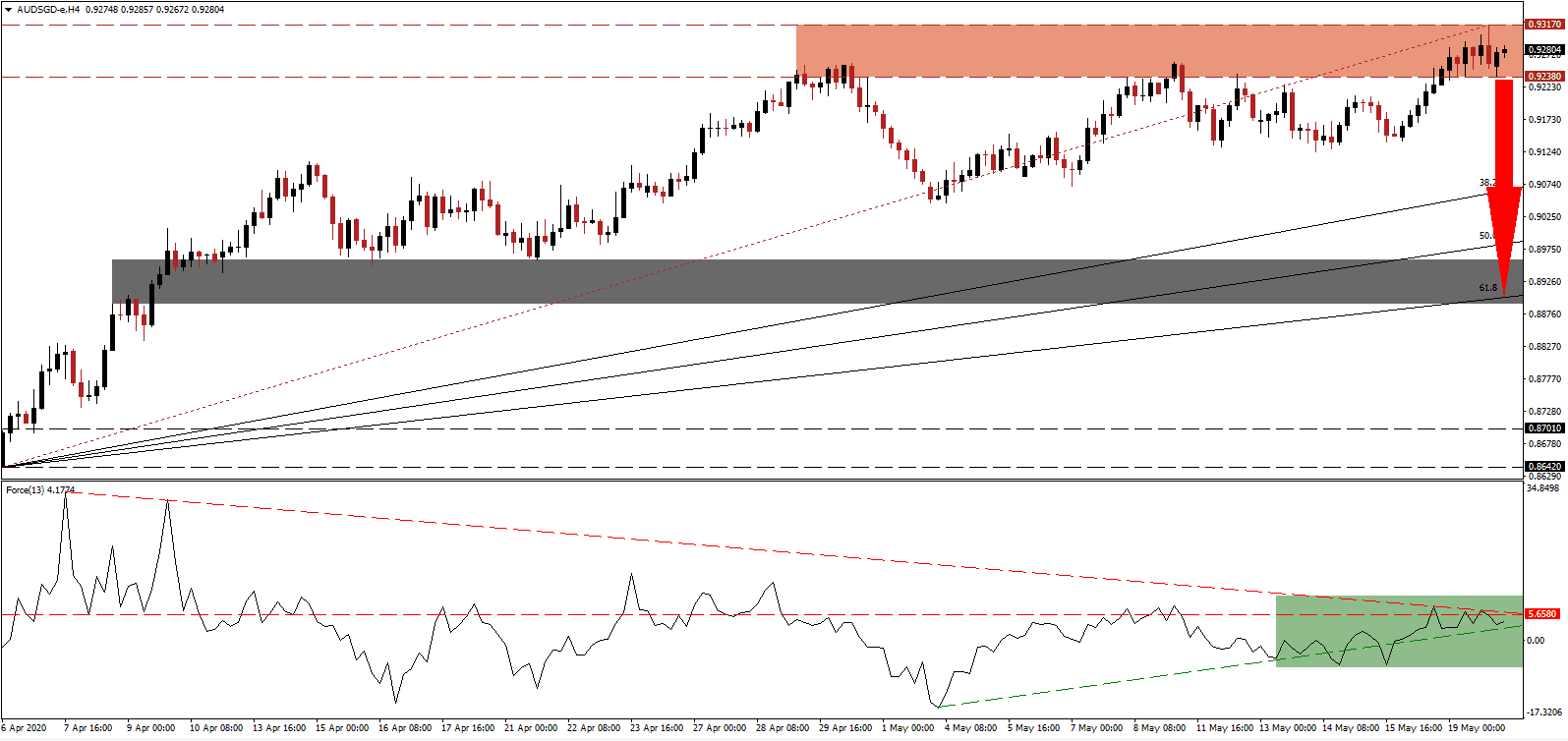

Australia seeks greater economic sovereignty as part of its Covid-19 recovery strategy. It includes replacing coal with natural gas, speedier project approvals, and a decrease in company taxes. The aim is to strengthen manufacturing and readjust the supply chain with more reliance on the domestic sector. After the global pandemic exposed weaknesses in existing models, more countries are likely to announce similar adjustments, which will reshape globalism. The AUD/SGD is vulnerable to a profit-taking sell-off after drifting into its resistance zone with momentum deteriorating.

The Force Index, a next-generation technical indicator, briefly eclipsed its horizontal resistance level before its descending resistance level pressured it to the downside, as marked by the green rectangle. With bearish pressures mounting, the Force Index is expected to collapse below its ascending support level. Bears will resume control of the AUD/SGD once this technical indicator moves below the 0 center-line, leading to more downside momentum.

Adding to pressures for an economic readjustment is the diplomatic spat Australia started with China over the Covid-19 pandemic, which is leading to a potential trade war. China has announced 80% of tariffs on barley imports from Australia, delivering a A$500 million blow to the economy per year. While Australia threatened to challenge the decision at the World Trade Organization, it highlights its reliance on China. Tensions are anticipated to increase in the short-term, adding a bearish catalyst to the AUD/SGD. A breakdown below its resistance zone located between 0.9238 and 0.9317, as marked by the red rectangle, is favored.

MOFCOM, China's commerce ministry, cited anti-dumping and government subsidies as the reason for tariffs. It listed four Australian producers in its report, claiming harm to its domestic market. A breakdown in the AUD/SGD can close the gap between the AUD/SGD and its ascending 38.2 Fibonacci Retracement Fan Support Level. An extension into its short-term support zone located between 0.8891 and 0.8959, as identified by the grey rectangle, and enforced by its 61.8 Fibonacci Retracement Fan Support Level, is likely. More downside cannot be excluded but will require a new catalyst.

AUD/SGD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9280

Take Profit @ 0.8900

Stop Loss @ 0.9370

Downside Potential: 380 pips

Upside Risk: 90 pips

Risk/Reward Ratio: 4.22

In case the Force Index accelerates above its descending resistance level, the AUD/SGD may attempt a breakout. Given the uncertain short-term outlook over Australian relations with its primary trading partner, Forex traders are recommended to consider any advance as a secondary short-selling opportunity. The upside is limited to the next resistance zone, which awaits price action between 0.9430 and 0.9455.

AUD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9395

Take Profit @ 0.9445

Stop Loss @ 0.9370

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00