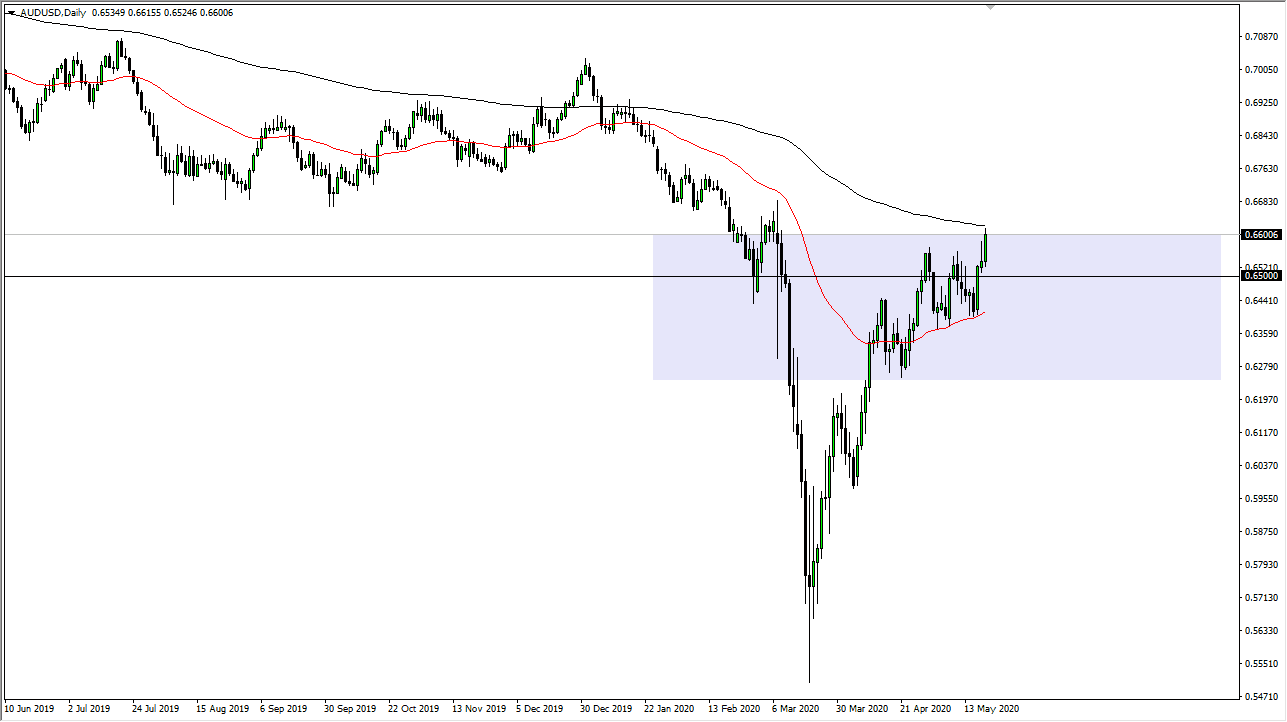

The Australian dollar has rallied significantly during the trading session on Wednesday, to test the 0.66 again. What is more impressive is the fact that it broke above the top of a shooting star, which is a very bullish sign. However, it also has to deal with this round figure and of course the 200 day EMA sitting just above. This is a combination of resistance that will be difficult to overcome. However, we should also keep in mind that this is an area we had broken down below, so it makes quite a bit of sense that there would still be pressure there.

To the downside, the market has a lot of support near the 0.65 handle, so it will be interesting to see whether or not we can break down through there. If we could, the market is likely to break down somewhat to reach towards the 50 day EMA which is colored in red on the chart. We are currently bouncing between the 50 day EMA and the 200 day EMA, so I think this is a perfect area to see more chopping back and forth and perhaps a resolution eventually.

Keep in mind that this pair is extremely sensitive to the US/China trade situation, which is noisy at best, so paying attention to that is crucial. The Australians are having tariffs thrown up against some of their commodities by the Chinese, as the war of words starts to heat up between Beijing and Canberra. Because of this, I think that the market should not be this high, but at this point in time it is difficult to understand that we can easily short this pair. Nonetheless, from a fundamental analysis situation it does make sense that we would pull back from this 200 day EMA.

If we break above it on a daily close, that would be a very bullish sign and most certainly if we break above the 0.67 level it would confirm that the market is breaking out for a bigger move. Quite frankly, it is “now or never” for the AUD/USD sellers. They need to make a stand here or the downtrend is over, and the market will simply rep higher. It is quite astonishing to me that this has happened, but at the end of the day it is what it is saying we can only trade the markets that we are offered.