The Australian dollar has rallied a bit during the trading session on Monday in very thin holiday trading as it was Memorial Day in the United States and a bank holiday in several other countries, including the United Kingdom. Because of this, you cannot read too much into the candlestick on Monday, as it will have more or less been retail traders, and not necessarily big institutions. Nonetheless, we are at extreme highs and we have seen quite a bit of a fight up here near the 0.66 handle.

At this point, on signs of exhaustion I am more than willing to fade the Aussie dollar, as I do not like the idea of holding onto something that is so highly levered to China, especially when the country is currently arguing with the Chinese in a bit of a spat when it comes to trade. At this point, that will certainly weigh against the Aussie dollar due to the fact that so much of its economy is based upon trade with the Chinese, for example selling copper, aluminum, and the like.

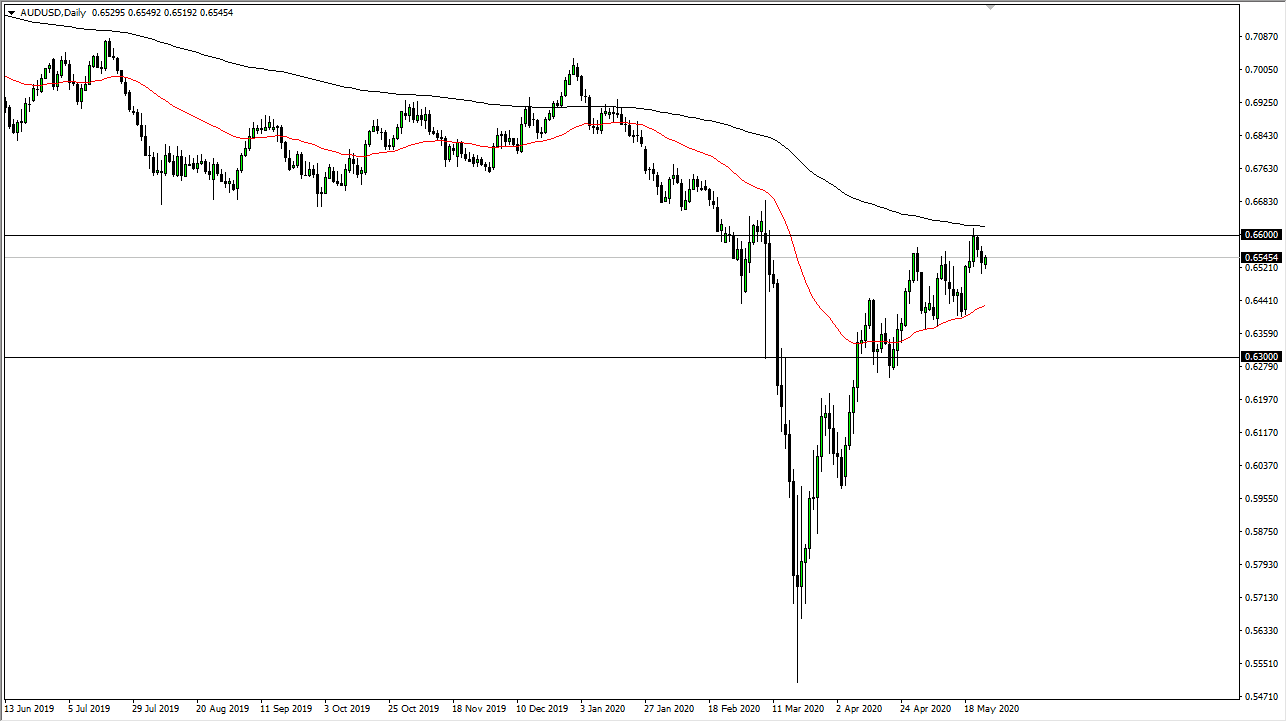

The 200 day EMA will come into play if we do try to rally, as it is just above the 0.66 level. If we break down below the candlestick from the Friday session, I think that opens up more selling, perhaps down to the 50 day EMA initially. A breakdown below the 50 day EMA could open up a move to the 0.63 level, where we have seen significant support as of late. It is difficult to imagine a scenario where we get enough positive news to break this market to the upside, but if we do and we get a break above the 0.67 level on a daily close, it is likely that the trend continues towards the 0.70 level in which what would be a major “risk on” type of move. About the only thing that is working in favor of the Aussie dollar in this pair is the fact that the Federal Reserve is doing everything he can to kill its own currency. However, fear could come back into play and if we see treasury bonds start to rise again in the United States, it is highly likely that the US dollar will continue to strengthen against the Aussie which obviously carries quite a bit more risk with owning it. I continue to look for fading opportunities.