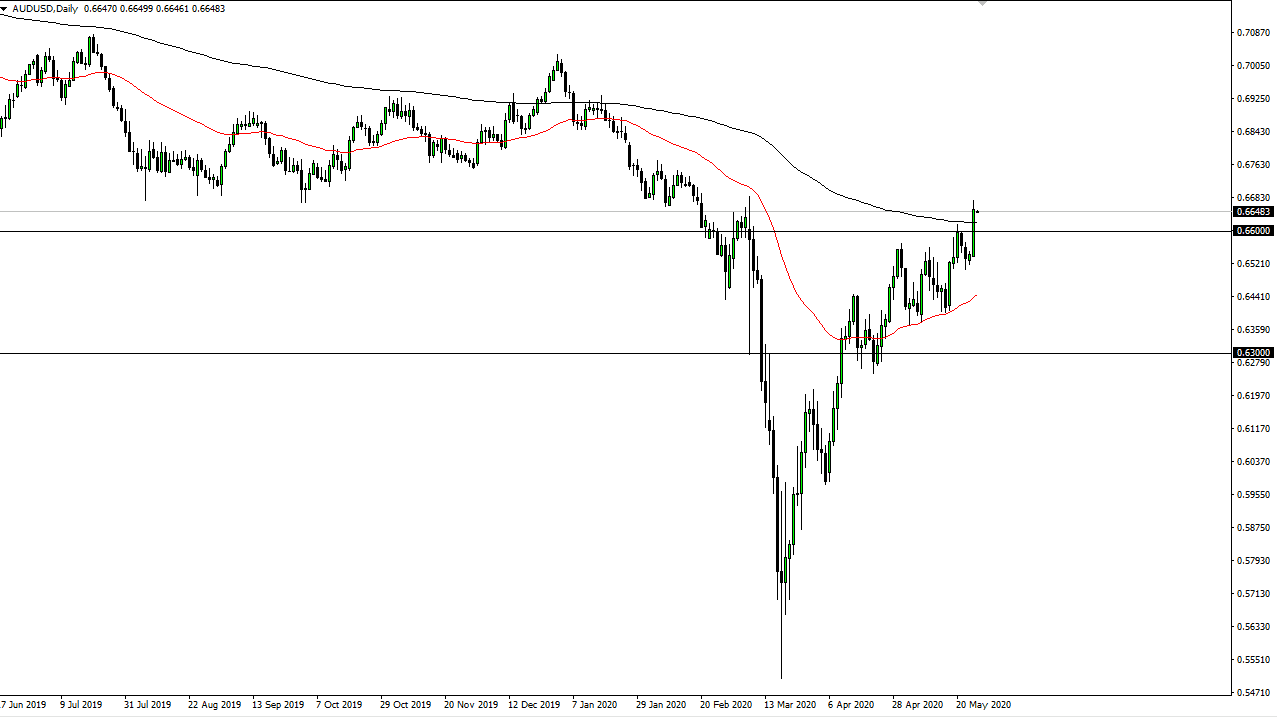

The Australian dollar has exploded to the upside during the trading session on Tuesday, breaking above the 200 day EMA and even managing to close above it. That being said, we also have a lot to worry about in the form of 0.67, which was the scene of massive selling. If we can break above there, then it is likely that the Aussie will continue the longer-term move to the upside. However, the Australian dollar has gotten ahead of itself as you can see, so it will be interesting to see whether or not we can continue this momentum. If we can, then that is an extraordinarily strong signal.

On the other hand, if the Aussie does in fact turn around a break back below the 0.66 handle, it could signal trouble going forward, perhaps reaching down towards the 50 day EMA before bouncing again. Overall, this is a market that seems to be focusing on everything going right in the global economy going forward, but there are also some concerns about the US/China trade relations. If that continues to be a major issue, then it will certainly have its effect on the Aussie dollar. When you zoom out and look at the Aussie dollar from a longer-term perspective, we are right at the level where we truly broke down for the most dangerous of the selloffs. In other words, this is a market that is at a key level for a longer-term trading.

With that in mind, if we break down, I think we could continue going much lower. However, if we break above the 0.67 handle and beyond, then it is likely that the Australian dollar will go looking towards the 0.70 level, and possibly even higher than that as it would be such a significant turnaround to the overall attitude of the Australian dollar. There are some reasons to think that the Aussie would take off to the upside, not the least of which would be the coronavirus numbers coming out of the country. Having said that though, if they do not have any customers, then it really will not matter how strong the local economy is, because it will not be for long in that environment. At this point, the market looks highly likely to continue seeing noisy trading, but clearly, we are right in the vicinity of a major crossroads when it comes to the Aussie dollar.