Preliminary Japanese first-quarter GDP data decreased less than forecast but confirmed the economy entered a recession. The world’s third-largest economy rolled out a massive stimulus in response to the Covid-19 pandemic, representing the most significant assistance package globally as measured by the percentage of total GDP at over 20%. Second-quarter data is likely to show a deeper slide due to the nationwide lockdown. The AUD/JPY was able to drift higher on the back of a temporary slowdown in safe-haven demand, where the Japanese Yen represents the primary choice in the Forex market. Breakdown pressures are on the rise, favored extending the correction in this currency pair.

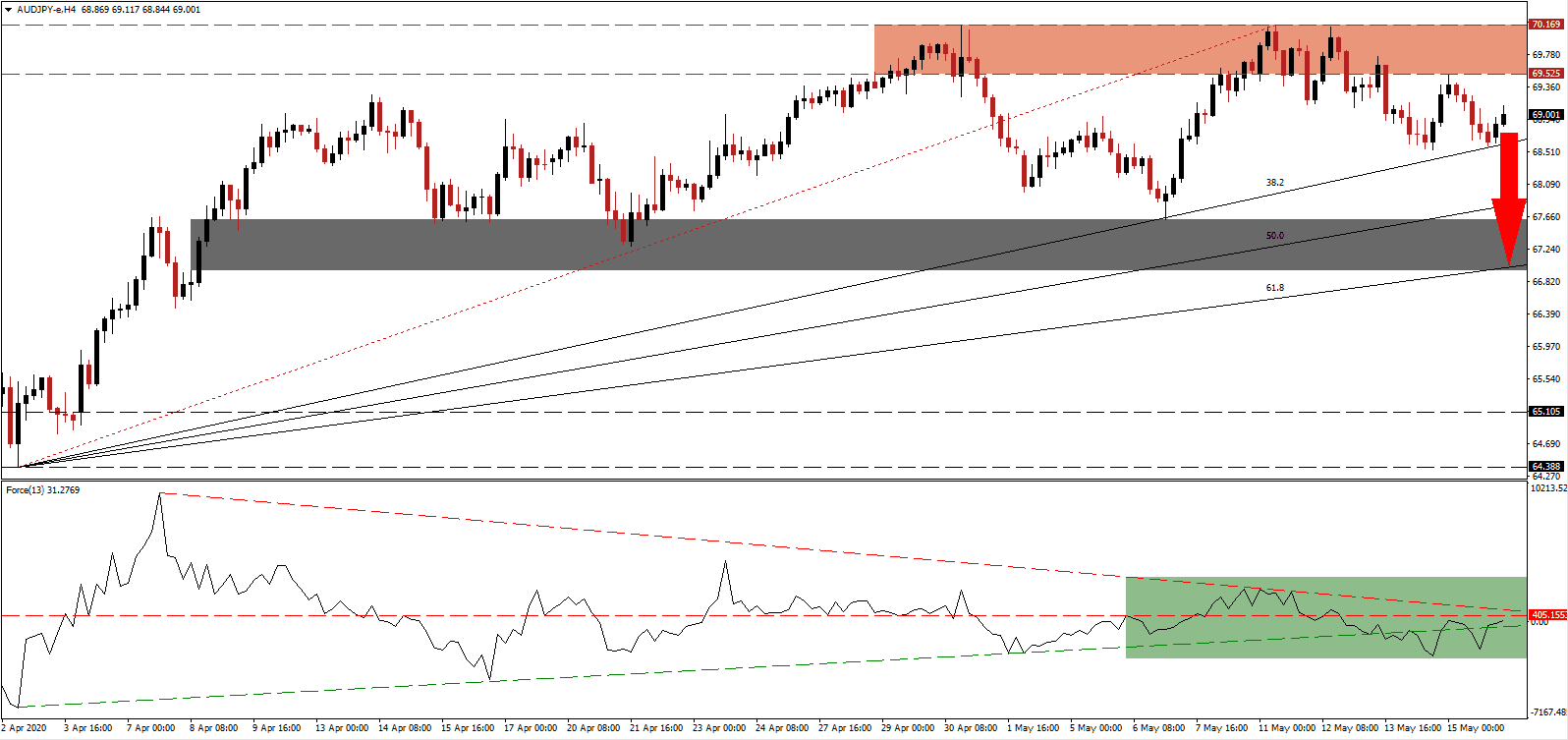

The Force Index, a next-generation technical indicator, reversed to the upside and reclaimed its ascending support level. It is now faced with its horizontal resistance level, as marked by the green rectangle, while the descending resistance level is adding bearish momentum. This technical indicator is expected to collapse below the 0 center-line, due to the enforced resistance level, which will allow bears to regain control of the AUD/JPY. You can learn more about the Force Index here.

While the Covid-19 pandemic has disrupted the economy, it also presents a unique opportunity for Japan to modernize its economy. A wave of digitalization emerged, where the country, despite its advanced technology, is trailing other developed countries. The society is heavily reliant on cash, and paperwork, as well as fax machines, are commonplace in small-to-medium sized companies. The Japanese Yen will benefit from modernization and an associated increase in labor productivity. It adds a long-term bearish fundamental catalyst to the AUD/JPY, which is presently positioned below its horizontal resistance zone located between 69.525 and 70.169, as marked by the red rectangle.

Economists warned Australia is likely to face a lower rate in long-term consumer spending due to forced changes in behavior related to lower-income and decrease in home values. The Australian government is under pressure to cover the shortfall with direct cash payments to consumers, adding downside risk in the Australian Dollar. The AUD/JPY is anticipated to push below its ascending 38.2 Fibonacci Retracement Fan Support Level from where it can accelerate down into its short-term support zone located between 66.962 and 67.624, as identified by the grey rectangle.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 69.000

Take Profit @ 67.000

Stop Loss @ 69.650

Downside Potential: 200 pips

Upside Risk: 65 pips

Risk/Reward Ratio: 3.08

In the event the Force Index advances above its descending resistance level, the AUD/JPY is likely to attempt a breakout. Due to a deteriorating outlook for the Australian economy, mired in a diplomatic spat with China, Forex traders are recommended to consider any price spike from current levels as an excellent selling opportunity. The next resistance zone awaits this currency pair between 71.503 and 72.196.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 70.450

Take Profit @ 72.000

Stop Loss @ 69.850

Upside Potential: 155 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.58