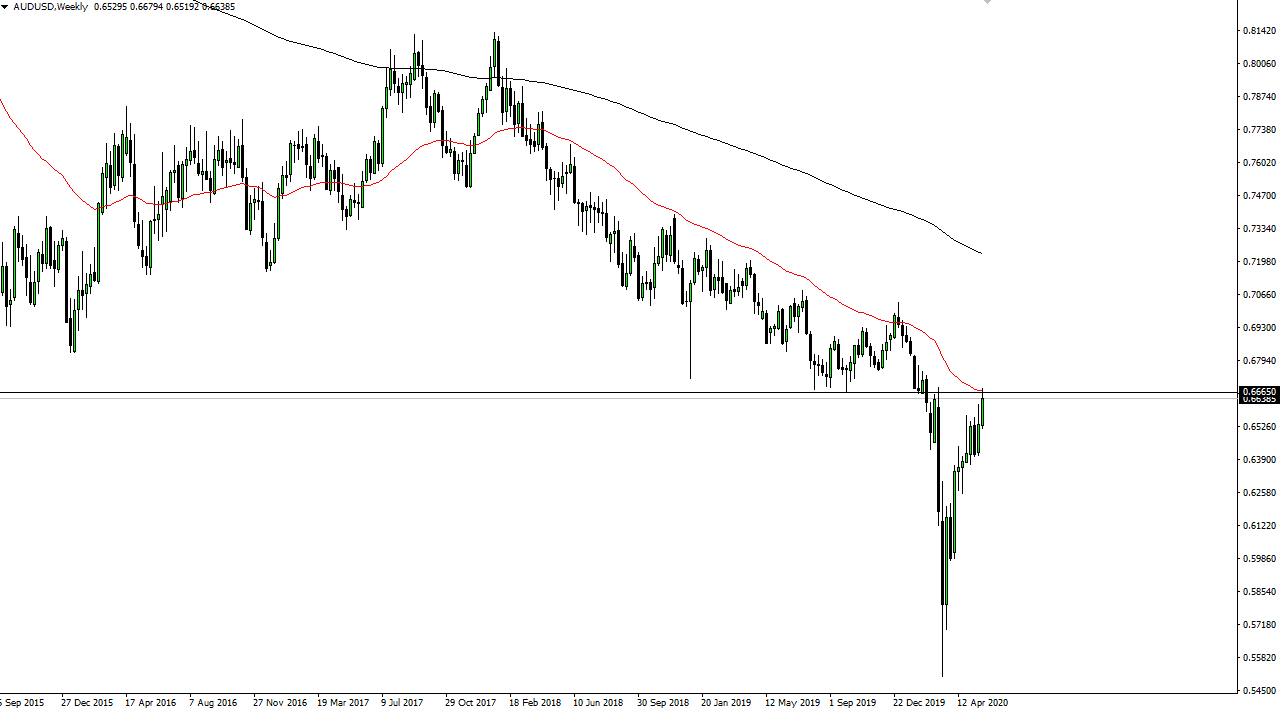

The Australian dollar has gone straight up in the air again during the month of May, reaching towards the 0.6665 level as I write this article. The 50 week EMA is sitting right there, and it is an area where we had seen previous resistance, so it makes sense that we are stalling in this general vicinity this also brings up some profoundly serious questions as to whether or not this trend can continue. This is an area that had not only been previous resistance, but it was massive support that broke down to send this market much lower in the past.

The shape of the candlestick on the weekly chart for the last week of the month is relatively strong, but it is pulling back from the crucial area. I think this sets up essentially what I like to call a “binary trade.” This is when it sets up a lot like a computer IF/ELSE statement. Somethings either going to happen or it will not. In other words, if it breaks above the 0.67 handle on a daily close, then I think there is nothing to stop this pair from going to the 0.70 level, and then after that possibly much higher. This would be based solely upon the idea of the world economy wakening backup and everything going back to normal or at least something close to it.

However, if you do not believe that is going to happen then you are probably expecting this pair to roll over. After all, the Australian dollar is highly levered to the US/China situation which looks to be getting worse. With the elections coming later this year, it is probably a relatively safe bet to think that Donald Trump is going to bash China every chance he gets. After all, that was one of the main reasons he got elected. Furthermore, it does have bipartisan support, something that is quite rare in Washington DC. If that is going to be the case, then it is likely that the Australian dollar will eventually take it on the chin. If we break down below the 0.65 handle, that could open up a move down to the 0.6250 level of the course of several weeks. Remember, this pair is highly risk sensitive, so it is going to be based almost solely upon how the market “feels” at any given moment going forward, and we certainly are at an area where the market needs to prove itself one way or the other. But frankly, I think it looks overdone, but I also could have said that several weeks prior.