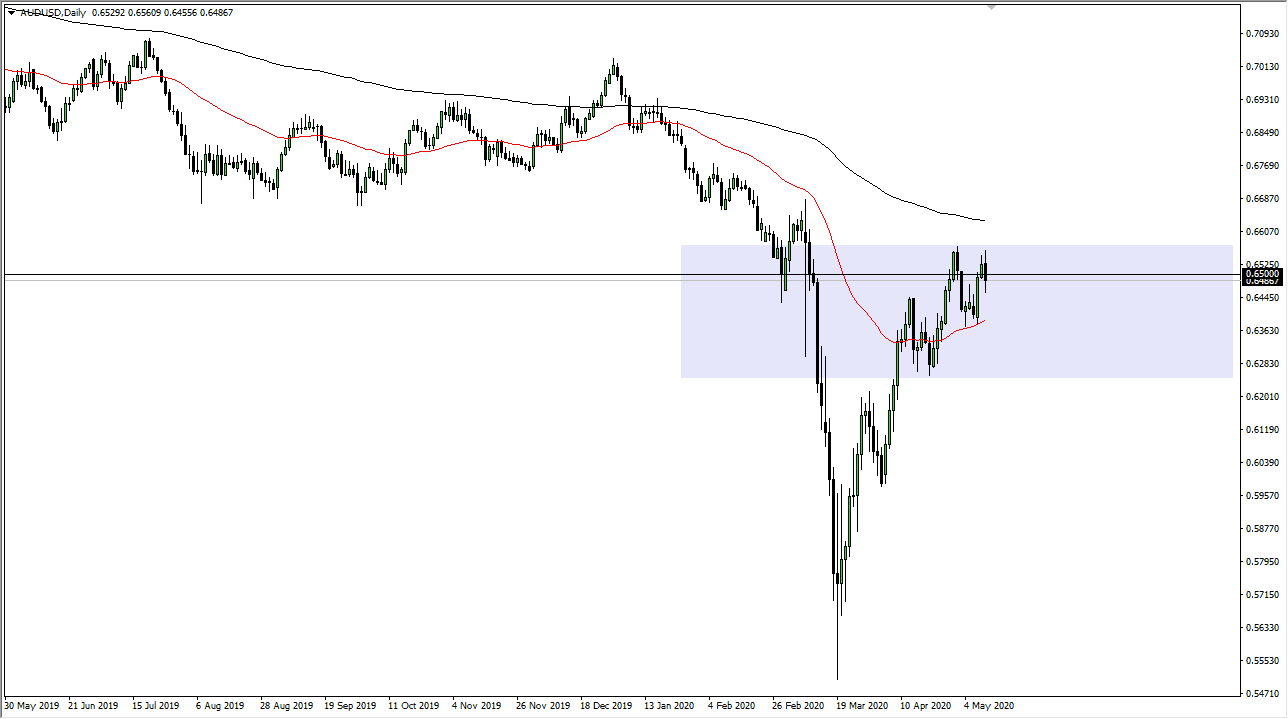

The Australian dollar continues to go back and forth around the 0.65 level, which is an area that should attract a lot of attention. Quite frankly though, it is astonishing how the Australian dollar refuses to accept the idea of gravity. At this point, it is likely that the market is going to have to make some type of decision, because we cannot seem to make a move in one direction or the other for any real length of time. One thing that is noticeable is the fact that the most recent high is lower than the one before, so it is worth noting that we are still in a downtrend, but the Australian dollar simply will not give up its gains.

Perhaps this is due to the coronavirus situation in Australia been much better than other places, but quite frankly the Aussie dollar has far too much attached to the Chinese economy to think that it will continue to go higher without some type of boost. Ultimately, this is a market that also has the face the 0.67 level above where the 200 day EMA currently sits. That is where everything changes, and it becomes a longer-term “buy-and-hold” type of situation. I find that extraordinarily difficult to accept at this point, as there has been far too much in the way of negativity out there for this to continue. It should be noted that momentum is starting to wane in this pair, and that is the death knell of a trend. This is not to say that it cannot go higher, just that it is a lot less likely to do so.

To the downside, I suspect that the market goes looking towards the 50 day EMA, perhaps even down to the 0.6250 level. This market will continue to be very noisy, but ultimately, we will have to make some type of decision. Once that decision is made, it is highly likely that we will see a lot of momentum into the marketplace in one direction or the other. Because of this, it is highly likely that we will continue to see choppy moves, but eventually we will get the impulsive candlestick that is necessary to show market participants where momentum is going to continue to go. We have seen an extraordinarily bullish move over the last couple of months, but we are starting to approach an area where gravity should come into play.