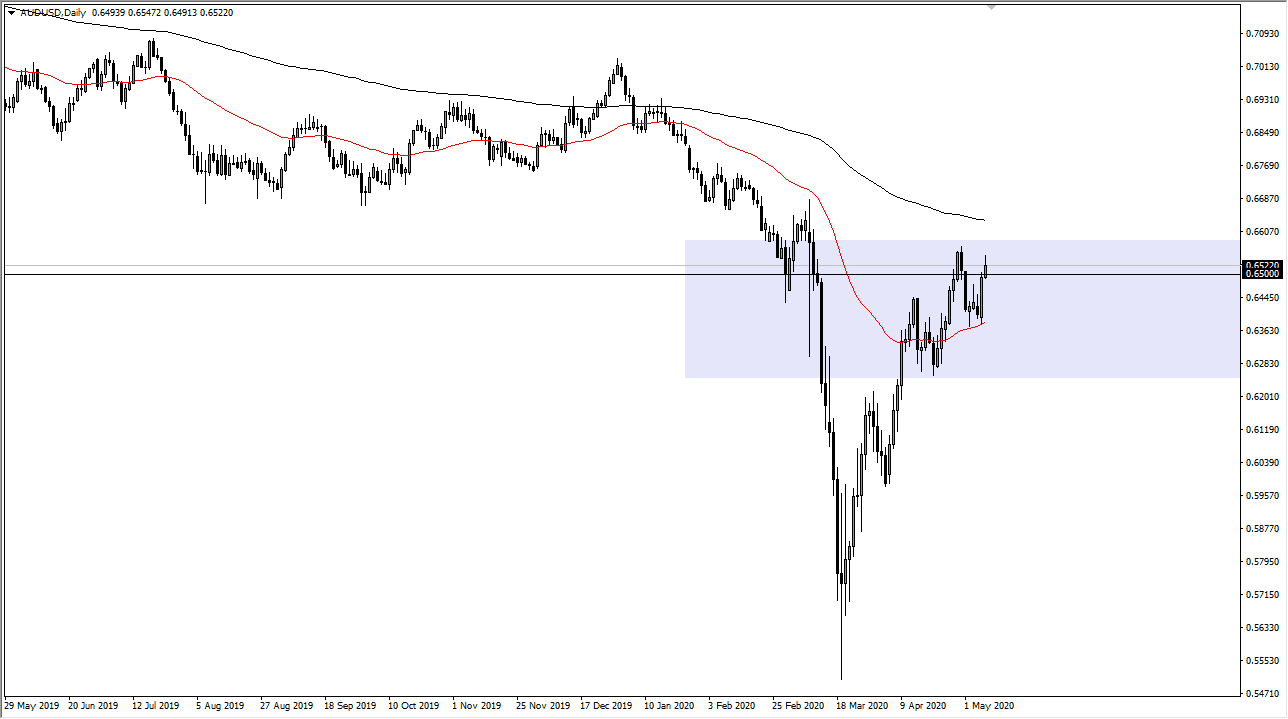

The Australian dollar has rallied a bit during the trading session on Friday but gave back the gains at the very highs that we had just made. This suggests that we are probably going to rollover from here and that makes quite a bit of sense. After all, the Australian dollar cranking above the 0.65 level is a bit absurd when you think about everything that is going on right now. The only thing that is lifting this currency pair is the fact that the coronavirus is not as destructive in Australia as it is another place. That being said, the Australian economy has the misfortune of being tied to commodities and of course the overall global growth situation.

At this point, it looks as if we are struggling to continue going higher, with the 200 day EMA just above showing signs of negativity. The 0.67 level above should offer significant resistance, as it is an area that we have seen a lot of selling pressure at. Once we break above the 200 day EMA and that level, the overall trend should continue to go much higher. That being said, the market is highly likely to see sellers between here and there first, so I think that the market will more than likely show that we are running out of momentum by breaking down. On a daily close below the 0.65 level, it is likely that the market will then go looking towards the 50 day EMA underneath. A breakdown below that level opens up the door for the market to go much lower. The recovery has been quite stringent, and it should be noticed a bit overdone.

The Australian dollar being tied to global growth is going to continue to be a major problem, although in the most recent weeks, the Forex markets have rewarded the Australians for their lack of disease, but sooner or later people are going to look at the lack of growth globally as something that is going to hurt demand for Australian commodities such as copper, iron, and aluminum. Because of this, the market is likely to eventually rollover as the flow of money into US Treasuries also brings up demand for the greenback, but there is a significant amount of fear out there that is going to show itself favor the greenback in general. All of that being said, if we were to turn around a break above the 200 day EMA, then this becomes a “buy-and-hold” scenario.