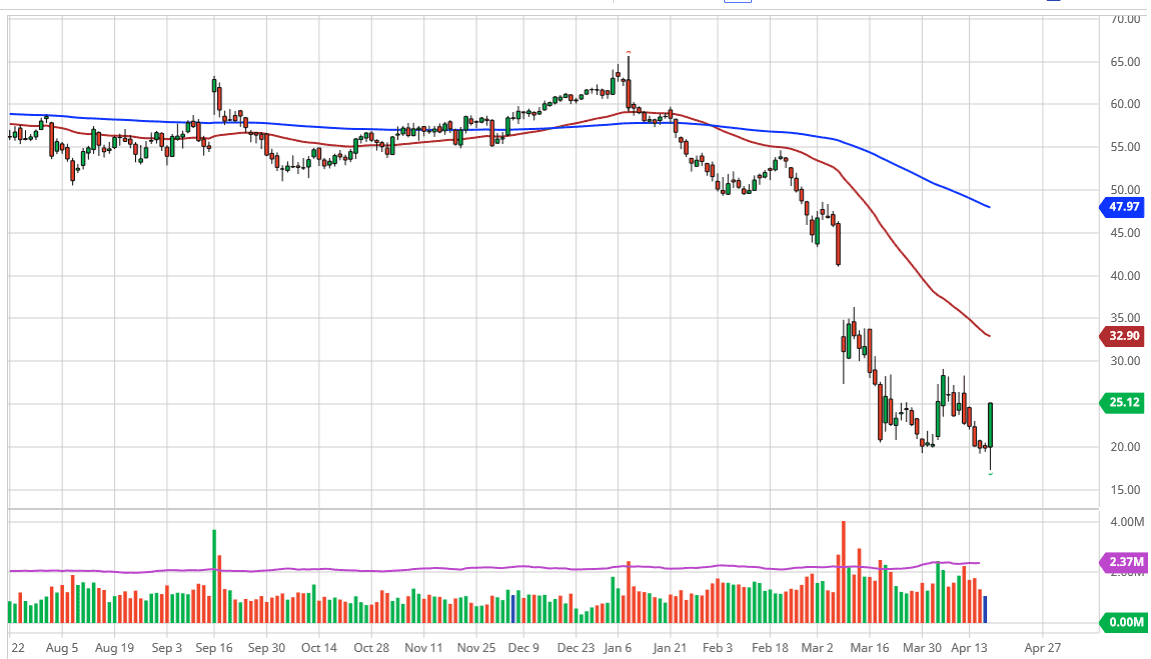

We rolled over to the June contract at the end of the session on Friday, so this is the chart that we are looking at. It’s at the $25 level, and it looks as if the $30 level above is going to be one of the biggest barriers that this market faces in the short term. Quite frankly, oil has no business rallying for any significant amount of time, due to the fact that the markets continue to see major demand destruction and we are to the point where some areas are using pipelines as storage. That’s ridiculous, and not something that we see very often. Regardless of what OPEC does, the reality is that cuts will have to be massive in order to turn the tide.

The economy doesn’t look like it’s any closer to getting robust again, because even if we do have a lot of the restrictions listed, it’s still going to be some time before we are back to pre-crisis demand. Furthermore, it should be noted that the pre-crisis demand wasn’t enough to take out the supply anyway, so with that being the case I think it is only a matter of time for shorting this market to pay off. I think that the 50 day EMA above is a specifically interesting technical indicator, and traders will be paying quite a bit of attention to it. The $30 level of course is a massive resistance barrier, and the two are going to get close to each other here soon.

Looking at the chart, I believe that the $20 level underneath is massive support, and therefore I think it’s only a matter of time before we reach towards that level again. On the other hand, if for some reason we break out to the upside, the gap above that sits at the $42 level will more than likely offer a massive ceiling as well. I look for signs of exhaustion after short-term rallies to sell, and I think that this will be one of the better trades for the next several months. That being said, bear market rallies can be brutal so keep that in mind when you put your position on. Don’t over lever, which is a major failing of most retail traders. Murphy’s Law dictates that as soon as you do, the market will be up four dollars in the blink of an eye.