The Australian dollar has fallen rather hard during the trading session on Thursday as it reached towards the 50 day EMA. However, the market turned around to form a somewhat supportive candlestick, so it looks as if we are going to continue the volatility overall, as there is a lot of crosscurrents going on at the same time. After all, the Australian economy has taken on recession for the first time in 30 years, and of course the Australian economy is highly levered to the Chinese economy, and with the recent headlines it is hard to believe that the harmony is going to continue after the Australians asked for an investigation into the Wuhan lab, and the Chinese snapping back that they would rack the Australian economy. Clearly, at this point we are seeing global supply chains shifting, and as a result there is going to be a lot of underlying weakness here.

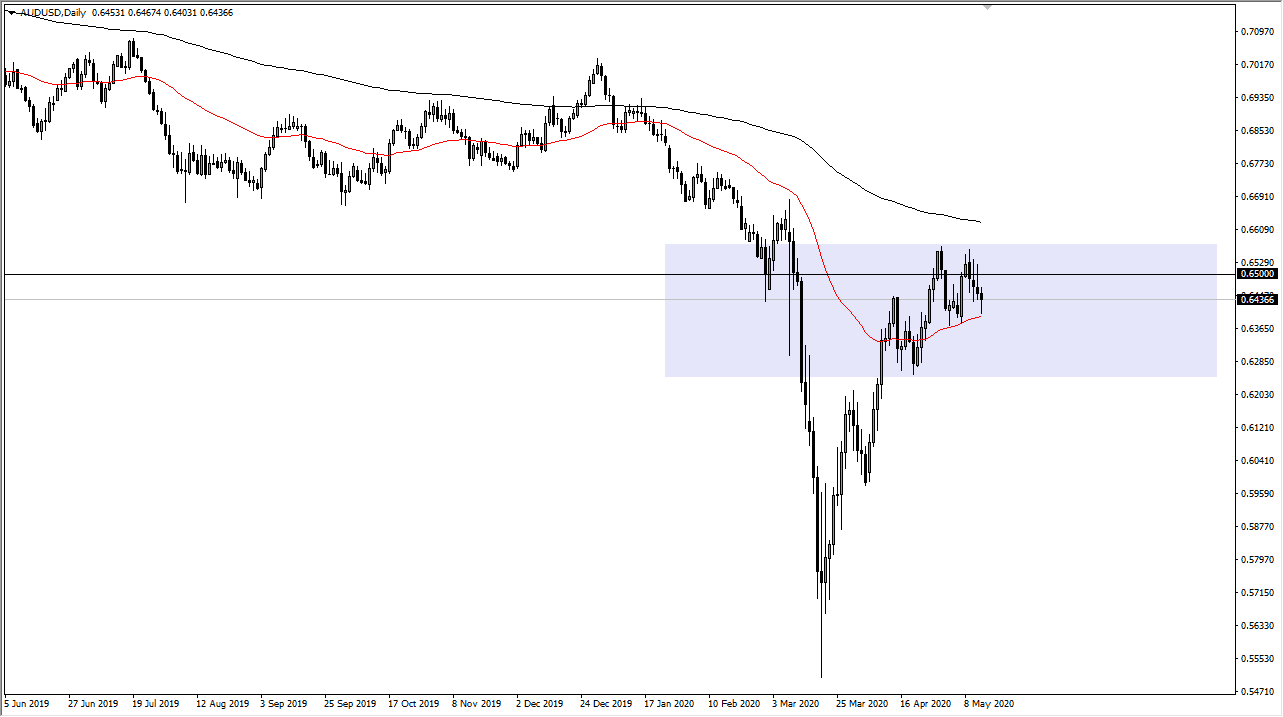

Keep in mind that the Australian economy is highly levered to commodities, and commodities of course are somewhat beaten up with perhaps the exception of precious metals. At this point, the market is seemingly stuck near the 0.65 handle, an area that has been massive support and resistance in the past. Because of this, I believe there is a certain amount of “market memory” in this general vicinity, so I am looking for opportunities to short the Australian dollar just above.

Looking at this chart, you can see that the rate of change is starting to slow down, meaning that the uptrend is running out of momentum. Furthermore, as we head into the weekend, I think that most of the gains that are enjoyed by the Australian dollar will probably be vacated. After all, the market is likely to start to come back towards the economic reality and of course the gravity of the situation. At this point, the market looks very unlikely to simply break to the upside, but I am the first person to admit that if we were to break above the 0.67 handle, and of extensively the 200 day EMA, then it is likely that the market could turn around drastically and go much further. I suspect that this point rallies will still get sold into, and if we can break down below the 50 day EMA then it is likely that we will go much lower and it could bring in fresh selling.