Australian consumer sentiment for May recovered due to gradual easing of lockdown measures, but extreme caution is warranted. China, Germany, South Korea, and the US have shown a spike in new infections after social distancing rules were relaxed. A modified approach to the likelihood of new infections will be regional lockdowns and travel restrictions, in an attempt to balance health and the economy. It will prevent full recovery for an extended period, which is a fact financial markets will have to adjust to, as consensus hopes for a V-shaped one. The risk-off sentiment is fueling demand for the safe-haven Swiss Franc, providing a bearish catalyst for the AUD/CHF. Therefore, a breakdown extension is favored.

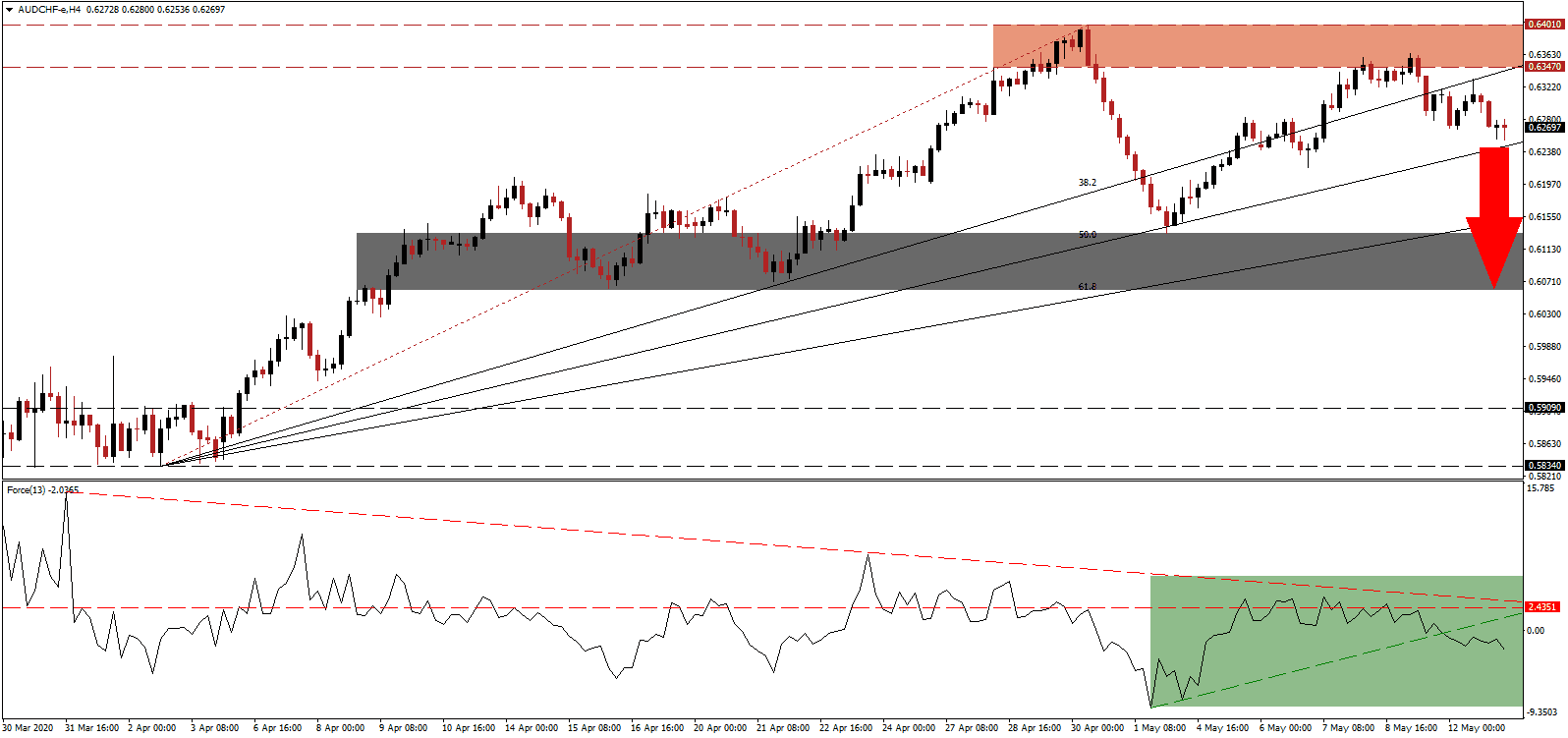

The Force Index, a next-generation technical indicator, accelerated to the downside after drifting sideways along with its horizontal resistance level, pressured lower by its descending resistance level. Adding to bearish developments was the collapse in the Force Index below its ascending support level, as marked by the green rectangle. Bears have gained control of the AUD/CHF after this technical indicator moved below the 0 center-line.

Switzerland is implementing strict contact tracing measures alongside the return to modified economic activities. The economy is bleeding up to an estimated CHF17 billion per month, adding pressure to find an alternative path forward. A change in consumer behavior should be expected, extending the recovery period for the economy. Following the breakdown in the AUD/CHF below its resistance zone located between 0.6347 and 0.6401, as marked by the red rectangle, bearish pressures have accumulated.

One essential level to monitor is the ascending 50.0 Fibonacci Retracement Fan Support Level, where this currency pair is taking a temporary pause. A breakdown is anticipated to invite the next wave of sell orders in the AUD/CHF, providing the required volume to extend the sell-off into its short-term support zone. This zone awaits price action between 0.6060 and 0.6133, as identified by the grey rectangle. Australia and Switzerland understand that a quick recovery, despite optimism by politicians, is not supported by fundamentals. The safe-haven status of the Swiss Franc may result in a more massive correction.

AUD/CHF Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.6270

- Take Profit @ 0.6060

- Stop Loss @ 0.6330

- Downside Potential: 210 pips

- Upside Risk: 60 pips

- Risk/Reward Ratio: 3.50

In case the Force Index reverses above its descending resistance level, the AUD/CHF may attempt a breakout. Due to existing fundamental conditions, in combination with the diplomatic row Australia started with China, the upside potential is significantly limited. Forex traders are recommended to view any breakout as an excellent secondary selling opportunity. The next resistance zone is located between 0.6522 and 0.6556.

AUD/CHF Technical Trading Set-Up - Confined Breakout Scenario

- Long Entry @ 0.6410

- Take Profit @ 0.6530

- Stop Loss @ 0.6350

- Upside Potential: 120 pips

- Downside Risk: 60 pips

- Risk/Reward Ratio: 2.00