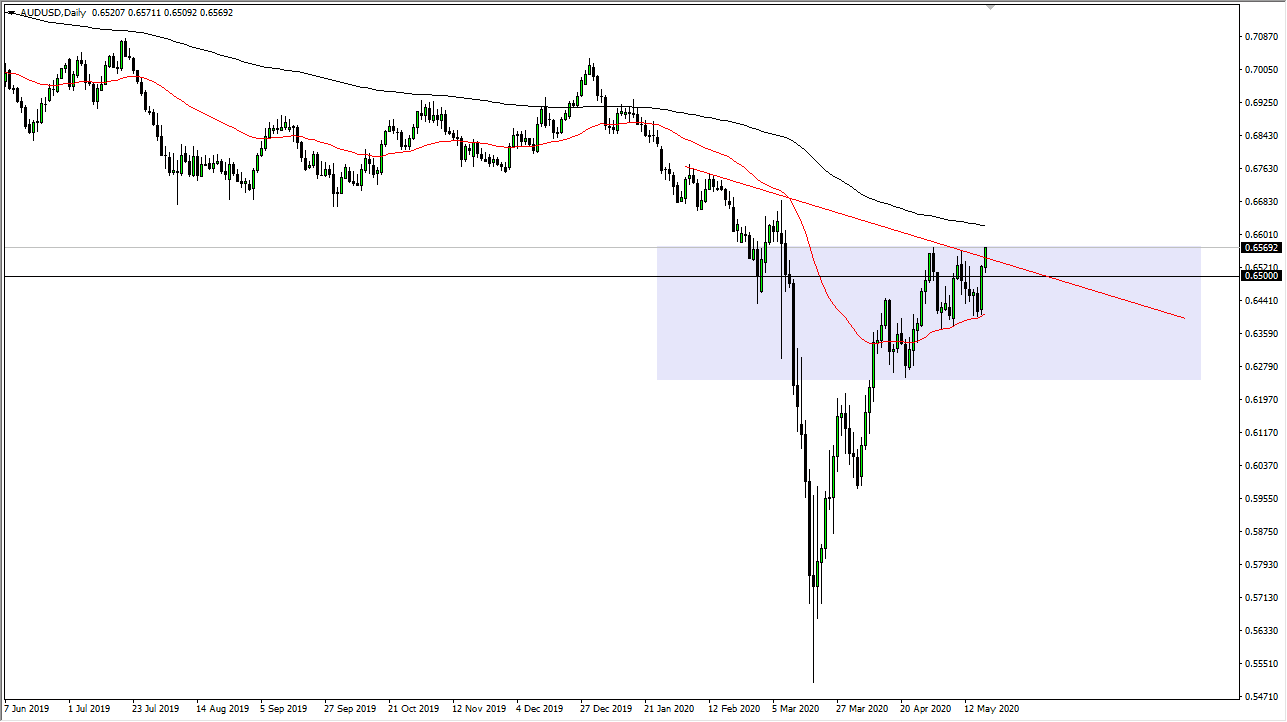

The Australian dollar continues to ignore the US/China trade war which is almost certainly heating up at this point. Quite frankly, the 0.66 level is an area to pay attention to and of course the 200 day EMA which sits just above there. It is quite surprising just how resilient the Australian dollar has been, although I suppose you can make an argument for people trading it based upon the coronavirus figures. However, they are missing the point, but it does not really matter I suppose.

You can make an argument that the Australian economy is going to be crushed due to the fact that global demand for raw materials will shrink. Furthermore, China and Australia are starting to show signs of hostility towards each other, and that of course is not going to help as Australia’s number one trading partner is China. If China starts looking at other places for commodities, Australia is going to find nothing but pain at that point.

That being said, we are getting at an area where the sellers must absolutely get involved, because if they doubt the downtrend will be over. It is a bit hard to imagine, considering that the markets are almost certainly not going to be going straight up in the air forever, but we have learned that Wall Street does not care about economic reality, so it is quite possible that the currency markets one either. Having said that, if we do rollover from here, then it is likely that the 0.65 level will be targeted, and then possibly the 50 day EMA. One thing I think I can say about the Australian dollar is that it is probably going to cause a lot of economic pain for traders, because quite frankly it has no idea where it wants to go. It has shown an extreme amount of resiliency, but then again it has not been able to break out so we are essentially in a very rough fight from a fundamental standpoint, it makes quite a bit more sense to own US dollars but you can see that has been a 50-50 trade at best. With this, it is probably best to stay out of this pair, or simply look for back-and-forth trading opportunities at best. Eventually we will get a significant move, and you can make an argument that a downtrend line has been broken, but there is still a lot of noise just above that could cause some issues for buyers.