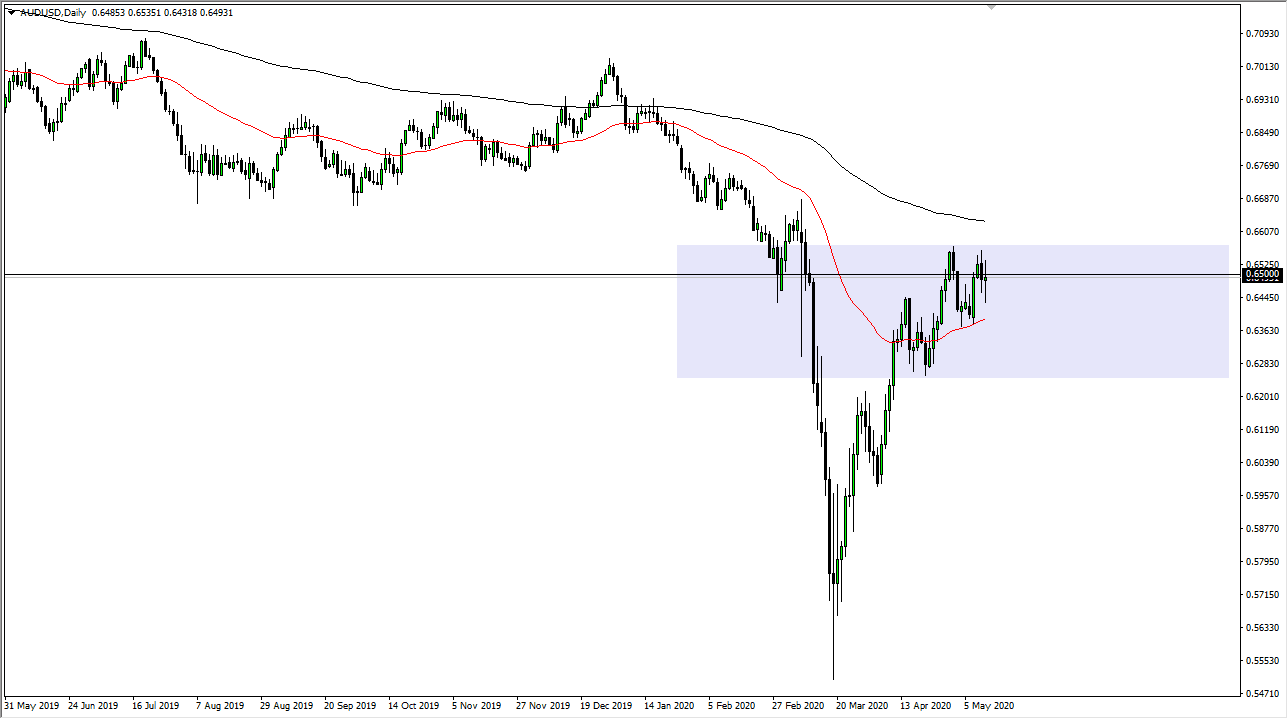

The Australian dollar has gone back and forth during the trading session on Tuesday as we continue to look at the 0.65 level as an area that is going to offer significant resistance. The fact that we cannot seem to go anywhere at this level shows that we are in fact running out of momentum. If that is going to be the case, then I believe it is only a matter of time before we rollover and start falling. Being quite frankly, the Australian dollar looks as if it is trying to rollover, but it might be a bit of a longer-term trade more than anything else.

A breakdown below the bottom of the trading session for the Tuesday candlestick does suggest that we are going to go towards the 50 day EMA, and then possibly the 0.6250 level. Ultimately, this is a market that is going to be based upon the risk appetite of traders around the world and it looks to me as if we are starting to run out of the good cheer that traders need in order to continue pushing assets higher. Ultimately, this is a market that is looking very much like the pace of the gains is starting to favor the downside and therefore I do think that it is only a matter of time. That being said, this will probably need some type of catalyst to get going, which could come at any point.

If the market were to turn around a break above the 0.67 level, the market is very likely to continue going higher for a longer-term move. It would not only break above a significant break down from the past, but it would also signify that the market was breaking above the 200 day EMA, something that a lot of longer-term traders will pay close attention to. I do believe that we are more likely to see the market fall than rise, but quite frankly the resiliency of risk appetite has been something to behold as of late. It appears that a lot of market participants are looking to place a trade based upon monetary policy coming out of the Federal Reserve but it is a bit much to ask that the world should suddenly be a very cheery place that allows the possibility of the Aussie to continue to work against the greenback as it is so highly levered to the Chinese economy and of course the commodity markets which are under serious stress.