Preliminary PMI reports out of Australia for May show the manufacturing sector contraction at a steeper rate than in April, while services recovered slightly but remain in a deep recessive state. It confirms disruptions caused by the Covid-19 pandemic are significantly worse than previously anticipated, and are likely to persist longer than economies can afford. Consumers are faced with a decline in home values and income losses, ensuring a swift recovery is unlikely. It added to a bullish momentum breakdown in the AUD/CAD after this currency pair drifted sideways below its resistance zone before pushing to the top range. A more violent sell-off is anticipated to materialize.

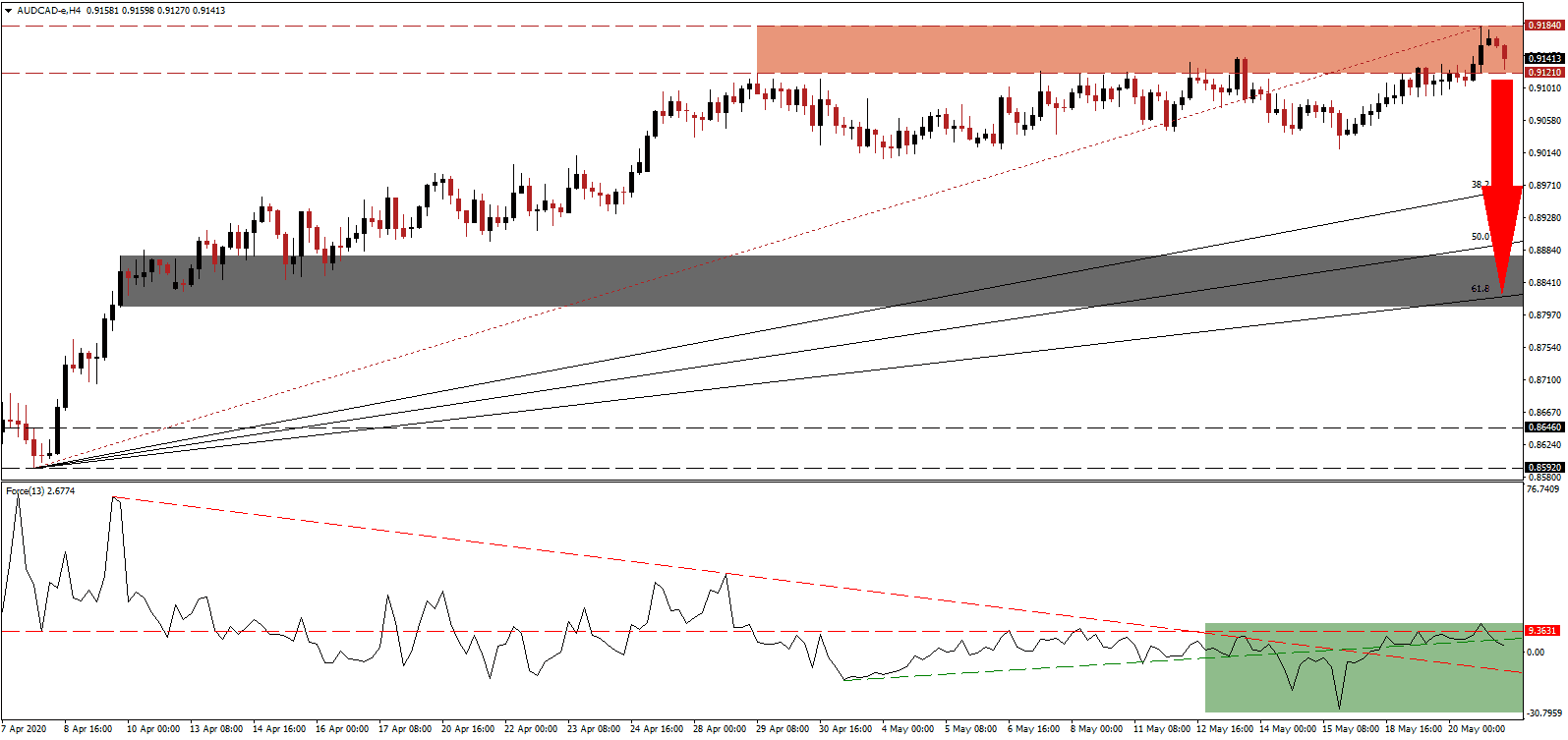

The Force Index, a next-generation technical indicator, was unable to maintain a temporary, marginal move above its horizontal resistance level, as marked by the green rectangle, and immediately reversed to the downside. Increasing bearish momentum was the breakdown below its ascending support level, setting the Force Index on course for a collapse below its descending resistance level. Bears wait for this technical indicator to cross below to 0 center-line to resume full control of the AUD/CAD.

After the Chinese government applied 80% anti-dumping tariffs on Australian barley imports, tourists and students are boycotting Australia. The tariffs are expected to deliver an annualized blow to the economy of approximately A$500 million, but the boycotts will take the total economic loss to well above A$1 billion. Australia opted to start a diplomatic row with its primary trading partner, which is leading to a widening trade war the Australian economy cannot handle. A collapse in the AUD/CAD below its resistance zone located between 0.9121 and 0.9184, as marked by the red rectangle, is favored to emerge.

China is embarking on a slow path to recovery with the world closely watching. The People’s Bank of China left its benchmark interest rate unchanged, while the business community pleads for more government assistance. With the worsening of relations between China and Australia, other commodity exporters like Canada will benefit in the short-term. The pending profit-taking sell-off in the AUD/CAD can close the gape to its ascending 38.2 Fibonacci Retracement Fan Support Level. It can extend into its short-term support zone located between 0.8808 and 0.8877, as identified by the grey rectangle, and enforced by the 61.8 Fibonacci Retracement Fan Support Level.

AUD/CAD Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 0.9140

Take Profit @ 0.8820

Stop Loss @ 0.9220

Downside Potential: 320 pips

Upside Risk: 80 pips

Risk/Reward Ratio: 4.00

A reversal in the Force Index above its ascending support level is likely to inspire a new breakout attempt in the AUD/CAD. While the Canadian economy faces significant challenges, they are superseded by Australia’s present ill-advised confrontational course with China. Forex traders are recommended to consider any breakout attempt as an excellent selling opportunity. The next resistance zone is located between 0.9315 and 0.9395.

AUD/CAD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.9250

Take Profit @ 0.9390

Stop Loss @ 0.9180

Upside Potential: 140 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 2.00