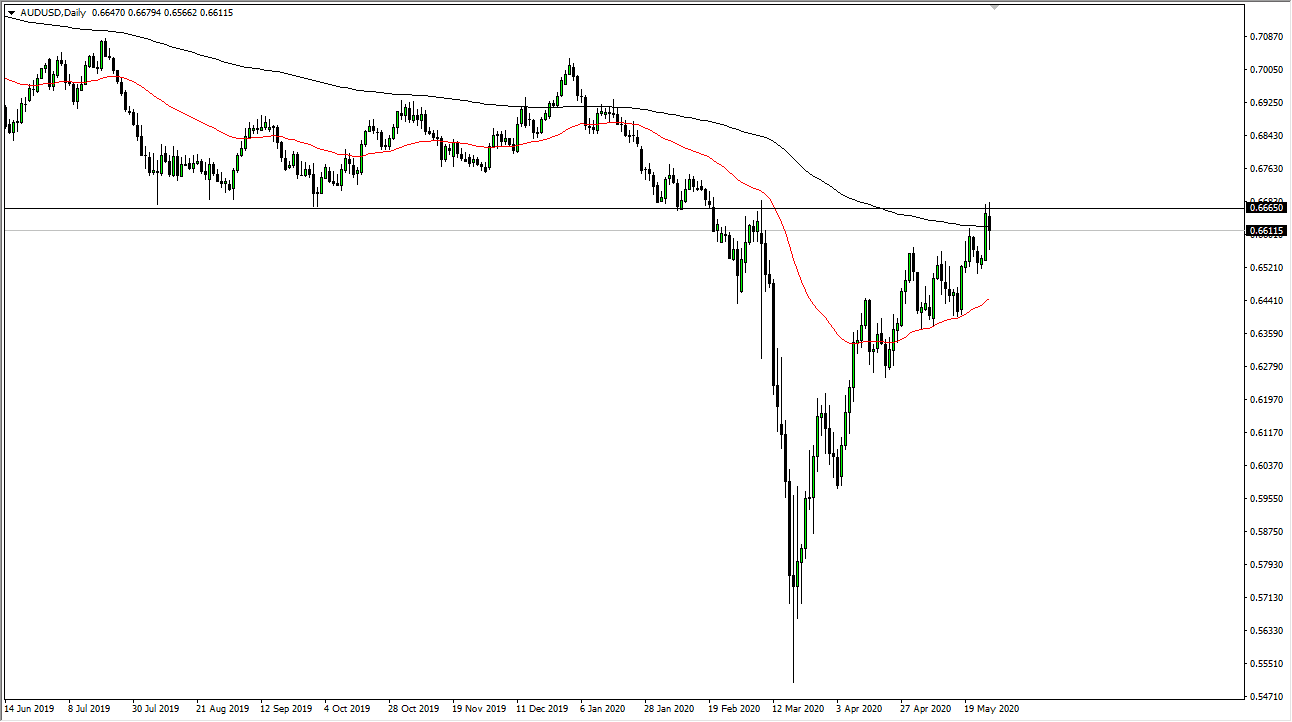

The Australian dollar has gone back and forth during the trading session on Wednesday, reaching towards the 0.6665 level before pulling back. At this point, the market then broke back down below the 200 day EMA, before bouncing a bit. After all of this, it is likely that we will continue to see a lot of noisy trading but given enough time it is likely that we are going to see some type of major decision made at this point. The 200 day EMA slice is right through the candlestick, so that of course is something worth paying attention to. After all, the 200 day EMA is an area that a lot of people will pay attention to, so the fact that it also coincides quite nicely with the major selloff that sent the market down drastically is a huge area of confluence. With this confluence, we need to make a lot of decisions.

The market breaking above the 0.67 level could open up a move much higher, and therefore send the Australian dollar looking towards the 0.70 level. At this juncture, then the large, round, psychological importance of the figure could come into play. Ultimately, this is a market that is extremely sensitive to risk appetite so do not be surprised at all to see this move on the latest headline. With the US/China trade situation getting worse, it is likely that we will see some type of reaction here.

As soon as the US/China trade tensions take front and center as far as attention is concerned, that will more than likely put downward pressure here. That is not to say that we cannot break out to the upside though, because quite frankly the Australian dollar has been extraordinarily resilient. On the other hand, if we were to break down below the candlestick from Tuesday, then we could break down towards the red 50 day EMA and then make a move down to the 0.6250 level. I suspect that sooner or later we are going to see some type of major issue rock this market but if we do not, then it is only a matter of time before we break out to the upside. The market continues to be very noisy, but one thing that is worth paying attention to is the fact that it does not seem to give up, something that is quite impressive.