The West Texas Intermediate Crude Oil market initially gapped higher to kick off the trading session on Monday as rumor started to come out that the members of OPEC and the G 20 were looking to cut more production than anticipated. However, the only thing that has been agreed upon by the time that I write this is a cut of 9.7 million barrels. That’s not enough, as demand has dropped significantly and storage is almost completely full. Furthermore, OPEC and other oil-producing countries can do very little about the lack of demand.

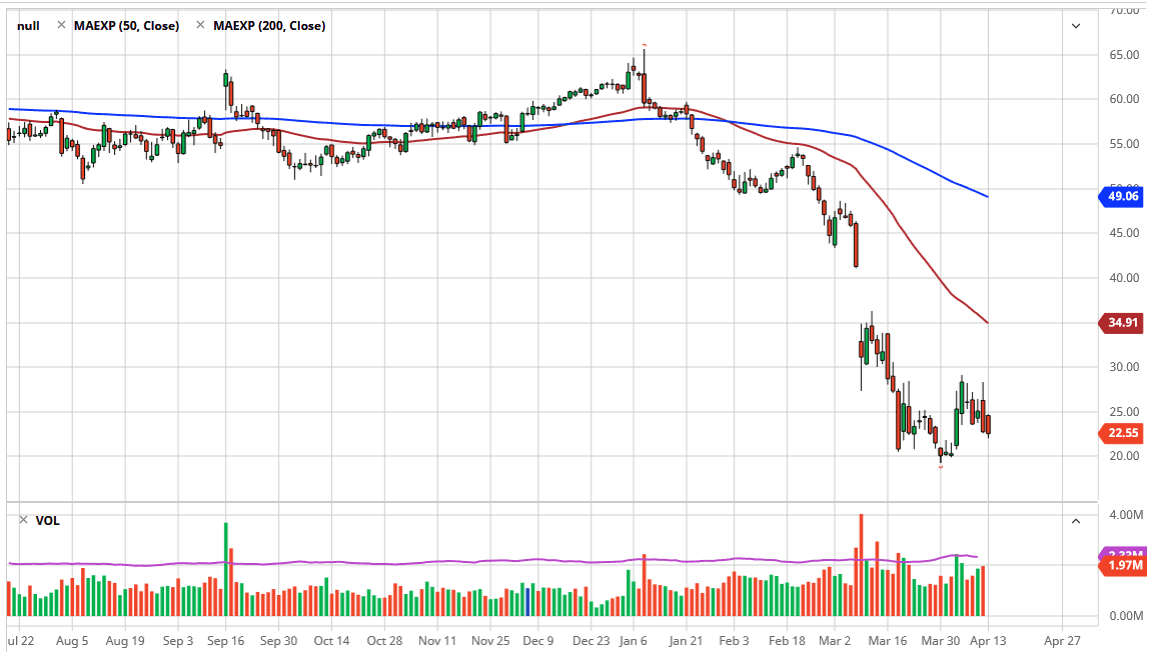

With the coronavirus ripping through the world’s economy, there is a lot less demand for crude oil, which quite frankly had been oversupplied for some time anyway. That being said, it is going to be a process rather than a simple matter of “flipping a switch” in order to put bullish pressure into this market. The best case scenario is probably going to be that the market simply grind back and forth in order to form some type of larger base to turn things around and bounce from an extraordinarily low level. In fact, right now it looks as if the market is trying to use the $20.00 level as the bottom of the range that could extend his high as $30.00 above. The longer the market spends going back and forth between these two levels, the better off it’s going to be for the buyers longer term.

However, if we were to slice down below the $20.00 level, the crude oil markets will probably give up quite a bit and drop down towards the $15 level, possibly even the $10 level. Granted, there is a gap above that needs to be filled but I think we are a long way away from have that happen, because that would mean that the market needs to go all the way to the $42 level in order to do that. I do think we get there someday, but right now we are nowhere near showing that type of strength. If there are deeper cuts coming, then it’s possible that could help crude oil but right now it seems very unlikely that crude oil gets any type of reprieve for more than a simple occasional short-term bounce. Until the economy starts moving again, it’s difficult to imagine that there will be a lot of demand for crude oil.