Australia and New Zealand are partially easing their lockdown measures, with new Covid-19 infection rates well-below their counterparts in the developed world. The virus mutated to a more infectious strain, spreading across Europe and the US, rendering existing vaccine research useless, and no proper cure has been identified. How economic life will adjust to what could be a new normal centered around social distancing remains to be seen. Dangers of a second infection wave over the summer months are elevated, but both countries are discussing a travel zone, allowing free transit in an attempt to boost activity. Australia’s diplomatic spat with China adds a bearish catalyst to the AUD/NZD, presently awaiting a corrective phase after reaching its resistance zone.

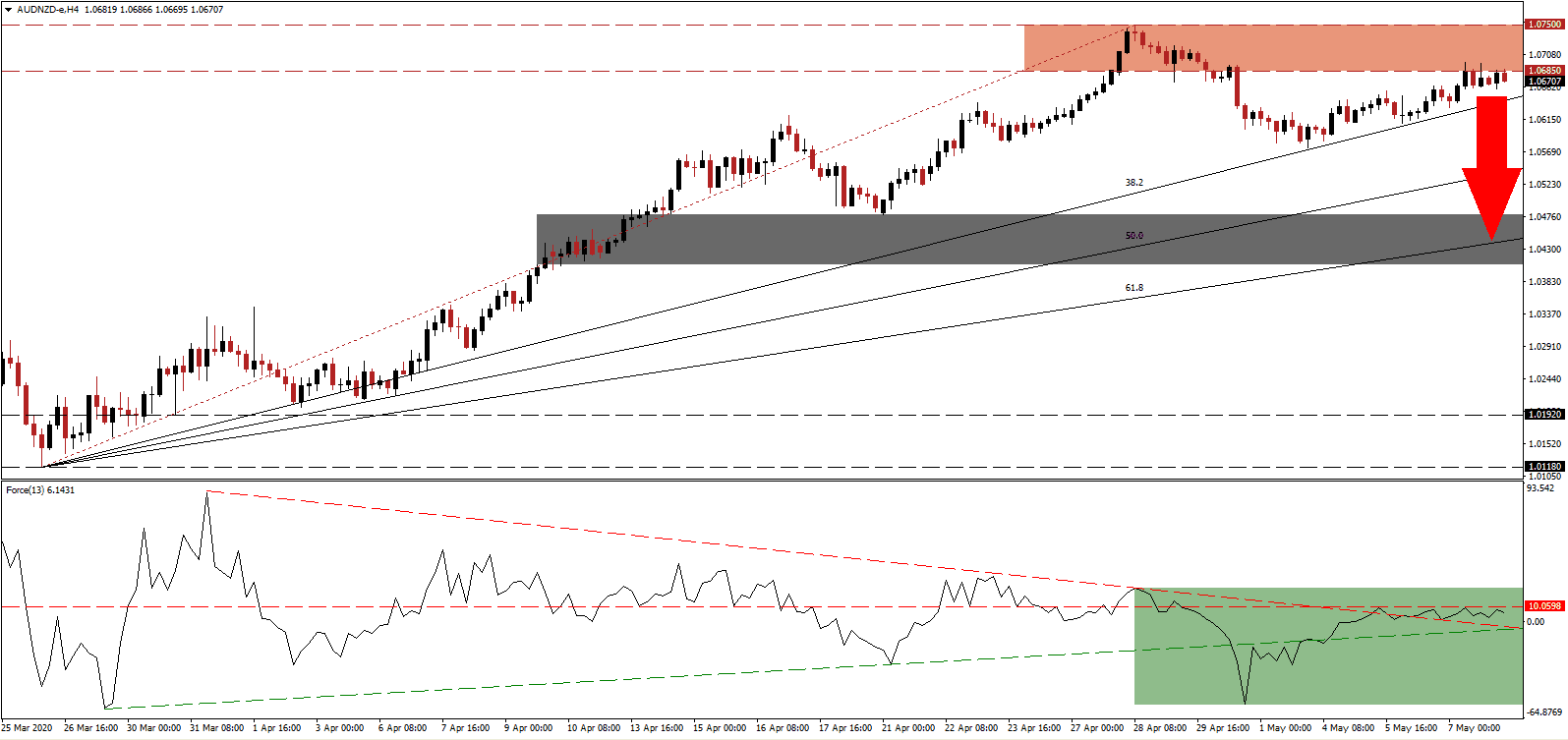

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level following a push above its descending resistance level, as marked by the green rectangle. While the ascending support level is keeping bullish pressures intact, fundamental bearish circumstances are more excessive. This technical indicator is expected to correct below the 0 center-line, placing bears in control of the AUD/NZD, and initiating a new breakdown sequence.

Governments in developed markets responded to the virus with massive stimulus and bailout programs, exceeding fiscal measures to the 2008 global financial crisis. Discussions of rollbacks of the temporary assistance are met with calls for more. Markets are addicted to debt and financial incentives, creating unsustainable market conditions. The thought that only a government-led economic recovery is an option threatens more significant long-term changes in the wrong direction. With budget deficit starting to gain attention, the AUD/NZD is on the verge of a breakdown below its resistance zone located between 1.0685 and 1.0750, as marked by the red rectangle.

With the ascending 38.2 Fibonacci Retracement Fan Support Level narrowing the gap to the bottom range of the resistance zone, a double breakdown is possible. It will additionally provide downside momentum for an extended profit-taking sell-off until the AUD/NZD can challenge its short-term support zone. This zone is located between 1.0408 and 1.0479, as identified by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level is passing through it, presenting the final obstacle to a potentially more violent sell-off.

AUD/NZD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 1.0670

Take Profit @ 1.0450

Stop Loss @ 1.0740

Downside Potential: 220 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 3.14

In case the ascending support level pressures the Force Index higher, the AUD/NZD may be enticed to attempt a breakout. Due to uncertain Australia-China relations, the upside potential for this currency pair remains limited to its next resistance zone located between 1.0827 and 1.0864. Forex traders are advised to consider this as a secondary short selling opportunity unless a material change in present conditions emerges.

AUD/NZD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.0785

Take Profit @ 1.0860

Stop Loss @ 1.0750

Upside Potential: 75 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.14