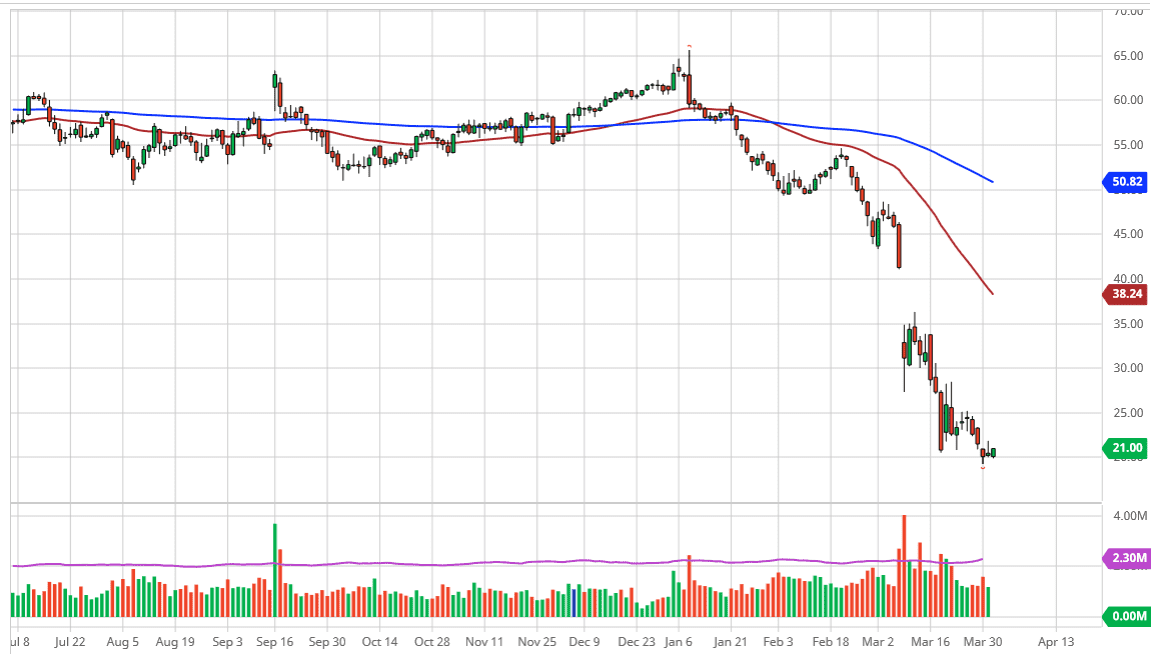

The West Texas Intermediate Crude Oil market initially tried to rally but then fell towards the $20.00 level. That is an area that I think is offering significant support, but I believe it’s only a matter of time before we break down below it. Once we do, the bottom is going fall out and we will more than likely drop down to the $17.50 level, possibly even the $15 level.

As you can see, every time this market tries to rally, there seems to be sellers coming in to punish it. That makes quite a bit of sense considering that the Russians and the Saudi Arabian governments are doing what they can to flood the market with crude oil in a price war. That being said though, there is no demand anyway so there is no reason to think that this market is suddenly going to take off anytime soon. In fact, at the very least we need to see the oil price war and, and even then, there isn’t much in the way of demand so it’s more or less a “one-two punch” when it comes to crude.

Something that is even more concerning is the fact that the market is very likely to find storage to be a major issue. Almost all of the land based storage is full now, and we are just a few short weeks from running out of space. At that point, then tanker start to get filled up and the world is awash in crude oil. We are seeing a major shift in crude oil and it is going to be a long time before the bullish pressure pushes this market to the upside. After all, the demand is probably months away from going back to normal, and the massive oversupply of crude oil is something that is going to take a significant amount of time to break through. In other words, there’s no reason to become bullish.

Going forward, I like fading short-term rallies and believe that the $22.50 level and then the $25 level both should offer plenty of selling opportunities. Eventually things may change, and we could go looking to fill the gap above, but we are light years away from that happening at this point. As we continue to see a lot of volatility, we also have seen a lot of US dollar strength which works against crude oil as well.