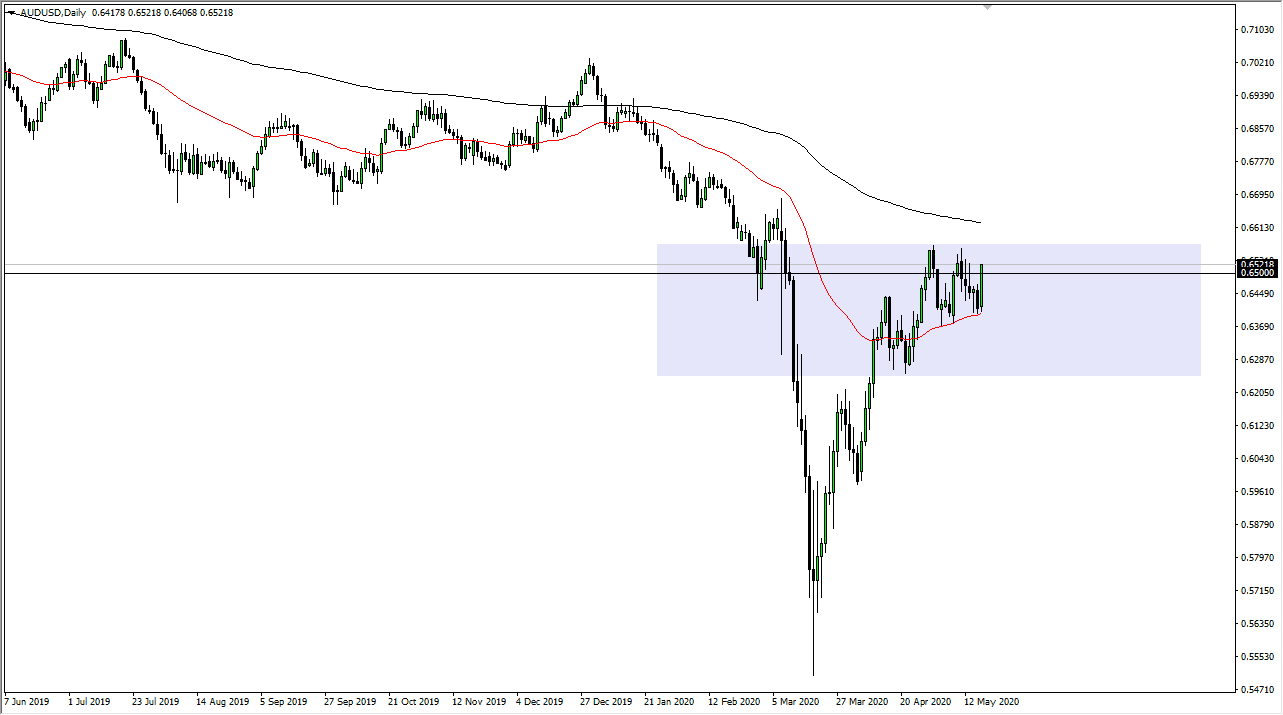

The Australian dollar has shot straight up in the air during the trading session on Monday as we continue to see a lot of volatility. The 0.65 level continues to be an area that attracts a lot of attention, so it is not a huge surprise to see that the market is stopping just above there. I do believe that ultimately this is a market that will probably continue to see downward pressure from above, but clearly, we are getting ready to squeeze in general. This squeezing could continue to be a major factor here, but quite frankly one has to wonder how much longer the Australian dollar can go back and forth like this?

Clearly, there is a lot of attention to this pair, as the Aussie is so highly levered to the Chinese economy. With the US and China heating up the trade war yet again, it is likely that we will see some negative pressure given enough time. Keep in mind that the Australian dollar is also a currency that needs to be in more of a “risk on” type of environment again. While we have seen that in spades on Monday, the reality is that a lot of things out there are still very tenuous at best. Because of this, I will be watching for signs of exhaustion that I can start selling but right now we obviously do not have it. I think there is a major resistance barrier in the form of the 0.66 handle, so as long as we stay below there it is likely that we will continue to see selling again.

To the downside, the 50 day EMA is clearly coming into the picture and offering support. I think at this point we continue to see a lot of back-and-forth trading, and therefore a lot of choppiness that will continue to cause issues. If we broke above the 200 day EMA, then we may be able to go higher for a longer amount of time, but right now it looks like we are simply content to sit here and rip apart trading accounts. With this, I believe that we need to see which one of these moving averages get pierced before putting on a sizable position. In the meantime, short-term back-and-forth trading may be possible, but that is probably going to be about it. It is clear that the market still has no idea what it wants to do for the longer term.