Financial markets have moved past the looming negative impacts of the global Covid-19 pandemic and believe trillions of dollars in new government debt provided the solution to economic problems. It resulted in capital outflows from safe-haven currencies like the Swiss Franc and allowed the AUD/CHF to drift into its resistance zone. Complacency and a disconnect from fundamentals positions this currency pair for a correction. Uncertainty over what will happens once the stimulus runs out, in conjunction with Australia’s decision to worsen relations with China, is expected to lead to a breakdown in price action.

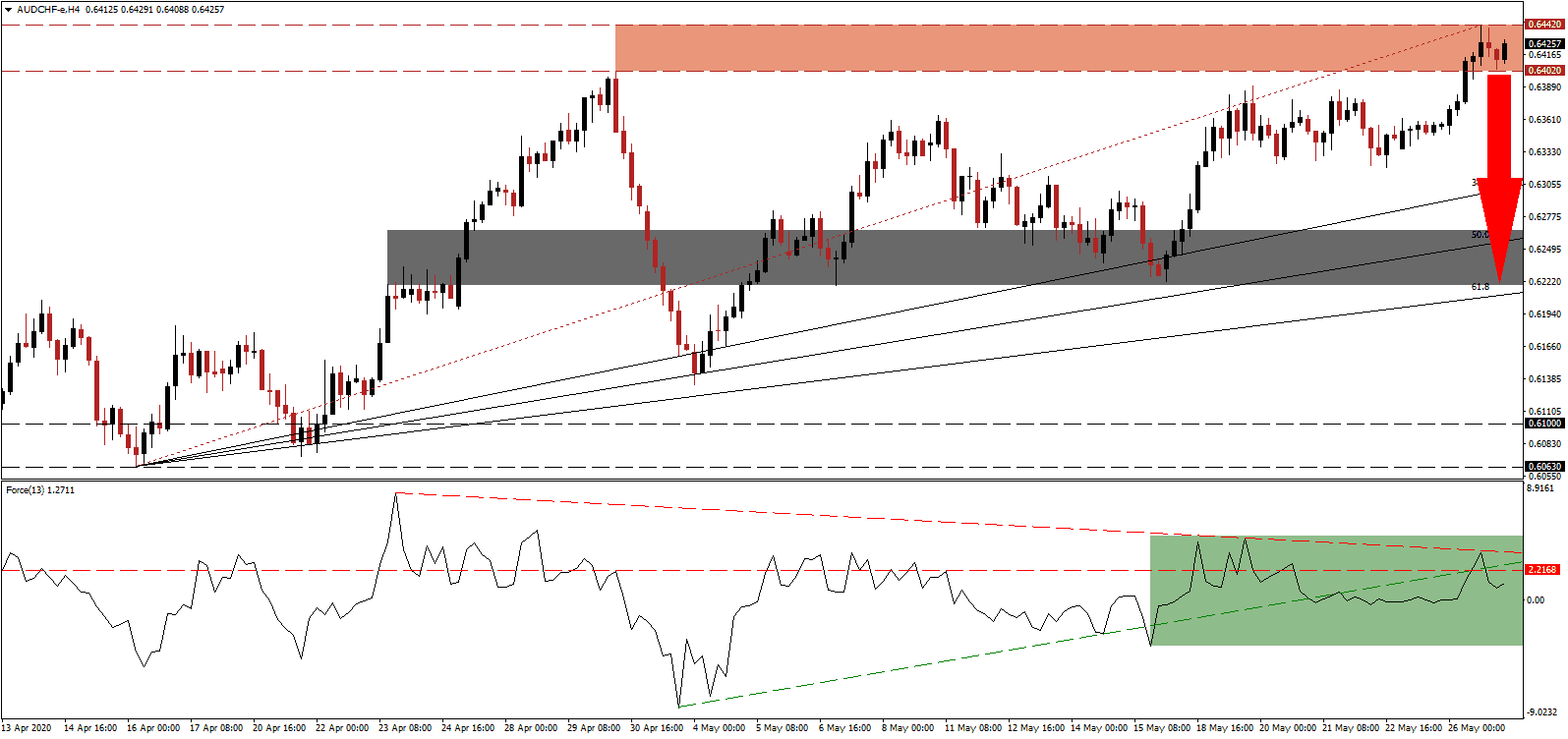

The Force Index, a next-generation technical indicator, offers an early warning that a trend reversal is imminent. While this currency pair advanced, the Force Index recorded a lower high and weakened, allowing for the formation of a negative divergence. A brief push above its horizontal resistance level was reversed by its descending resistance level, as marked by the green rectangle. Adding to bearish developments was the collapse below its ascending support level, and this technical indicator is now anticipated to cross below the 0 center-line, ceding control of the AUD/CHF to bears.

Warnings over a slow recovery and structural problems are being ignored. Australia wants to become economically more independent, repatriating manufacturing jobs, and focusing on natural gas. Permanent changes to consumer behavior are equally disregarded. The pending global tradition could yield tremendous positive results, but supply chain adjustments require time, and the transition is costly and painful. It adds to downside pressure on the AUD/CHF, pending a collapse below its resistance zone located between 0.6402 and 0.6442, as identified by the red rectangle.

Australia thrived with Chinese support, and a premature decoupling could have long-lasting negative impacts the country cannot afford. Switzerland endured severe economic distress, but recorded an increase in its April trade surplus, on the back of a collapse in imports. Swissmem, an umbrella group for the mechanical and electrical engineering sector consisting of 1,100 firms, has warned that the full negative impact will not be evident until the end of the year. Price action, faced with deflated bullish momentum, is favored to enter a profit-taking sell-off, until the AUD/CHF can challenge its short-term support zone located between 0.6219 and 0.6266, as marked by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is enforcing this zone.

AUD/CHF Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.6425

Take Profit @ 0.6225

Stop Loss @ 0.6485

Downside Potential: 200 pips

Upside Risk: 60 pips

Risk/Reward Ratio: 3.33

In case the Force Index advances above its descending resistance level, the AUD/CHF could attempt a breakout. Due to the collision course, Australia embarked on with its primary trading partner, China, the upside potential remains limited to its next resistance zone located between 0.6522 and 0.6557. Forex traders are recommended to consider this an excellent short-selling opportunity.

AUD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.6505

Take Profit @ 0.6555

Stop Loss @ 0.6485

Upside Potential: 50 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.50