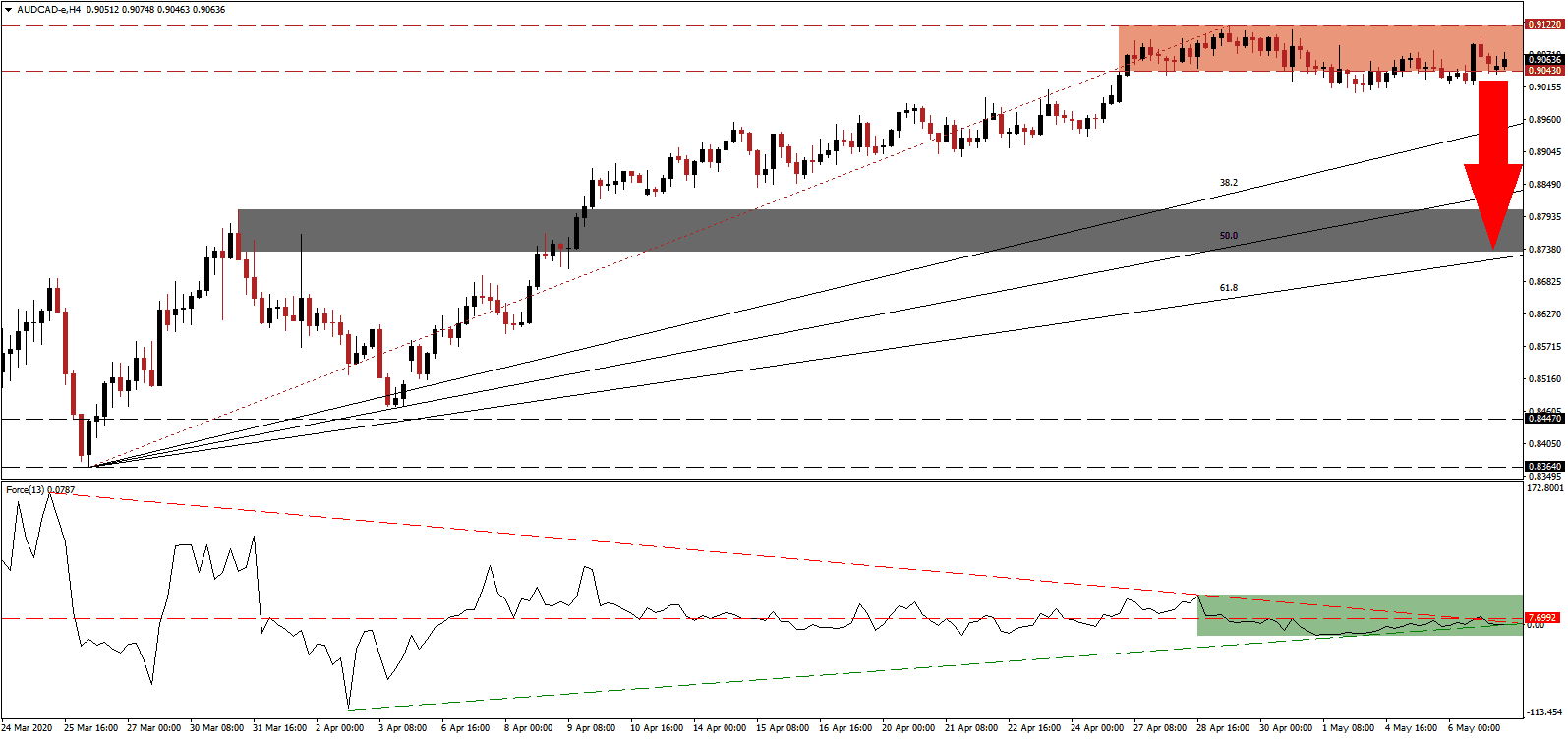

Australia reported an unexpected 15% surge in March exports, but the Australian Dollar was unable to benefit from it. With the economy losing an estimated $4 billion per week due to Covid-19 related disruptions, the government announced plans to revert its JobSeeker program to pre-virus levels in September. Over 1.22 million individuals benefit from it, while the private sector is unlikely to absorb the unemployed by the specified time. Adding to long-term issues is the diplomatic row Australia initiated with China, which could deal a crippling blow to the recovery potential unless it is resolved. The AUD/CAD currently awaits a breakdown inside of its resistance zone.

The Force Index, a next-generation technical indicator, points towards the gradual increase in bearish momentum after being rejected by its horizontal resistance level. Adding to breakdown pressures is the convergence of the ascending support level and the descending resistance level, as marked by the green rectangle. This technical indicator is expected to collapse more profoundly into negative territory, allowing bears to regain full control of the AUD/CAD. You can learn more about the Force Index here.

A report by the Australia-China Relations Institute at the University of Technology Sydney cautioned against the decoupling of the trading partners. It highlighted the severe negative impact the Australian economy will face, especially the commodity and educational sectors. Canada will become a primary beneficiary of the potential commodity export vacuum. Until more clarity emerges how Canberra will proceed, the AUD/CAD carries a distinct bearish fundamental driver. Price action is anticipated to correct below its resistance zone located between 0.9043 and 0.9122, as identified by the red rectangle.

Canada faces significant problems to adjust its economy and position it for a post-Covid-19 recovery. The latest estimates by the budgetary office forecast government spending to increase by C$146 billion and a deb-to-GDP ratio above 100%, which would present the most significant deficit since record-keeping began over sixty years ago. Over the short-term, the AUD/CAD is favored to undergo a profit-taking sell-off until it can test its next support zone. It is located between 0.8733 and 0.8805, as marked by the grey rectangle, and enforced by the ascending 61.8 Fibonacci Retracement Fan Support Level.

AUD/CAD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9060

Take Profit @ 0.8740

Stop Loss @ 0.9130

Downside Potential: 320 pips

Upside Risk: 70 pips

Risk/Reward Ratio: 4.57

Should the Force Index accelerate above its descending resistance level, the AUD/CAD may attempt a breakout. Due to the uncertainty over Australia-China relations, Forex traders are recommended to consider any advance as an additional selling opportunity. The next resistance zone awaits this currency pair between 0.9246 and 0.9301. Uncertainty over Australia’s diplomatic relations and Canada’s funding concerns cloud the long-term outlook.

AUD/CAD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9160

Take Profit @ 0.9300

Stop Loss @ 0.9000

Upside Potential: 140 pips

Downside Risk: 60 pips

Risk/Reward Ratio: 2.33