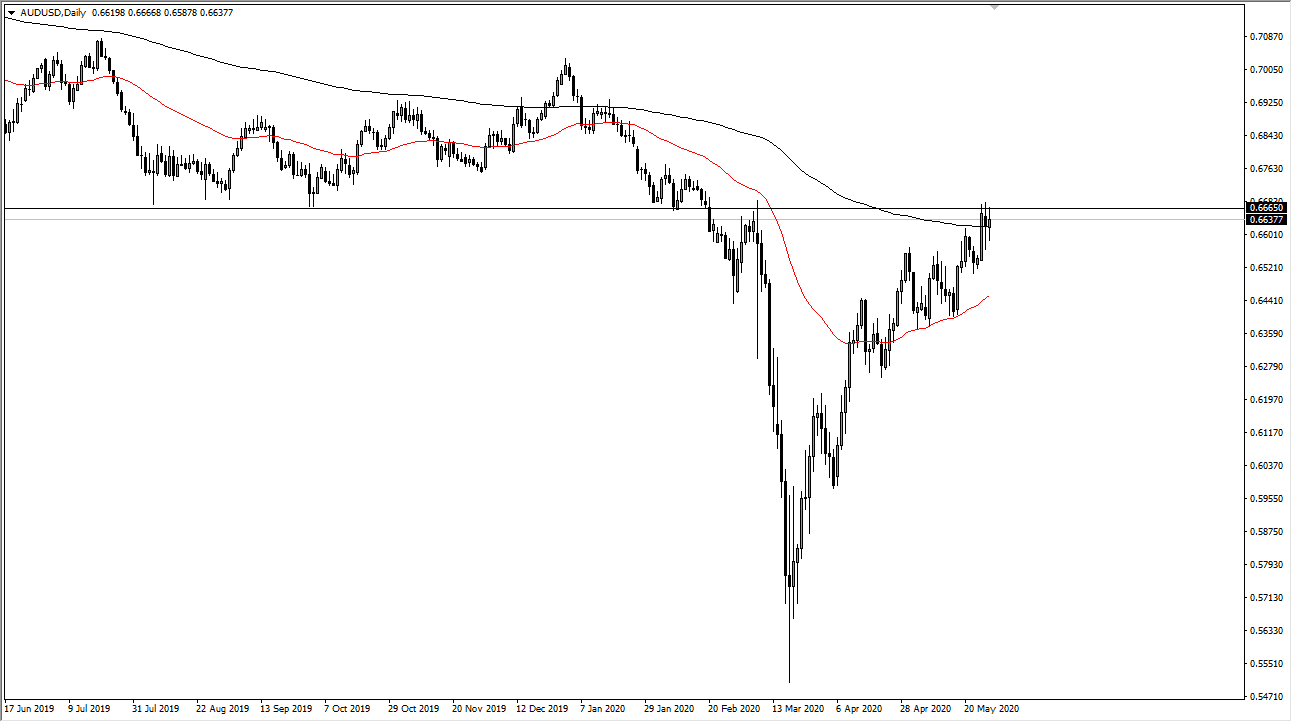

The Australian dollar went back and forth during the trading session, in what has been very choppy trading. However, towards the end of the day it was noted that the President will be having a news conference on Friday involving China, and that of course has a direct effect on the Aussie dollar. With the announcement, one would have to think that it is only a matter of time before some type of escalation between the Americans and the Chinese, and the short term reaction has been to sell the Australian dollar which you would expect. Ultimately, this is a pair that I think will continue to see a lot of choppy behavior, and we clearly are in an area where there is a lot of built-in resistance anyway.

The candlestick is less than impressive, and it is likely that we will continue to see a lot of noisy behavior. If we break down below the lows of the trading session on Wednesday, then it turns that candlestick into a “hanging man”, which is an extremely negative sign. The 0.67 level above is a massive barrier, and quite frankly if we cannot get above there we could see or roll over in this pair finally. I think it is overdone, but I am the first person to admit that if we find this market above the 0.67 level, you have to be a buyer and then aim for the 0.70 level.

This candlestick for the Thursday session is rather anemic looking, and that does suggest that there could be more selling. The stock markets in America late in the day sold off rather drastically, as the US/China tension seem to be reaching higher pitch as well. Overall, if the market does continue to go lower, I think that we could eventually go looking towards the 0.6250 level, but it is very noisy between here and there. I think that there is serious trouble between here and there, so it is not like it is going to be a straight shot lower. However, this is a market that desperately needs to pullback anyway, so maybe it is just an excuse. However, above the 0.67 level I could see an acceleration to the upside, perhaps due to extreme amounts of “hopium” like we have seen for some time now. Ultimately, I am not a huge fan of buying up at this level, and I do think at the very least there are people taking profits going into the weekend.