Given Australia’s dependence on China, commentary by US President Trump regarding more tariffs added downside pressure on the Australian Dollar, the primary Chinese Yuan proxy currency. Trump is determined to blame China, where the virus was initially reported, for the global Covid-19 pandemic. Economic data released out of Australia confirmed a collapse in the labor market, as job advertisements plunged over 50%. Increasing selling pressure on the AUD/JPY is the diplomatic stand-off Australia initiated with China, with the former pushing into an official inquiry of wet markets where some experts believe the transmission of the coronavirus started. After the breakdown in this currency pair below its resistance zone, a more massive correction is likely, while the long-term uptrend remains intact.

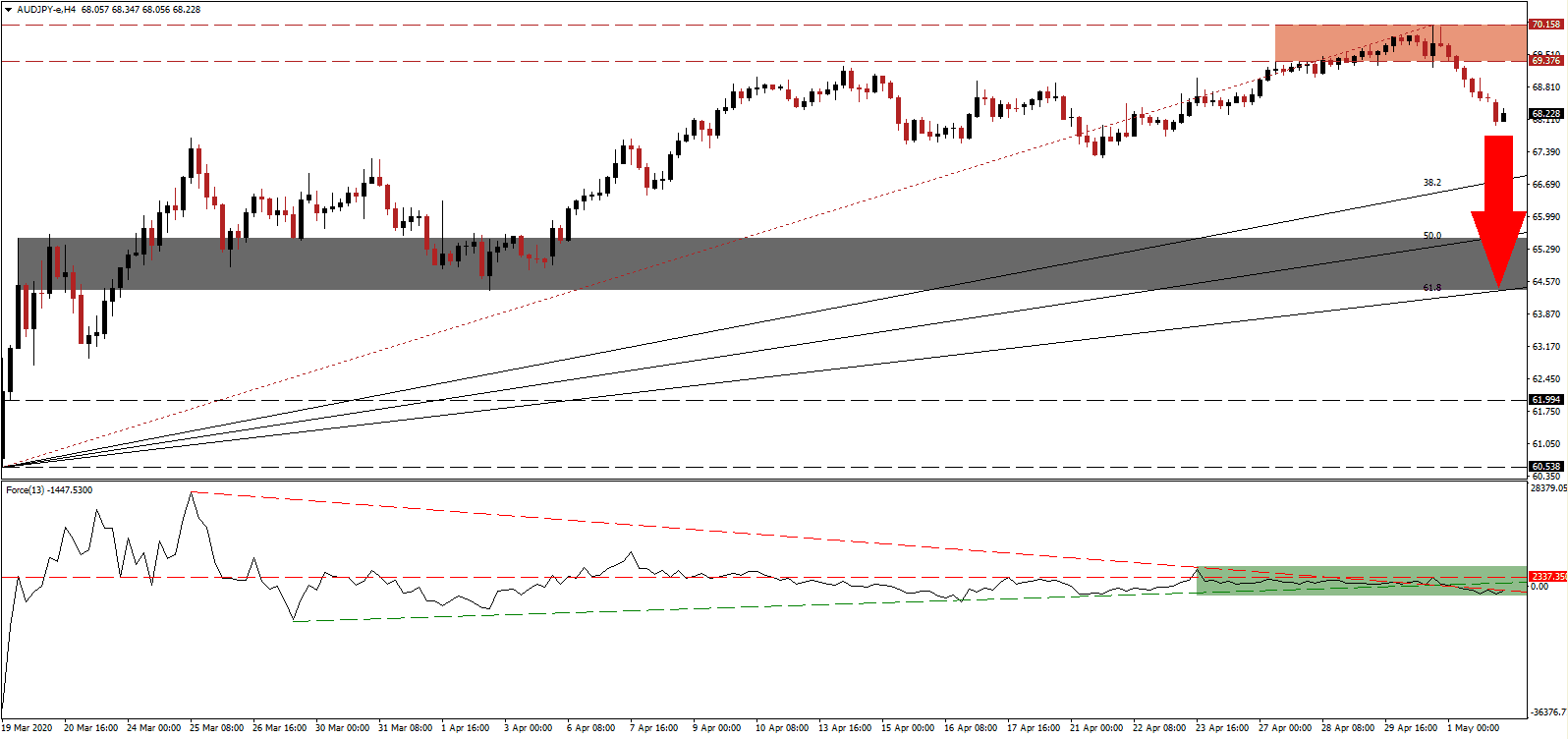

The Force Index, a next-generation technical indicator, maintains its position below its horizontal resistance level, with the descending resistance level increasing downside pressure. Adding to bearish developments was the contraction in the Force Index below its ascending support level, as marked by the green rectangle. Bears remain in control of the AUD/JPY, and this technical indicator is favored to slide deeper into negative territory.

Japan is forecast to post its most significant post-war GDP contraction in the second quarter, down 22%, with a likely return of deflation. Since the financial bailout in 1999, duplicated by the US in 2009, Japan struggled with weak growth and a deflationary environment. The safe-haven appeal of the Japanese Yen trumps growing economic concerns in the short-term. Following the collapse in the AUD/JPY below its resistance zone located between 69.376 and 70.158, as marked by the red rectangle, more downside pressure is anticipated to extend the sell-off.

One essential level to monitor is the intra-day low of 67.282, the base of a previous rejection in this currency pair by its resistance zone. A sustained breakdown is expected to provide the required volume for an accelerated move to the downside, with the addition of new net short positions. The AUD/JPY is on course to challenge its short-term resistance zone located between 64.388 and 65.528, as identified by the grey rectangle. It is enforced by the ascending 61.8 Fibonacci Retracement Fan Support Level, which emphasizes the long-term bullish trend.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 68.200

Take Profit @ 64.500

Stop Loss @ 69.000

Downside Potential: 370 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 4.63

In case the Force Index spikes above its ascending support level, presently serving as resistance, the AUD/JPY may resume its uptrend. Short-term fundamental developments distort the long-term outlook, making it dependent on how Australia proceeds with China. Neither economy is prepared to cut ties with a strategic trading partner, with the latter in a superior position to wait out developments. Forex traders are, therefore, advised to consider any advance as a selling opportunity. The upside potential remains confined to the top range of its resistance zone.

AUD/JPY Technical Trading Set-Up - Confined Reversal Scenario

Long Entry @ 69.350

Take Profit @ 70.150

Stop Loss @ 69.000

Upside Potential: 80 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 2.29