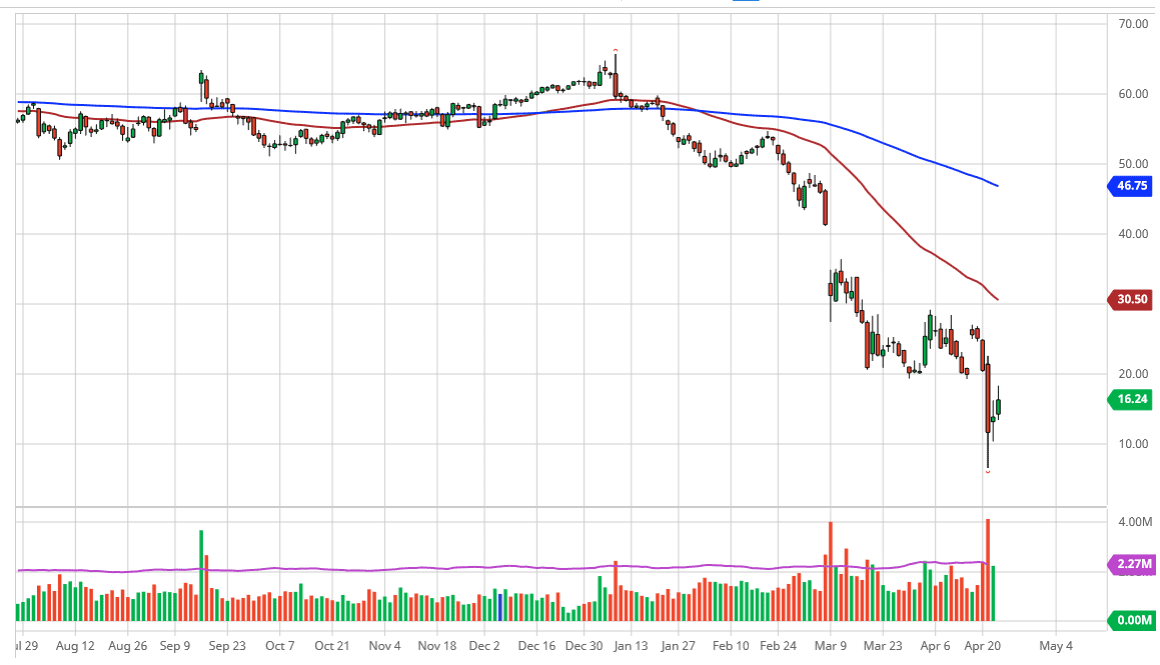

The West Texas Intermediate Crude Oil market rallied during the trading session initially on Thursday but did reach towards the $20 level before rolling over. At this point in time it looks like we are simply trying to retest the previous highs, so I do think that there will be some selling pressure near the $20 level. I like the idea of shorting this market as we get closer to that level, so therefore I like the idea of simply waiting for opportunities.

The overall demand for crude oil is definitely down, as the coronavirus has shut down so much of the world and therefore it is likely that we will continue to see a lot of trouble. I like the idea of fading rallies like I said, and I do think that it is only a matter of time before the pressure gets to the market again, because quite frankly we are light years away from being able to rip through the supply. Furthermore, it is very possible we may see something like we did at the end of the May contract, people running for the hills as they cannot find places to store crude oil, and we could see some negativity as far as pricing happen.

If the $20 level above gets broken to the upside, I do believe that there is a significant amount of resistance all the way to the $25 level, so I think it’s probably likely that we will see exhaustion between $20 and $25, assuming that we could even make that move. With all of that being said, it is very unlikely that things are going to change anytime soon, especially as the jobless numbers continue to skyrocket around the world. With that in mind, I believe that we will continue to see commodities suffer, although it is obvious that a lot of Wall Street traders still believe that the economy is going to go back to normal like a light switch being flipped. Regardless, if you are patient enough you should get an opportunity to short this market. In fact, I have no interest whatsoever in trying to break above the $25 level on a daily close, something that would take quite a bit of momentum. Expect more volatility more than anything, as this market is not done breaking accounts and wiping out speculators. We have a long way to go before normalcy returns to the crude oil market.