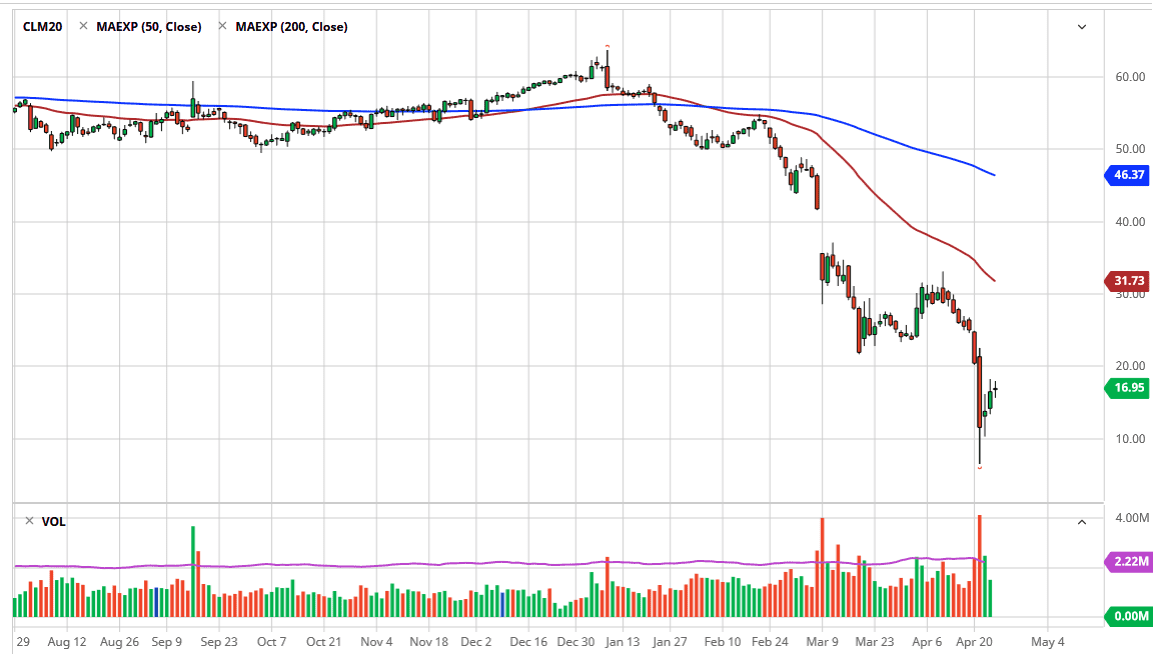

The West Texas Intermediate Crude Oil market did extraordinarily little during the trading session on Friday to in the week, after gaining quite drastically for several sessions. By doing so, it has shown that perhaps we are running out of bit of momentum, and that is not a good sign for people who are looking to go long. If that is going to be the case, then it is highly likely that the buyers are starting to run out of steam.

When you look at the chart, we have obviously bounced from a significant sell off, as we reached towards the $17.50 level. There is a significant amount of resistance extending all the way to the $20.00 level, as it was previous support. The support being broken down the way it was led to massive selling as traders could not find storage for oil, or at least were afraid of doing so at the rollover from the May contract.

The all things being equal, the market is likely to see a lot of sellers between here in the $20 level, as we will more than likely go back down towards the $10 level. This is a market that continues to see a lot of negative pressure, as we are almost certainly going to see the same problem in the June contract as we are not burning through enough crude oil to get rid of the oversupply. In fact, Goldman Sachs recently has stated that they thought oil storage would be completely filled within the next three or four weeks. We are going to continue to see a lot of headlines when it comes to that, and at this point it is likely that we will see significant volatility. The fact that we recovered suggests that the market is at least trying to find some type of normalcy, but the reality is that a lot of the rally has been that a lot of the buying pressure may have actually been short covering. I believe that it is only a matter of time before we will see a reason to sell off, and even if we break above the $20 level, I think there is still significant resistance all the way to the $22.50 level. The 50 day EMA is racing towards that region as well, so I think it will establish itself as a bit of a “ceiling” in the market.