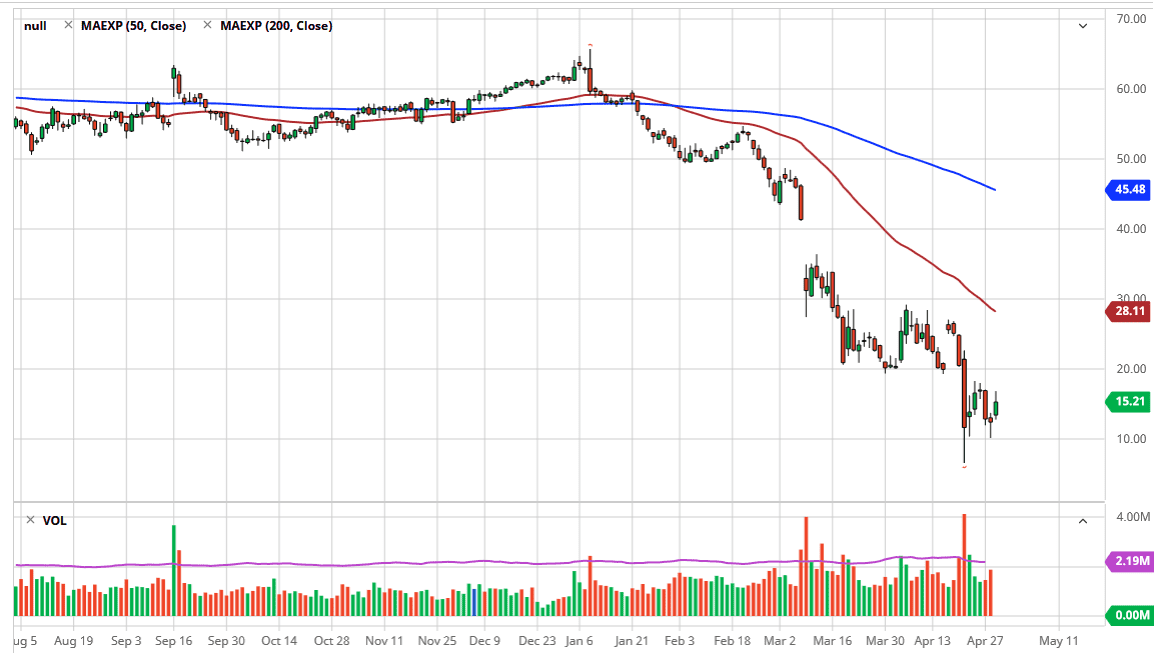

The West Texas Intermediate Crude Oil market initially tried to rally during the trading session on Wednesday and did keep quite a bit of the gains as we closed up 24%. Having said that, the market is at extreme lows, so it is only a matter of time before the sellers get involved and push his market back down. When you look at the chart, it is easy to see that the $20 level has offered significant support in the past, so it would make significant resistance going forward. With that being the case, I believe that the market will probably continue to be a “fading the rallies” type of scenario.

In fact, the closer we get to the $20 level, the more likely I am to throw a ton of money into a short position as crude oil is an absolute disaster right now. There is no actual demand for crude oil, so therefore it is difficult to get excited about trying to buy it. With that in mind, it is likely that we will continue to see a lot of resistance come into play and therefore I would anticipate that one of the easiest trades to take is to short this market, because the massive red candlestick that sent us down here is sitting just above there as well, and one would have to think there is a lot of order flow there.

To the downside, the $10 level should offer plenty of support, and I think at this point as we rollover it is likely that the market will probably go looking towards the $10 level for support. At this point, if the market breaks down below there probably goes looking towards the $7.50 level, which is an area that had seen a bit of buying in the past as well. Longer-term, people have to worry about whether or not anybody is going to want to take delivery of crude oil at the end of the month, and that could cause massive problems. We have already seen that with the May contract and there is nothing to suggest that the June contract will do the exact same thing. With that in mind, I like the idea of selling this contract any time it tries to rally as it has no business going higher. Ultimately, I think it is a real question as to whether or not we at the zero dollars level.