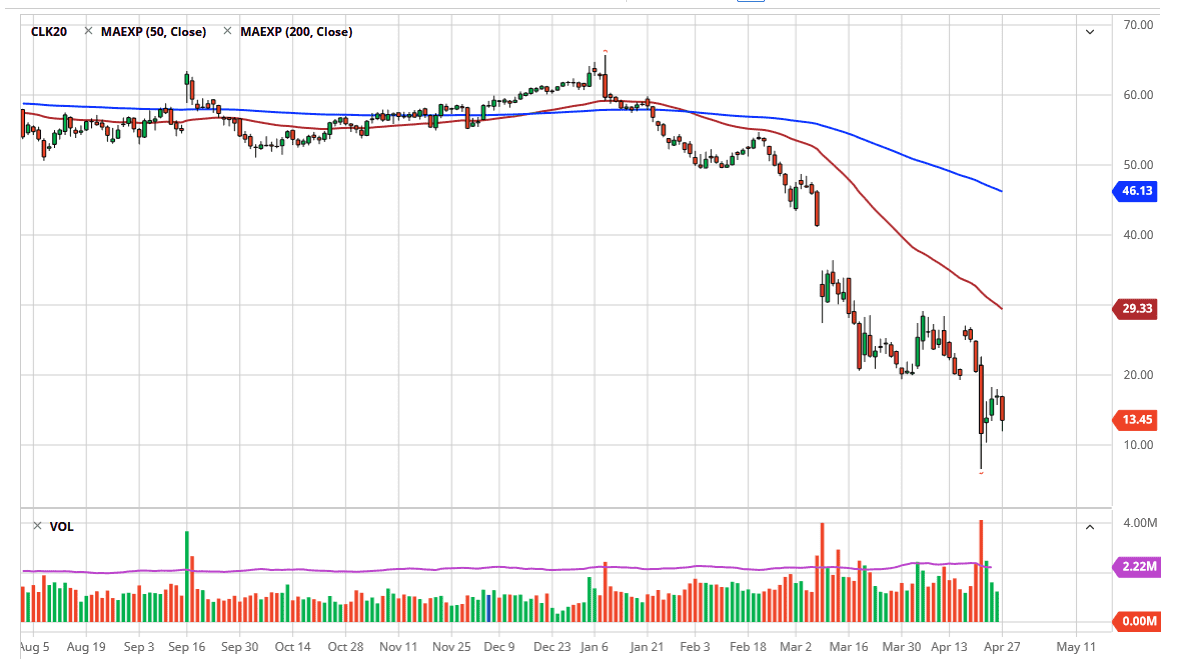

The WTI Crude Oil market broke down a bit during the trading session on Monday, losing quite a bit of the gains from last week. At the end of the day, we turned around and rallied a bit, but the reality is we bounce from a significantly low level. At this point, this is a market that has a lot of concerns when it comes to storage, as we had seen at the close of the May contract. The June contract does not look like it is going to do much better, and the reality of running out of space is going to continue to be a major problem. Because of this, it is likely that we will see this market sold every time it tries to rally.

To the upside I see the $20 level as a major resistance barrier, and as a result it is likely that any time we see any type of rally, traders will look to short this market as it is decidedly in a bearish trend, and quite frankly running out of space is a bad look as traders will not want to have anything to do with trying to take delivery. Remember, most of the trading in this contract is simple speculation and getting stuck with 5000 barrels or more at the end of the month is a nightmare just waiting to happen.

To the upside, I believe the $20 level will act as a short-term ceiling, while the $10 level underneath looks to be rather supportive. Do not get me wrong, I think we will find it more than enough pressure to break down below the $10 level. Furthermore, there is no demand for crude oil which is going to make this even worse. We have gotten far beyond the ability of OPEC to cut enough barrels to bring the price back up, because quite frankly until economies get moving, there is no need for crude oil. Barring some type of miracle, this is a market that will not be able to rally for exceptionally long. You can even see that during the previous week we had three green days in a row, but they were not exactly explosive. Because of this, crude oil will continue to see negative momentum from everything the chart is telling me.