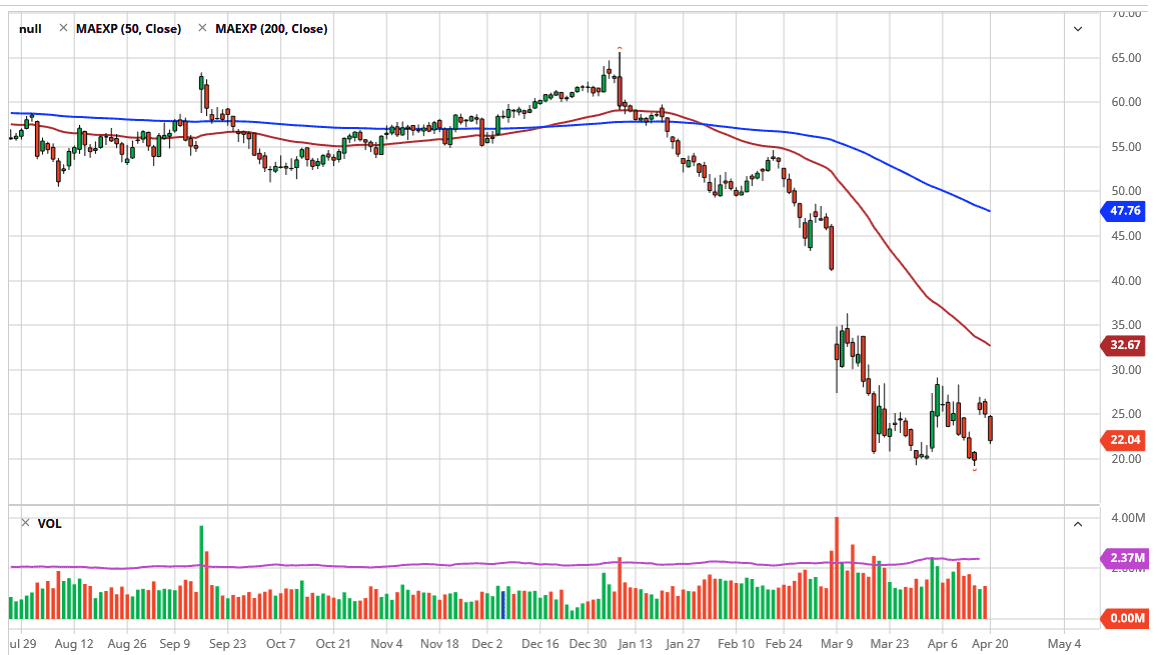

The West Texas Intermediate Crude Oil market has been very negative to say the least, with the May contract going negative. This was a function of people not wanting to take delivery of crude oil, but this is not the forward contract. That being the case, there are a lot of headlines out there about this, but the reality is that you won’t be trading this market unless you are willing to take delivery in the next few days of at least 5000 barrels.

As far as the front month is concerned, it got whacked hard as well, breaking down significantly and looking very likely to fill the gap down at the $20 level. In fact, that is my short-term target for this market, but I also believe that we go through the $20 level and go much lower. Oddly enough, there have been several production cuts as of late, and as a result one would have expected the market to rally, but that’s not actually what has happened, as we simply do not have enough demand out there to get rid of the excess supply. There is so much debt out there that we could see massive bankruptcies, and if that’s going to be the case that might be the next driver but right now until the demand picks up due to economies possibly opening up. However, it’s going to take some time for the economy to burn through all of the oversupply of crude oil right now, as there is so much out there that we are literally running out of places to store the commodity.

As long as that is going to be the case, the market will struggle. If we break down below the $20.00 level, it’s very likely that the market will go looking towards the $17.50 level, possibly even the $15.00 level, which I think is more likely than not at this point. I believe that short-term rallies will be sold into, so I will be looking for short-term bounces that show signs of rolling over to get negative again. In fact, it may be several months before crude oil wakes up for a sustainable move. At this point, I would think that we are plenty of reasons to think that there is significant damage that will last for quite some time when it comes to this market. I have no scenario in which I am willing to start buying.