Ripple has lost its second executive this year. After veteran engineer Evan Schwartz, who led the development of the Interledger Protocol or ILP, left the foundation in January, the head of XRP Markets, Miguel Vias, departed the firm. No announcement was made, as it appears the company tried to keep his departure silent to avoid adding selling pressures to the XRP/USD. Vias oversaw over $1 billion in sales of the XRP token, which many likened to dumping the asset and depreciating its value. The departure of key executives should not be ignored. Following the rejection of this digital asset by its resistance zone, renewed selling is favored to retest the critical short-term support zone.

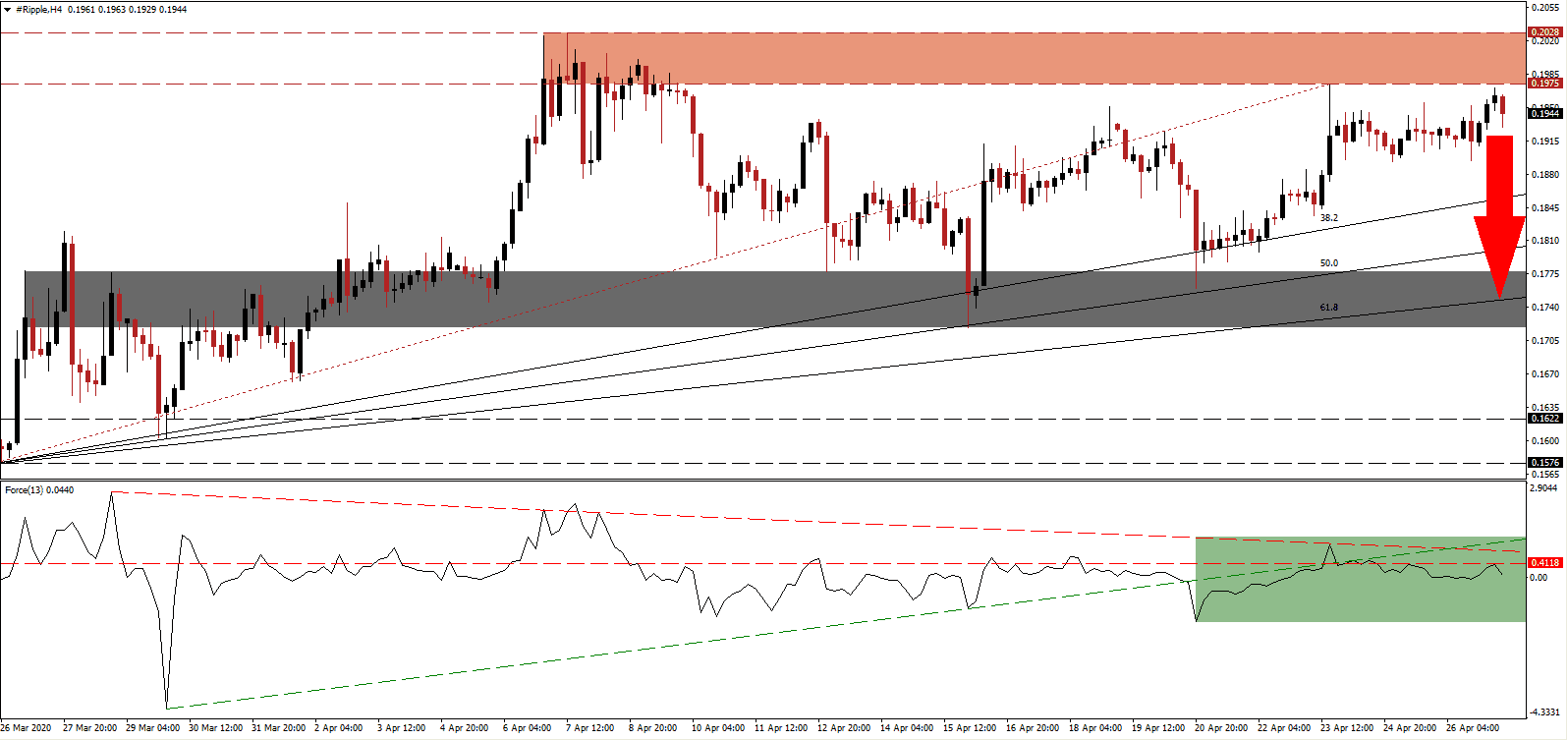

The Force Index, a next-generation technical indicator, failed to convert its horizontal resistance level into support on two occasions, confirming the significance of it. After the breakdown below its ascending support level, as marked by the green rectangle, the descending resistance level is adding to downside momentum. This technical indicator is on the verge of a cross-over below the 0 center-line, at which point bears will regain control of the XRP/USD. You can learn more about the Force Index here.

Adding to bearish developments is the loss of confidence by long-term investors and supporters. An XRP investor’s post went viral on Reddit this weekend after he questioned the outlook for the third-largest digital asset by market valuation. Primary concerns were the adoption by financial institutions as well as the On-Demand Liquidity (ODL) tool intended for crypto-based payments. It highlighted broader issues and assisted in the reversal of the XRP/USD off of the bottom range of its resistance zone located between 0.1975 and 0.2028, as identified by the red rectangle. A more massive breakdown sequence cannot be excluded.

Price action is well-positioned to close the gap to its ascending 38.2 Fibonacci Retracement Fan Support Level. While the Ripple Foundation secured a $200 million Series C funding round, how the capital is utilized to bolster the XRP token remains unclear. In a positive development, steps to protect the community from social media scams, have been initiated. Short-term bearish pressures remain dominant, and the XRP/USD is expected to challenge its short-term support zone located between 0.1719 and 0.1777, as marked by the grey rectangle.

XRP/USD Technical Trading Set-Up - Breakdown Extension Scenario

- Short Entry @ 0.1945

- Take Profit @ 0.1745

- Stop Loss @ 0.2010

- Downside Potential: 200 pips

- Upside Risk: 65 pips

- Risk/Reward Ratio: 3.08

A breakout in the Force Index above its descending resistance level may inspire a push higher in the XRP/USD. Long-term bullish fundamental conditions are in place, but the execution of the Ripple management team started to raise concerns over proper implementation. The patience of investors is being stretched thin with hopes of a sustained advance persistent. This currency pair will face its next resistance zone between 0.2318 and 0.2445 from where more upside requires a significant catalyst.

XRP/USD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 0.2100

- Take Profit @ 0.2010

- Stop Loss @ 0.2320

- Upside Potential: 220 pips

- Downside Risk: 90 pips

- Risk/Reward Ratio: 2.44