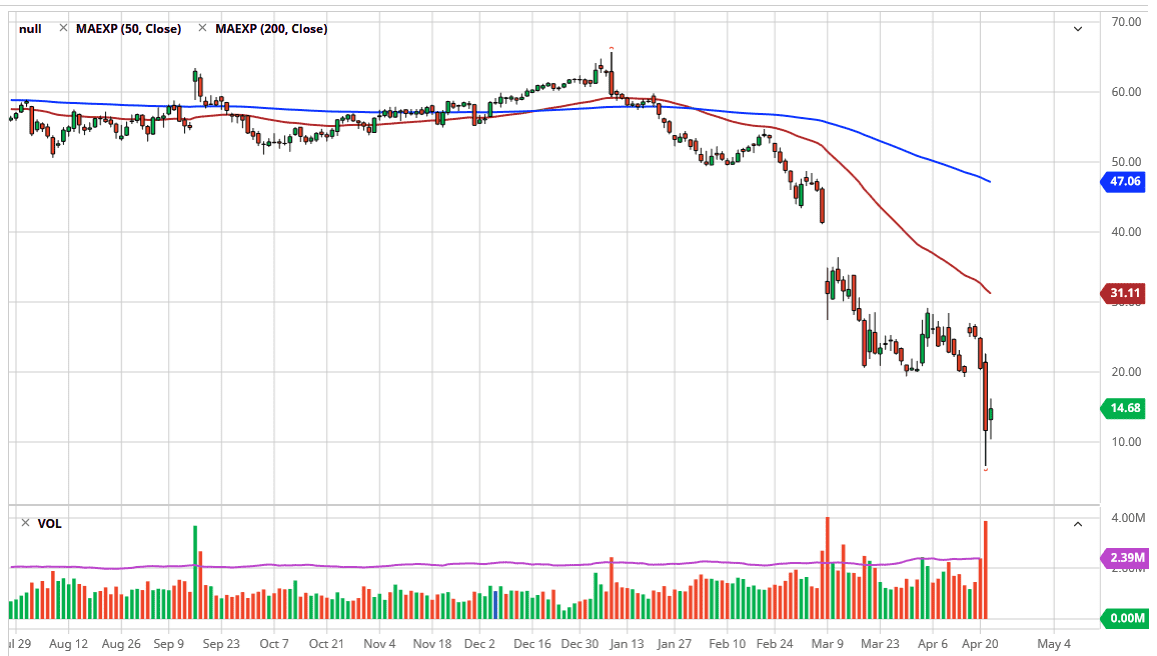

The West Texas Intermediate Crude Oil market gapped to the upside at the open on Wednesday, but then pulled back to try to fill that gap which of course it ended up doing so. From there, the market then rallied rather significantly to show extreme gains, but in the big scheme of things it is hardly impressive, because the market had fallen so hard. The volume of the breakdown during the trading session on Tuesday was extraordinary, so it shows just how negative this market truthfully is.

There is a real possibility that the June contract goes negative as well, unless of course something is done about cutting supply. After all, we are running out of room to store crude oil. The May contract reached as low as $-37, which is historic to say the least. At this point, I believe that the $20 level above is likely to offer a bit of resistance, so I am simply going to wait to see whether or not we get a bounce that I can take advantage of to start selling at the $20 level.

The candlestick for the trading session does look a bit bullish and supportive, and it should be noted that the $10 level offered a bit of support. I think at this point what we are going to see is a serious attempt to try to recover some of the losses, because if nothing else they will be a lot of short covering. Regardless, I look at this is an opportunity to sell this market from higher levels, because the fundamental situation is getting worse, not better. What is even more telling is the fact that the market gapped higher just last week and then promptly turned around to fall through that gap and then break down even further than it had previously. All things being equal, this is a market that needs to see massive production cuts in order to rebalance the market. This is going to take a significant amount of time to rebalance, so at this point it is simply a matter of waiting for opportunities to short this market as it gets a little bit overdone to the upside. Bear markets do tend to have extraordinarily strong moves to the upside in the middle of them, and it will be especially true in a market like oil that is so heavily traded by algorithms.