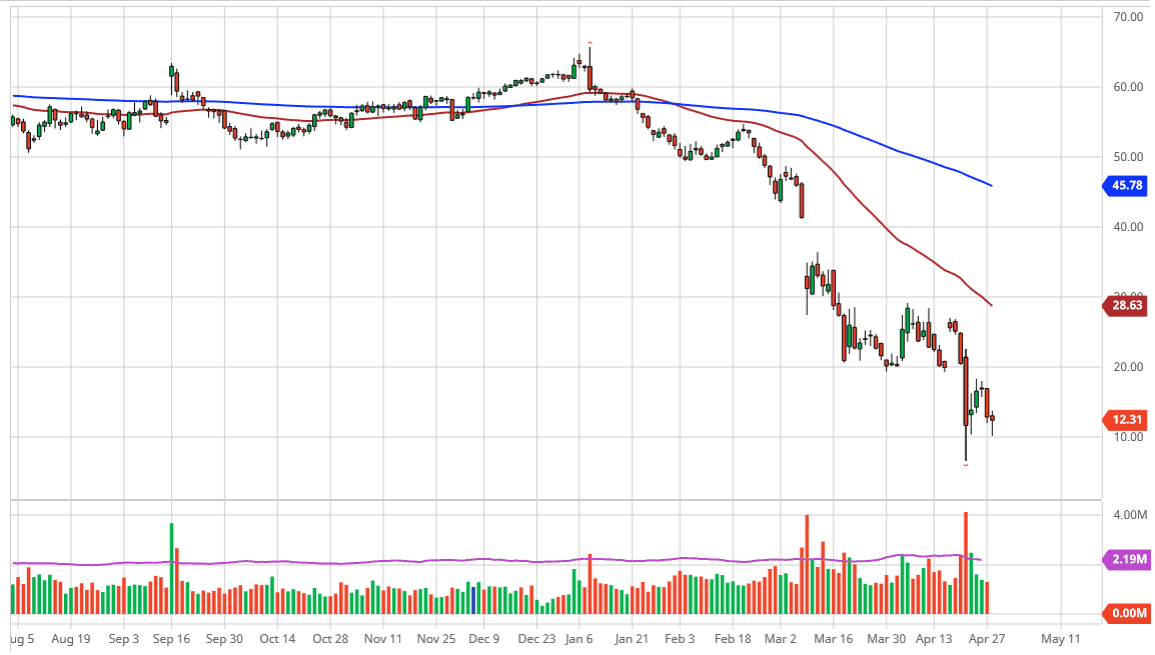

The West Texas Intermediate Crude Oil market broke down rather significantly during the trading session on Tuesday, reaching down towards the $10 level before bouncing a bit. By doing so it shows that we still at least have some semblance of support in the market, but I think it is only a matter of time before we break down through that support and continue to go much lower. The $10 level of course has a lot of psychology attached to it, so if we were to break down below that level it is likely that we will go reaching towards zero dollars again as we did during the May contract.

On the other hand, if we break above the top of the candlestick for the trading session on Tuesday, we could get a little bit of a bounce, considering that the hammer that formed for the day is so supportive looking. That being said though, it is only a matter of time before there is exhaustion above just waiting to be sold into as I believe we are trading in a range between the $10 level on the bottom and the $20 level on the top. The $20 level was previous support, so it should now be resistance. I look at signs of exhaustion in that area as a screening signal to start selling.

On the other hand, if we break down below the $10.00 level, then the market is likely to go looking towards the $7.50 level, and then down to the $5.00 level. All things being equal, there is a lot of concern out there when it comes to possibly running out of space for crude oil to be stored, and therefore we could see a repeat of the last contract. Ultimately, the market is one that you should be looking for signs of exhaustion to punish, because quite frankly this market has no business going higher. Not only do we have to worry about storage, the lack of demand of course is a major concern as well. Because of this, it is likely that we will see a lot of choppy behavior, but ultimately, we are in a downtrend and that is the one thing that you should be paying attention to more than anything else. Furthermore, the US dollar strengthens that will only cause more damage to this market going forward.