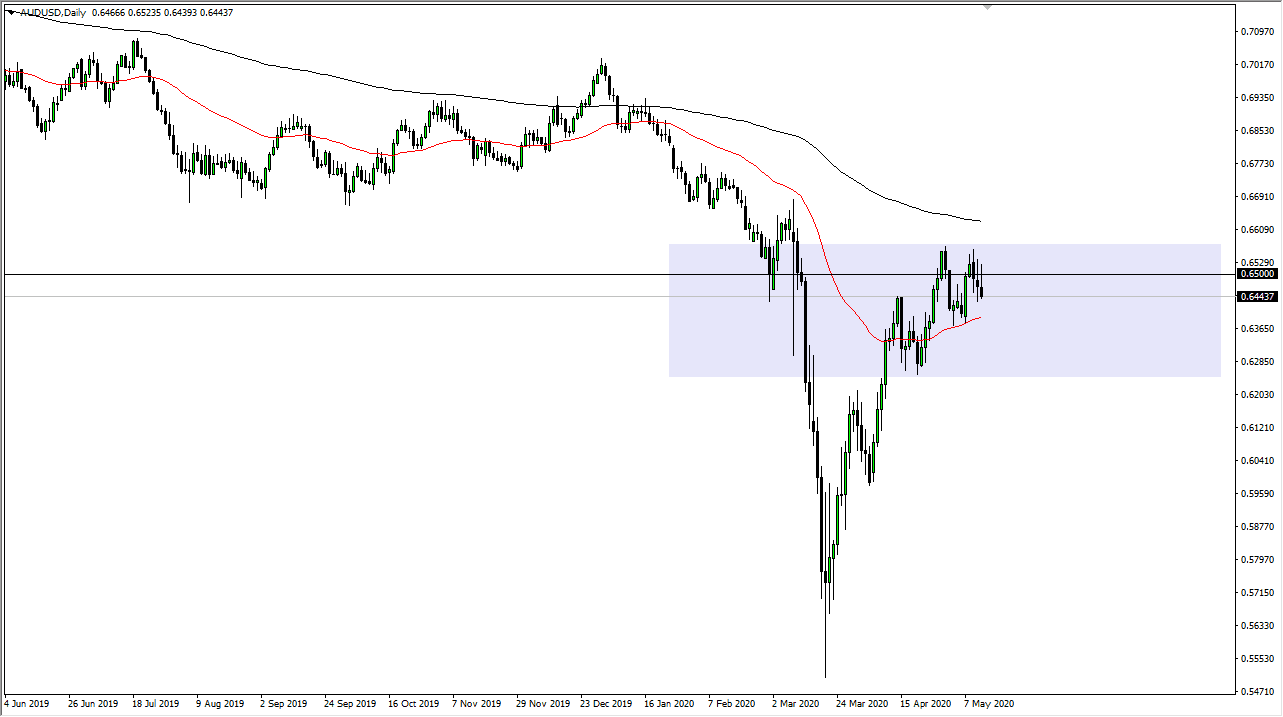

The Australian dollar has initially tried to rally during the trading session on Wednesday but has found a significant amount of resistance near the 0.65 level again. By doing so, the market ended up forming an extremely negative candlestick, it looks as if we are ready to rollover finally. This is an area that has been extraordinarily resistive lately, and at this point in time the market is likely to see sellers every time there is a rally.

To the upside, if the market were to break above the 0.66 level, then we will start looking towards the 0.67 handle in order to find even more sellers. If we break above the 0.67 handle, then it changes a lot of things but in the meantime, it does not look as likely to happen as one would expect. At this point in time I think that it is only a matter of time before we break down below the lows and go looking towards the 0.6350 level, possibly even the 0.6250 level. Remember that the Australian dollar is overly sensitive to global economic conditions, as Australian economy is built upon the idea of providing commodities for the rest of the world. With that in mind, I do believe that we will continue to see rallies as potential selling opportunities. After all, even though the global economy is trying to wake up, the reality is that it will be much slower than it was before the pandemic.

Politicians continue to stand in the way of economic movement of services and goods, and therefore it is likely that the Australian dollar will eventually reflect the new reality. Ultimately, a break down below the 50 day EMA will probably send this market much lower. At that point, we should see quite a bit of acceleration to the downside as the US dollar continues to offer quite a bit of safety for traders around the world. The US Treasury market continues to attract a lot of inflow as well, so at this point I like the idea of fading short-term rallies in the Australian dollar as it should continue to be negative looking overall. I would anticipate a lot of choppiness but the closer we get to the 0.65 handle, the more selling pressure should pick up in general. All things being equal though, if we were to break above that 200 day EMA I would have to stop arguing and simply start buying.