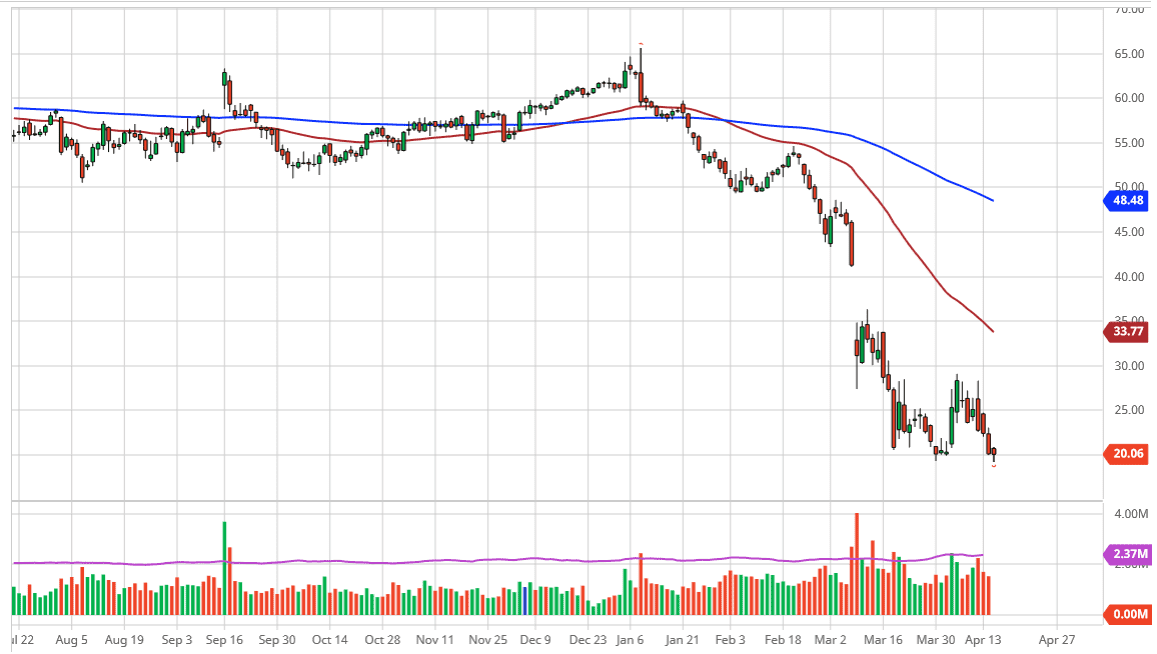

The West Texas Intermediate Crude Oil market has plunged during the trading session on Wednesday, as the markets have broken through the $20 level. This is a big deal, but it should also be noted that buyers came in and supported the market below there. In other words, the $20 level looks to be as if it is offering a bit of a battlefield for the longer-term trade. Ultimately, the market will turn things around and try to see if it holds.

The shape of the candlestick is a hammer, so having said that it’s likely that there will be a natural inclination for short-term rally, and I think at this point short-term traders will probably be looking to take advantage of the short-term pop, and I think we could even rally as high as $22.50, followed by the $25 level. That being said, one has to wonder exactly who was buying below the $20 level, as OPEC is known to jump into the futures market and supported crude. In other words, was it actual trading, or was it a bit of attempted price manipulation?

If we break down below the bottom of the hammer, that would be a very bearish sign and should open up the move down to the $17.50 level, and then eventually the $15 level. Ultimately, I think this is a market that is going to continue to struggle overall, because quite frankly there isn’t going to be enough demand out there to drive up the value of crude oil. Ultimately, this is a market that I think will eventually come down to supply and demand, and there is a massive amount of supply out there that is difficult to imagine ripping through anytime soon. Demand is obviously through the floor, as most global economy is our under lockdown, and therefore crude oil simply isn’t needed. Granted, OPEC did promise the cut 9 million barrels a day, but that isn’t going to be enough when we have seen such demand destruction and of course are starting from a base of massive oversupply. As long as that’s the case, crude oil will continue to suffer, and rallies are to be sold into until we can clear the $30 level which I see is the top of the overall range right now. Keep your position size somewhat small though, because volatility will continue to be a major problem.