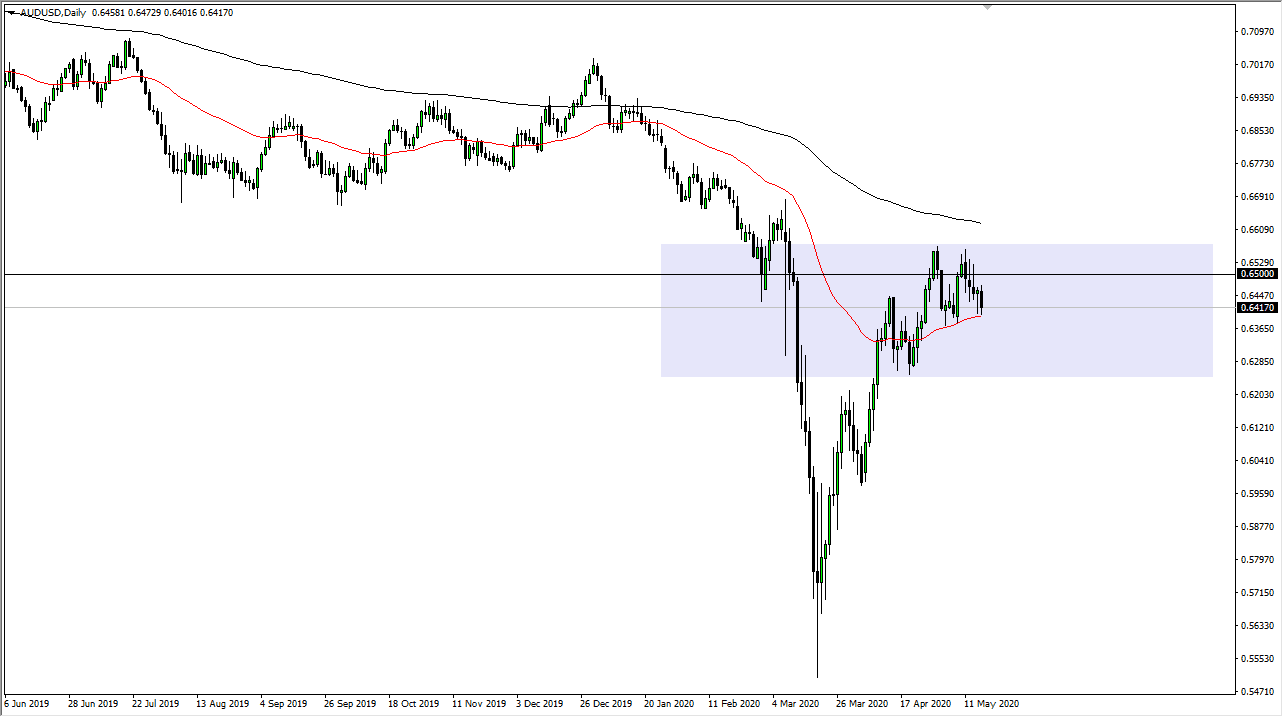

The Australian dollar has broken down during the trading session on Friday, reaching towards the 50 day EMA. The market has also reached towards the bottom of the hammer from the previous session, and if we can break down below that hammer, it will open up quite a bit of selling pressure. This would not only break a hammer to the downside, but also the 50 day EMA that will capture a lot of attention. A breakdown below that level it is likely that the market probably goes looking towards the 0.6250 level, perhaps even further than that.

Just above current trading, there is the 200 day EMA which sits above the 0.66 level. Ultimately, this is a significant technical indicator that is drafting lower, and it is likely that the market is continuing to see a lot of selling pressure. At this point, the market looks as if it is running out of momentum to the upside, as the 0.65 level has captured a lot of attention. The rate of change in this pair continues to dwindle, and one can see how it would only take a quick catalyst to send this market breaking down. Rallies at this point will be sold into, and that should show the overall downtrend remaining strong.

To the upside, the market was to break above the 200 day EMA then the Australian dollar suddenly becomes more of an investment, a “buy on the dips” type of scenario. I do not see that happening unless of course we get some type of explosive move in global growth, and even though economies are opening up, they are barely doing so. There will be a serious lack of growth at this point, so it is going to be difficult to imagine a scenario where the Australian dollar is suddenly in favor. After all, the market should continue to see a lot of volatility, but in volatility we have plenty of trading opportunities. I am still selling rallies until we break above the 200 day EMA, and then will be adding if we can break down below the 50 day EMA, and if we break down below the 0.6250 level, then I would become even more aggressive. I do think that day is coming but it may take a while to get here. All things being equal, this is a market that should continue to see a lot of jitters.