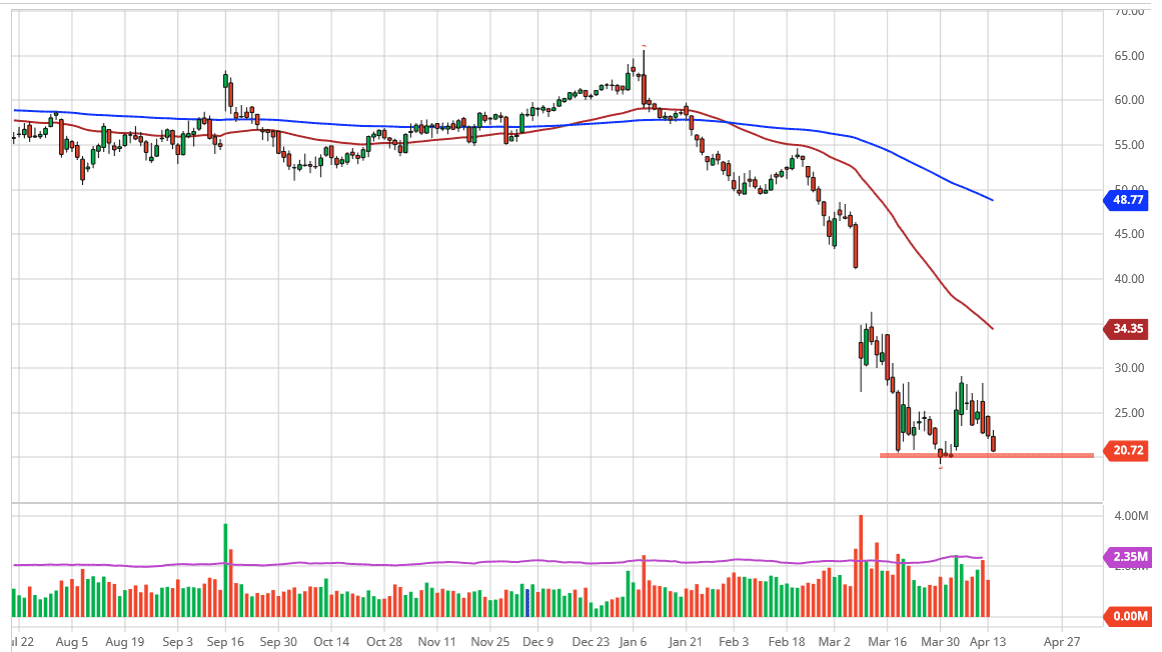

The West Texas Crude Oil market has sold off rather drastically during the trading session on Tuesday, reaching down below the $21 level. At this point, the ominous $20 level underneath is calling, and it certainly looks as if we are going to do everything we can to break down through it. If we do break down below the $20 level, it’s very likely at that point that we will start to see selling pressure pick up as it is the previous low and has been bounced from a couple of times.

Looking at the chart, I recognize the $20 level as an area that will attract a lot of attention, not to mention the fact that it will be all over the headlines. It does have a certain amount of psychological effect on the market, just as the fact that it is a large, round, psychologically significant figure will. Ultimately, I believe that this is a market that if and when we break down below that level, we should go to the $17.50 level next, followed by the $15.00 level. That being said, there is also the argument to be made that we could bounce from here and maintain the overall consolidation.

Looking at this chart, I recognize that the $20 level is the bottom of the overall consolidation that extends all the way to the $30 level above. At this point, if we do rally from here, I’m not looki Looking at this chart, I recognize that the $20 level is the bottom of the overall consolidation that extends all the way to the $30 level above. At this point, if we do rally from here, I ng to buy this market, rather I am looking to fade rallies at either the $25 level, or the $29 level. It’s not until we break above the $30 level that momentum would truly pick up and push this market much higher. At this point, I am looking for an excuse to sell this market, either at a higher level, which I would prefer but also will do so at lower levels as there will more than likely be a ton of stop loss orders just below the $20.00 handle. Regardless of what OPEC does, they have a major issue ahead of themselves, which of course is the fact that is that there is no demand out there, and quite frankly I don’t think there is going to be demand anytime soon. Because of this, I believe that we do eventually break down to the downside, but there is the possibility of trying to form some type of bottom. I don’t think we’re quite there yet though.